Revenue and volume declines

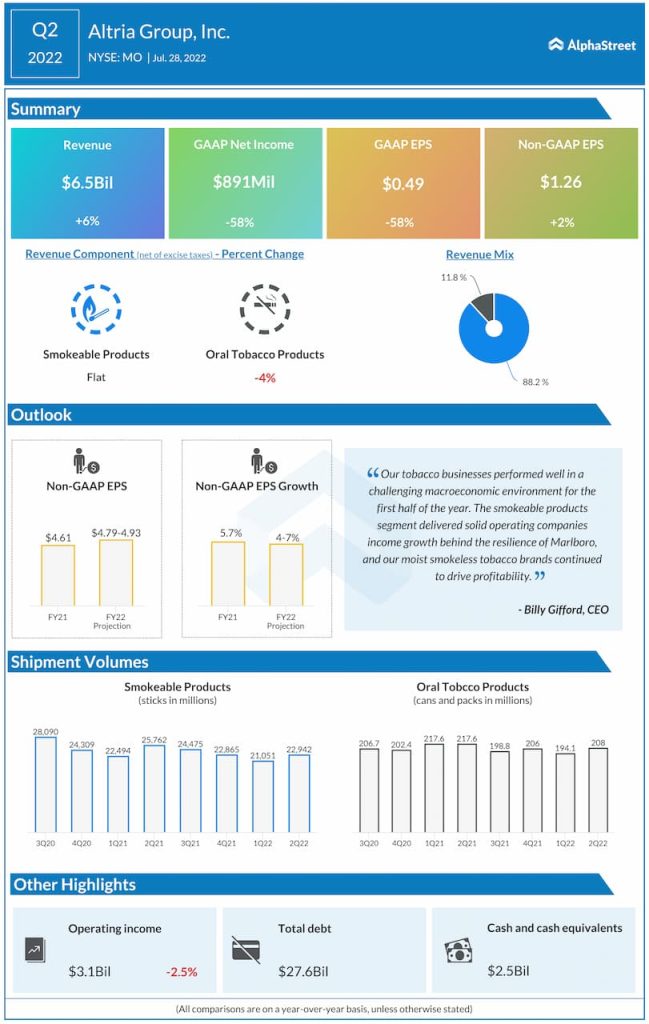

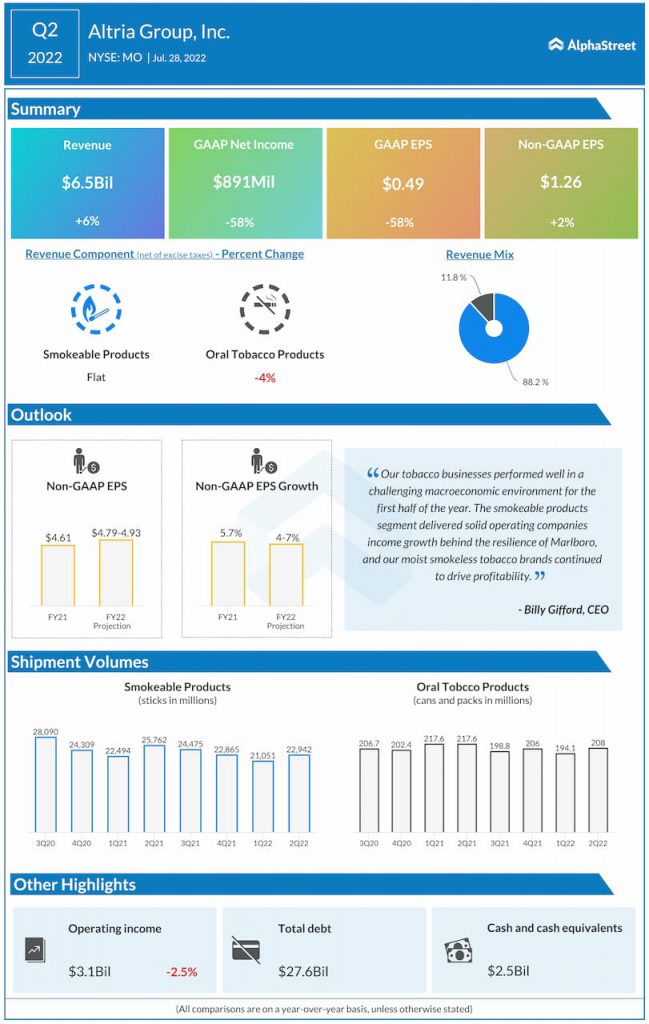

Revenues from Altria’s smokeable products fell nearly 3% in Q2, mainly due to lower shipment volume. Revenues from oral tobacco products were also down 4% due to lower volumes. This collectively led to a 5.7% decline in total revenues during the quarter. Revenues, net of excise taxes, were down 4.3%.

Reported EPS decreased nearly 58% to $0.49 mainly due to unfavorable results from equity investments. Adjusted EPS increased 2.4% to $1.26.

Investment in JUUL

Altria’s $12.8 billion investment in e-cigarette company Juul Labs is being seen as one of its biggest mistakes by the Street. In June, the FDA ordered all of JUUL’s products off the market in the US and although the ban has been temporarily lifted by the agency, Altria’s investment appears to have lost most of its value.

In Q2, the company recorded a non-cash pretax unrealized loss of $1.2 billion as a result of a decrease in the estimated fair value of our investment in JUUL. As of June 30, 2022, the estimated fair value of Altria’s investment in JUUL was $450 million. The regulatory issues that are plaguing the vape company do not bode well for Altria.

Sin stock

Smoking was never popular with the law and tobacco companies are constantly dealing with new regulations and prohibitions. For instance, the current administration in the US is considering setting a maximum nicotine level for cigarettes.

In general, cigarette smoking has been trending downward and at any given time, people are encouraged to quit smoking. These factors pose the risk of a gradual decline in demand for Altria’s products. As the concept of tobacco harm-reduction gains traction, companies are shifting their focus to smoke-free products and the opportunity in that space.

Dividend King

Altria has a good dividend profile. The company raised its dividend by 4.4% to $0.94 per share last month, marking its 57th increase in the past 53 years. This brings the annualized dividend rate to $3.76 per share, representing a dividend yield of 8.2%.

Click here to read more on tobacco stocks