Valuation

Given the strong prospects for a full-fledged recovery in the foreseeable future, long-term investors can consider taking advantage of the low valuation. When it comes to demand, the company has already booked more for the next quarter than what it did last year. Experts are of the view that the demand-supply balance in the airline industry is good, especially in the international segment where current traffic volume matches the levels seen before the pandemic. Strengthening the balance sheet is a key priority for the management, as it aims to reduce debt by $15 billion by 2025.

American Airlines’ third-quarter earnings report is slated for release on October 19, at 7:00 a.m. ET, amid estimates for a mixed outcome. Market watchers’ consensus forecast for Q3 adjusted earnings per share is $0.25, which is about half the profit the company generated in the year-ago quarter. Meanwhile, September-quarter revenue is expected to rise modestly to $13.51 billion.

Updating financial outlook, the company’s CFO Devon May said at the Q2 earnings call, “We expect third quarter CASMx to be up 2% to 4% year-over-year. Our current forecast for the third quarter assumes a fuel price between $2.55 and $2.65 per gallon. Based on our current demand and fuel price forecast, we expect to produce an adjusted operating margin between 8% and 10% in the third quarter and adjusted earnings per diluted share between $0.85 and $0.95, excluding special items. For the full year, we continue to expect to produce capacity that is 5% to 8% higher than in 2022. Our full-year forecast for unit revenue continues to be up low single digits year-over-year.”

Record Results

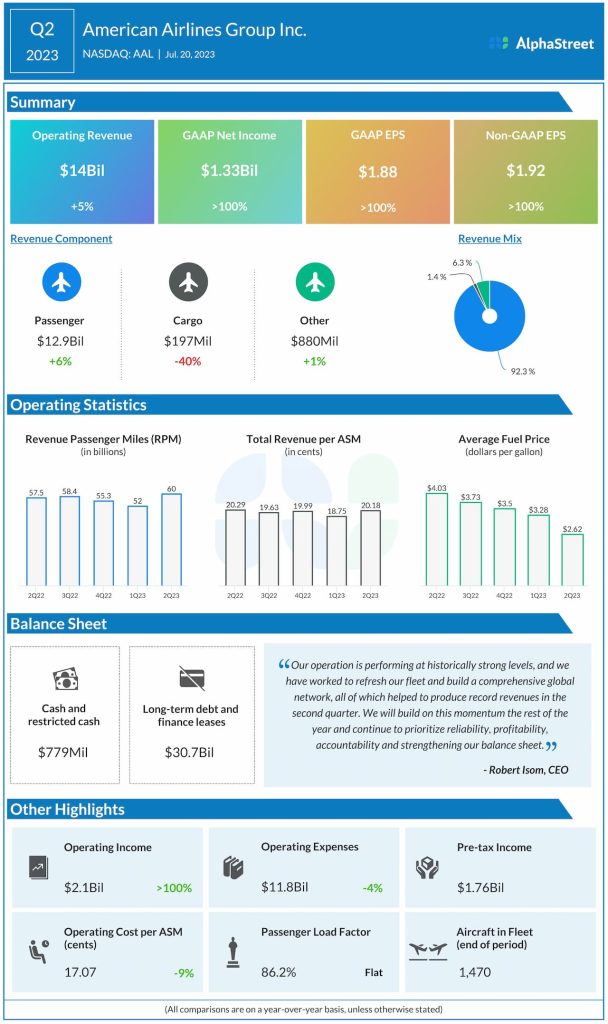

Ever since the company emerged from a losing streak more than a year ago, earnings beat estimates regularly and it is likely to maintain that trend this time. In the second quarter, revenues also topped expectations, growing 5% year-over-year to a record high of $14 billion. Passenger revenue, which accounts for more than 90% of the total, grew 6% and adjusted earnings more than doubled to $1.92 per share.

Shares of American Airlines traded slightly higher on Monday afternoon. The stock has declined 9% in the past 30 days.