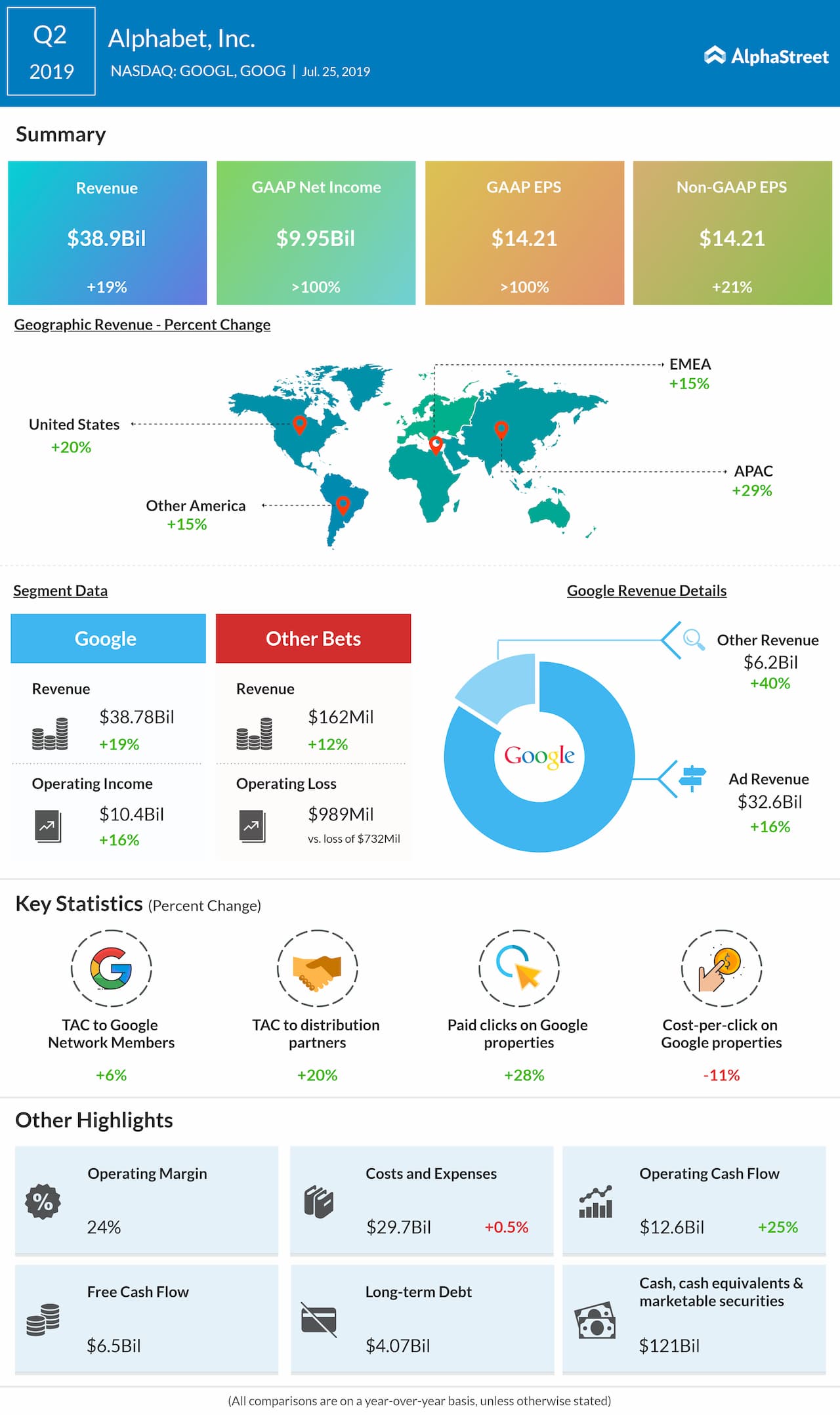

Analysts expect the company to report revenues of $40.3 billion for Q3 2019, reflecting an increase of 19% from the prior-year period. Revenues are expected to benefit from strength in advertising as well as cloud computing. In the second quarter of 2019, revenues grew 19% to $38.9 billion, beating estimates.

Earnings

Earnings are estimated to be $12.38 per share. This compares to $13.06 per share in the year-ago period. Alphabet’s subsidiary Google faces several lawsuits related to privacy and data collection. The bottom-line numbers could be negatively impacted by penalties and settlements related to these legal issues. Last quarter, adjusted EPS grew 21% to $14.21, topping forecasts.

Advertising revenues

The majority of Alphabet’s revenue comes from advertising. In the second quarter, the company managed to reverse the deceleration trend that it had been witnessing in its ad revenue and posted a higher year-over-year growth of 16%. Within advertising, the focus will be on metrics such as paid clicks and cost-per clicks. The company faces stiff competition in the advertising space from rivals like Amazon (NYSE: AMZN).

Also read: Alphabet Q2 2019 Earnings Conference Call Transcript

Other revenues

This division tracks the revenues from hardware and services such as Google Cloud, Google Play Store and Google Home. Last quarter, other revenues jumped 40% year-over-year to $6.18 billion. The company is seeing significant growth in its cloud segment but it still lags behind its competitor Microsoft (NASDAQ: MSFT) in the cloud computing space.

Other Bets

The Other Bets segment includes investments in ventures such as its autonomous driving unit Waymo and life sciences unit Verily. Last quarter, revenue in this division grew 11% to $162 million. It will be interesting to watch for updates on the progress the company is making with these projects as several of them have the potential to drive significant growth in the future.

Shares of Alphabet have gained nearly 12% year-to-date. The company has a strong Buy rating and an average price target of $1,427.66.