Buy CTSH?

Cognizant first-quarter 2021 earnings call transcript

The current trend indicates it would take some time for the tech firm to regain the lost strength. Nevertheless, being a leading provider of business process outsourcing, information technology, and consulting services – which are in high demand across the tech space in this digitization era – its long-term prospects remain intact.

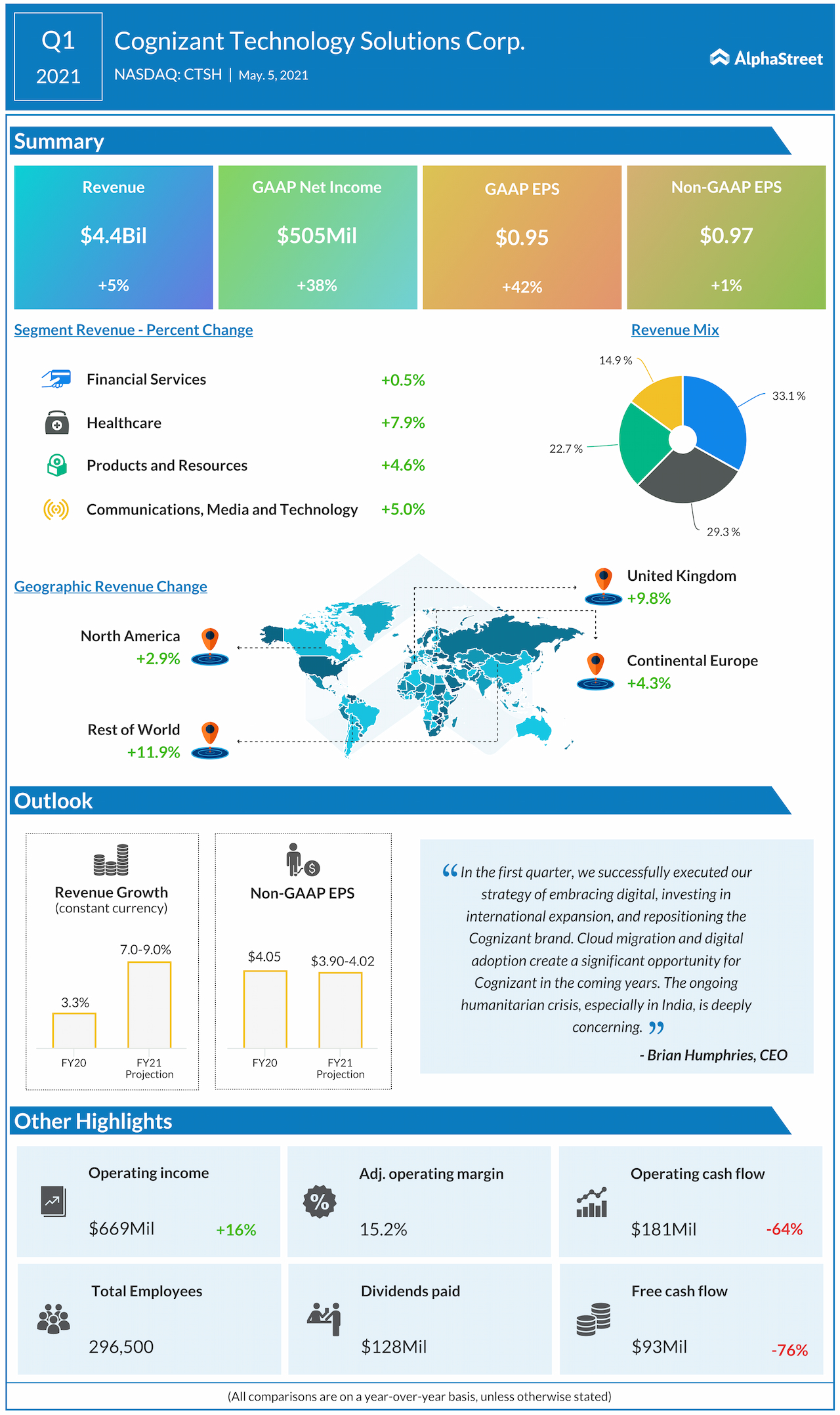

Mixed Outlook

Besides enterprise spending cuts, rising competition and employee attrition are the main challenges facing Cognizant currently, and the management is taking measures to address them. It continues to pursue strategic acquisitions to strengthen the portfolio – the latest being the purchase of software firm Magenic – and prepare the business for the post-COVID era. The vaccination drive and market reopening should bolster growth.

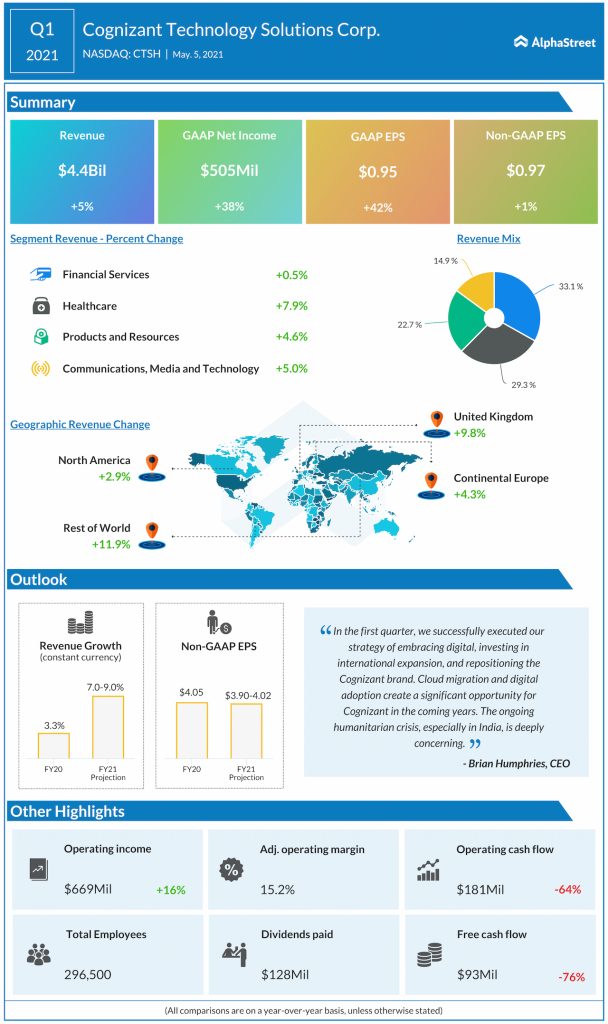

In the first quarter of 2021, revenues rose across all the business segments and geographical regions, resulting in a 5% increase in total revenues to $4.4 billion. Adjusted earnings edged up by a cent year-over-year to $0.97 per share and beat the estimates, after missing in the previous quarter. Anticipating that the ongoing momentum would continue, the management expects growth to accelerate this year.

From Cognizant’s first quarter 2021 earnings conference call:

“We had a strong quarter with growth across our payer and life sciences businesses and improving trends within our provider business. Over the past 18 months, we’ve refreshed our product strategy and better aligned our investments with market priorities. We recalibrated our product road maps to focus on our core platforms and cloud enablement, customer experiences, digital workflows, and automation. This intensified pivot to digital has resonated well with both existing clients and prospects, enabling us to achieve double-digit growth in our software product business.”

Stock Performance

Cognizant’s stock closed the last session sharply lower. At $75.22, the shares are still trading well above their 52-week average. They have gained 31% in the past twelve months.