The positive momentum might help the stock recover from the recent lows. Earnings topped expectations consistently in the trailing quarters, which is expected to be the case this time too.

Also see: Will Allergan-AbbVie merger be intercepted

ADVERTISEMENT

The ongoing weakness in revenue performance might continue, primarily owing to the recent recall of breast implants that dented customers’ confidence to some extent. Also, the top-line remains under pressure due to competition from the generic market after some of Allergan’s key formulations lost patent recently.

As per initial estimates, the bottom-line will be impacted by a $750 million charge related to the settlement of lawsuits filed by customers against the company’s subsidiary Forest with regard to its Alzheimer’s drugs.

Q2 Performance

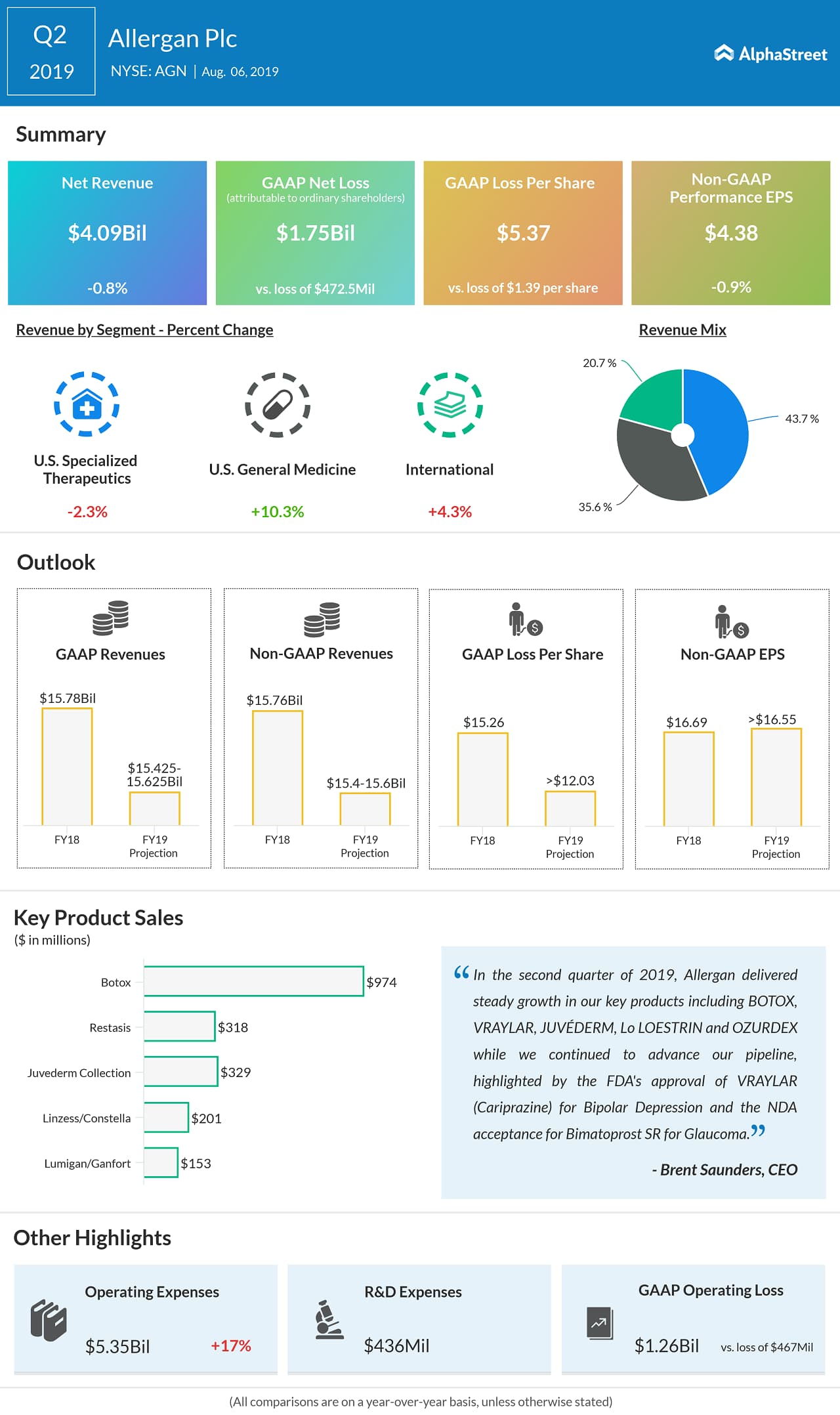

In the second quarter, adjusted earnings declined modestly to $4.38 per share on revenues of $4.09 billion, down 1% year-over-year. The results, however, topped expectations.

Bristol-Myers Squibb (BMY) this week reported higher revenues and earnings for the September-quarter, aided by strong sales performance by its key products. Earnings rose 7% annually to $1.17 per share, on revenues of $6 billion.

AbbVie Deal

Earlier this year, Allergan agreed to be acquired by AbbVie for about $63 billion in a cash-and-stock deal. The market will be looking for updates on the progress of the takeover procedures when the management conducts the post-earnings conference call.

Allergan lost significant market share over the last several years and slipped to a six-year low a few months ago. The stock bounced back in the following weeks and gained steadily since then. It is up 23% since then.