Earnings estimate: Alphabet does not provide any forecasts, so all we have are street estimates. For the second quarter, analysts estimate earnings of $11.30 per share, compared to $4.54 per share it reported in the same quarter last year. However, the last quarter earnings included 4.34 billion euros in a one-time fine by the European Commission. Excluding the fine, the bottom-line would have been $11.75 per share, which is higher than this quarter’s estimate.

READ: It’s Google 1-0 Amazon in the European Smart Home market

Such a decline in adjusted earnings would be driven by weakening foreign currency, analysts predict.

In the trailing four quarters, Alphabet has surpassed earnings estimates on two occasions.

Revenue estimate: Wall Street expects revenues to grow 17% to $38.17 billion. During the last reported quarter, the company’s revenue grew 17% to $36.3 billion, which was lower than $37.34 billion expected by the street. The top-line was hurt by a slowdown in advertising revenues, which takes us to the next key metric.

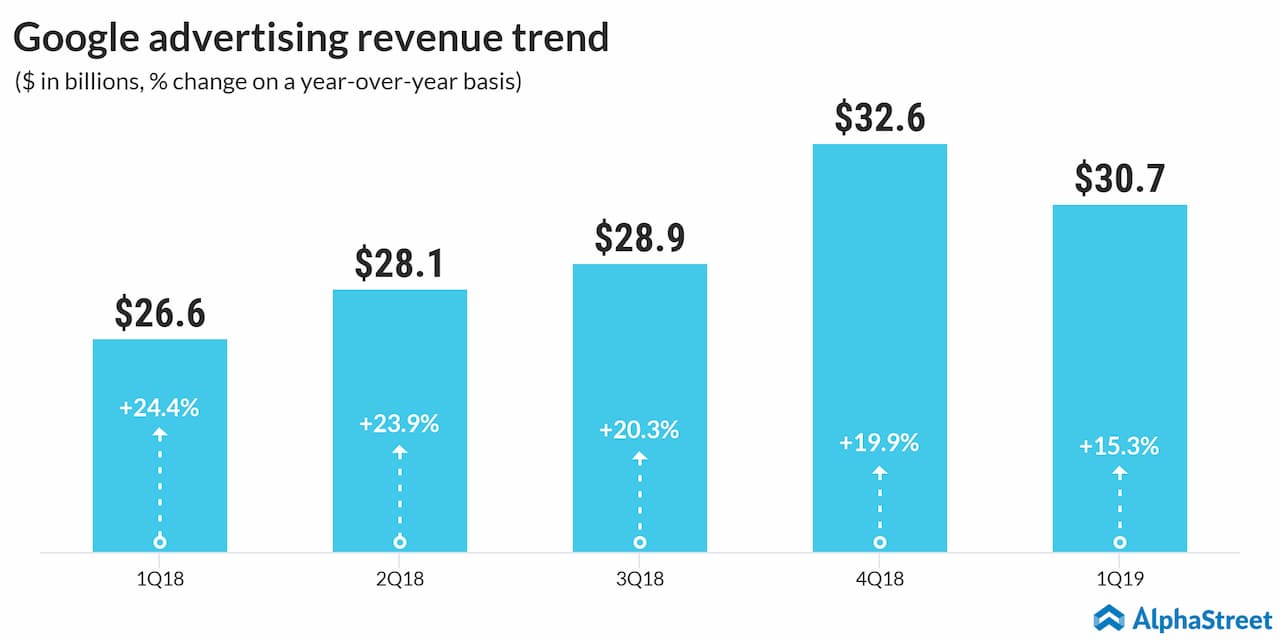

Advertising revenue: This metric is of paramount importance as it accounts for almost 85% of the company’s total revenues. However, there has been a marked slowdown in its growth, which has been worrying investors (see image). Year-over-year digital advertising revenue growth has steadily declined from 24.4% in the first quarter of last year to 15.3% in the first quarter of this year.

Since the company does not give a proper split of its advertising revenues, it is difficult to pinpoint a reason. The management has also been pretty close-mouthed about the deceleration.

Other revenues: This includes revenues from sales of hardware and services such as Google Cloud and Google Play. During the last quarter, there was a slowdown in this segment, due to weak sales of Pixel smartphone. Investors will be watching whether it was a one-time event or an emerging trend.

During the earnings conference call: During the conference call, look out for management comments on the weakening ad revenues, potential anti-trust actions and any updates related to the investments going into “Other bets.”

GOOGL stock has gained just 7.6% in the year-to-date period, compared to 18% by the S&P 500 index. The stock has a Strong Buy rating with an average 12-month price target of $1334, an upside of 18% from Monday’s trading price.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.