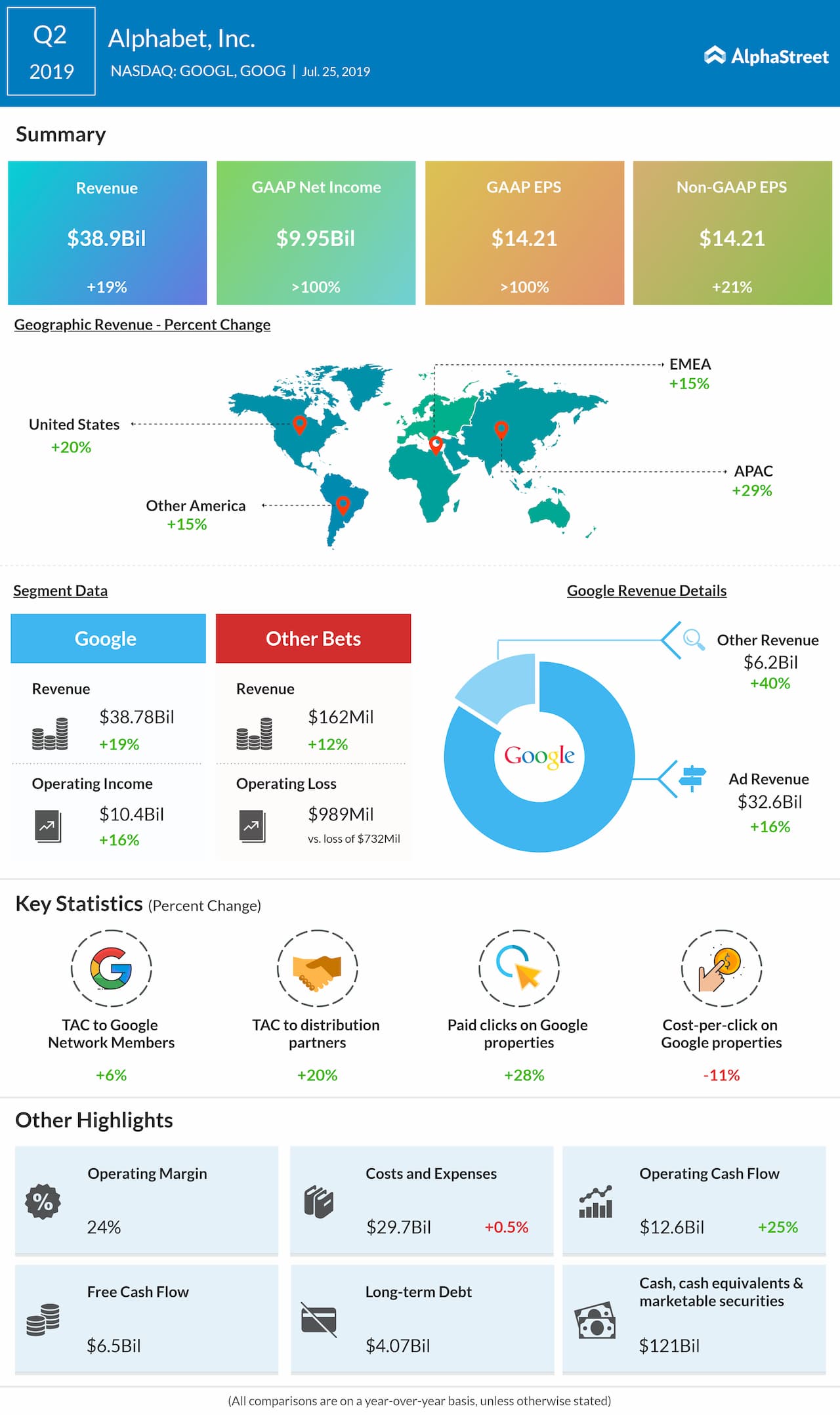

Alphabet (NASDAQ: GOOG, GOOGL), the parent company of search giant Google, on Thursday reported 19% growth in second-quarter revenues to $38.9 billion, surpassing the Wall Street projection of $38.17 billion. Advertising revenues grew 16%, ending a three- quarter streak of year-over-year growth deceleration.

Despite currency headwinds, adjusted earnings for the quarter grew to $14.21 per share, from $11.75 per share a year ago. This came in far ahead of the street view of $11.30 per share.

GOOGL shares jumped 6.5% following the earnings announcement. The stock has gained 8% in the year-to-date period, compared to 19.5% gains recorded by the S&P 500 index.

READ: It’s Google 1-0 Amazon in the European Smart Home market

The company’s Other Revenues segment, which comprises of Google Cloud, Google Play and hardware sales, spiked 40% to $6.18 billion.

In the other bets segment, where the company spends money on new and innovative, but not-yet-profitable operations, revenue improved 11% to $162. Meanwhile, operating losses from this segment widened to $989 million, from $732 million a year ago.

It’s been a pretty bumpy ride for the Google-parent over the past few weeks. The US Justice Department recently said it was planning to relaunch an anti-trust probe into the firm. Separately, the calls to break down big tech firms have been louder than ever before.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.