Pros

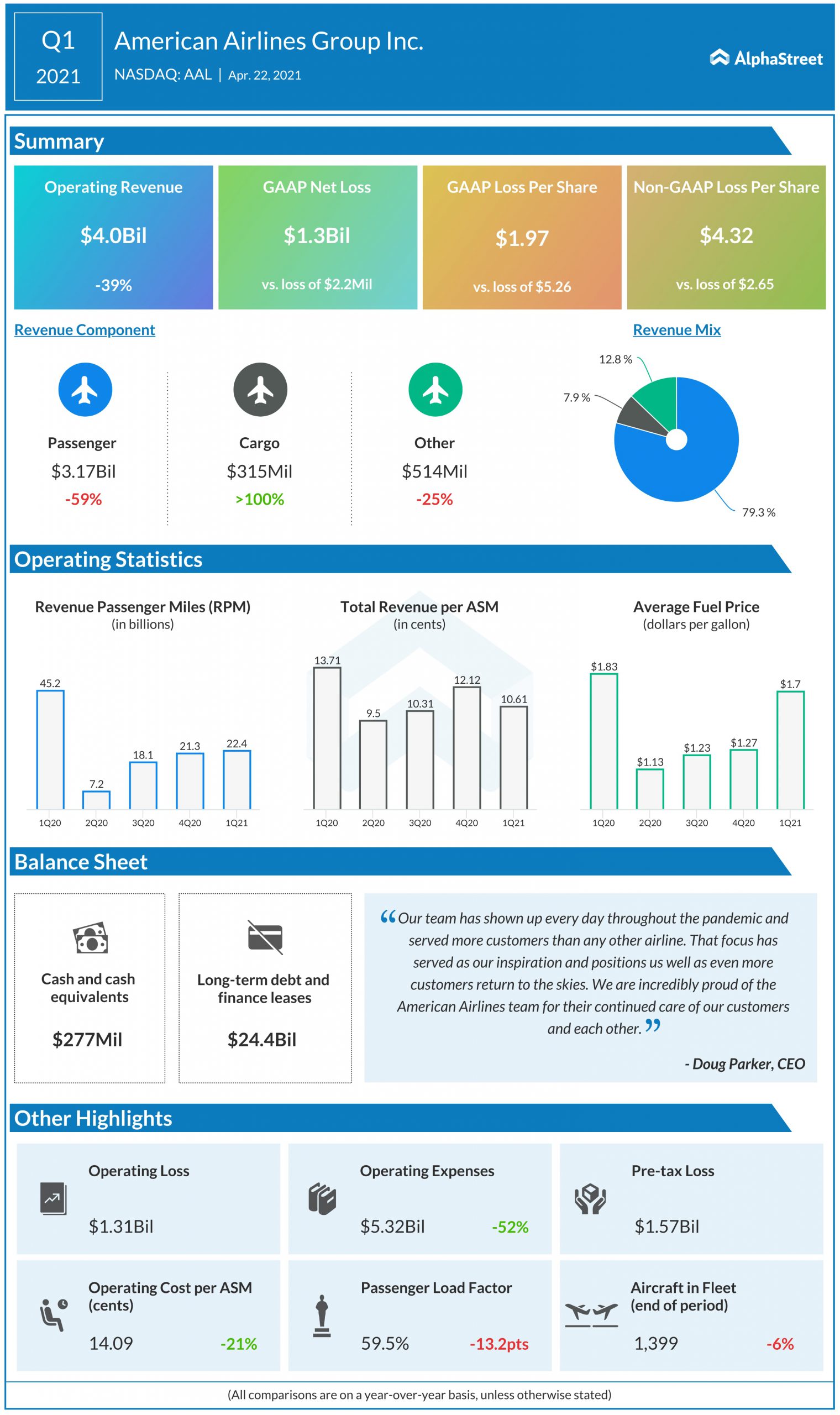

American is seeing strong trends in net bookings and load factors. Its domestic load factor for May was approx. 84% and greater than 88% over the Memorial Day weekend. The company expects the pickup in bookings to continue through the end of the second quarter of 2021 and into the third quarter. If the current trends continue, leisure yields are expected to reach or exceed 2019 levels during the summer travel period.

American expects to fly approx. 80% of its system seat capacity during the second quarter with this rising to 90% during the summer. For the second quarter, the company expects system capacity to be down 20-25% and total revenue to be down around 40% compared to the same period in 2019.

American’s strategic partnerships with JetBlue Airways (NASDAQ: JBLU) and Alaska Air Group (NYSE: ALK) will help it expand its network through the West Coast and Northeast markets and in turn drive good growth.

American has also been undertaking several cost-cutting measures such as headcount reductions, fleet simplification and other expense reductions which have yielded $1.3 billion in permanent cost reductions.

Cons

The company is facing significant staffing and maintenance issues and has been forced to cancel hundreds of flights over the weekend and on Monday, according to a report by Yahoo Finance. The report states that American may cancel 50-60 flights per day for the rest of June and 50-80 flights per day through July.

In addition, corporate travel remains soft although the company is seeing improving trends from small businesses and some of its large corporate accounts.

All in all, while some experts anticipate American to benefit from the improving trends in travel as well as its own initiatives, others prefer to take a more cautious approach to the stock.

Click here to read more on airline stocks