ADAPT Launch

Alteryx’s management is on track to roll out an innovative program called Advancing Data and Analytics Potential Together, designed to impart skill training to workers who have been affected by the shutdown. The near-term outlook on the company is positive as data security becomes very critical in times of crisis.

[irp posts=”60446″]

“When — we’ve always said that when things are good, analytics are important. But when times are bad, analytics are absolutely critical. And so we’re very optimistic about what is happening in this space, in the kind of customers that are joining us and the impacted verticals I think have another silver lining,” said Alteyx CEO Dean Stoecker in response to an analyst’s question at the post-earnings conference call.

Buy AYX?

Most analysts believe that Alteryx offers a good investment opportunity at the current price and the average price target is around $130. The shares were trading at an all-time high – after recovering from the lows seen towards the end of last year – when the market was battered by the Covid-19 outbreak. Then, they retreated to the pre-peak levels but returned to growth mode last month and gained 45% since then.

Withdraws Guidance

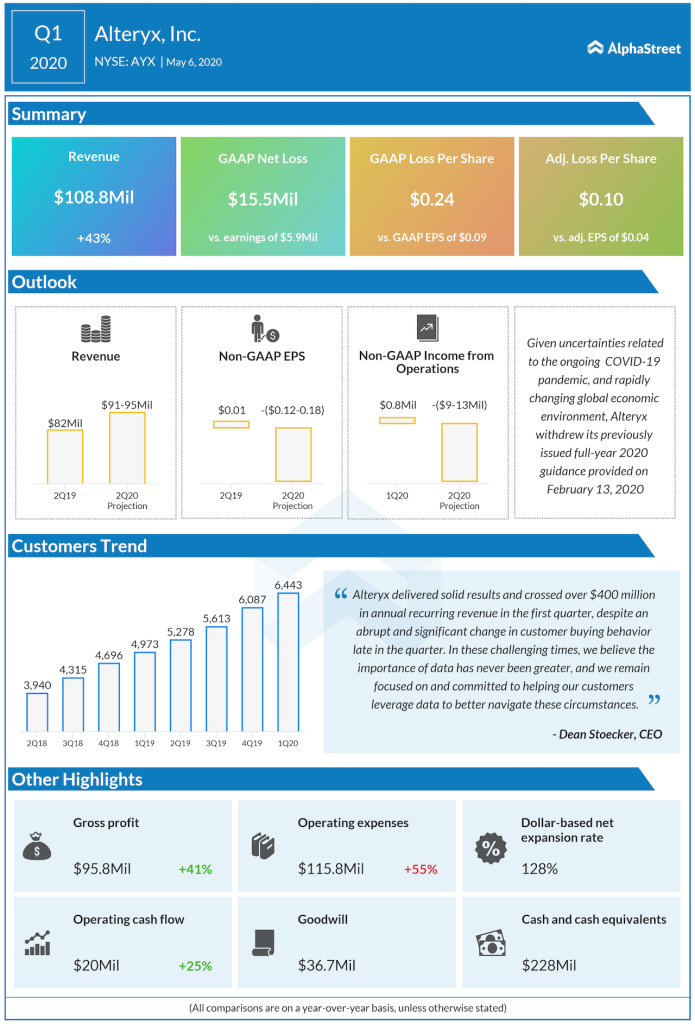

Meanwhile, the company withdrew the second-quarter guidance it had issued earlier, citing lack of proper visibility. The trend so far shows that deferred revenues and scheduled multi-year billings will play a key role in topline performance in the current quarter. Operating expenses are expected to decline, especially compared to the last quarter when margins were dragged by a one-time cost.

In general, the macroeconomic uncertainty demand flexibility on the part of companies, in terms of collecting payments from clients. Relaxed payment terms, combined with a potential rise in the churn rate due to the timing of renewals, might have an unfavorable impact on Alteryx’s revenues.

$1 Bln Cash

At the end of the quarter, the company had cash balance of $1 billion. Overall, sales were affected as some customers delayed purchases due to the uncertainty surrounding coronavirus. The unpredictability in customer behavior has prompted the management to halt hiring. There have been efforts to streamline the business by reducing non-priority investments and focusing more on areas that are crucial for recovery.

“If COVID-19 is not the wake-up call and not the accelerant to digital transformation then there will never be digital transformation. I personally have spent quite a bit of my day talking with not just our employees around the world, but executives around the world who are trying to figure this whole thing out.”

ADVERTISEMENTDean Stoecker, CEO of Alteryx.

Mixed Q1

Operations were affected by the disruptions in the final weeks of the first quarter, yet Alteryx recorded a 43% growth in revenues to $109 million, reflecting the favorable product mix and longer contract duration. The bottom-line, meanwhile, remained in the negative territory, and adjusted loss widened to $0.10 per share from $0.04 per share last year.

[irp posts=”50086″]

Going forward, the impressive product-market fit, together with the other positive factors, should help the company sail through the difficult situation and expand further into the largely untapped data analytics market.