Though air traffic has improved over the years, thanks to higher disposable incomes and a stable economy, the airline industry is not entirely benefiting the same due to a number of geopolitical and macro-economic headwinds. The world’s largest airline by fleet size, American Airlines (NASDAQ: AAL) has particularly been hit by the turbulence, sending its stock down to a 3-year-low.

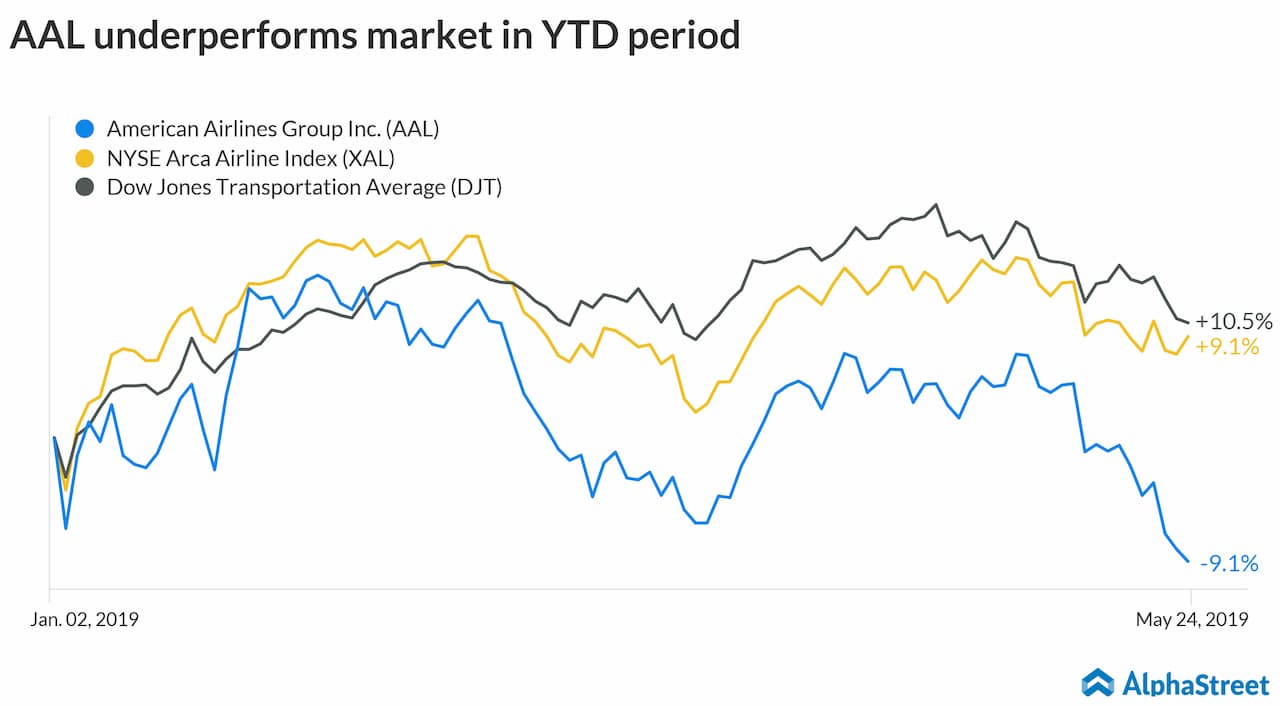

The stock has declined 9% of its value in the year-to-date period. This compares to a 10.5% gain registered by the Dow Jones Transportation Average and 9% increase by the NYSE Arca Airline Index during the same period.

737 MAX impact

While most of this decline was driven by a string of disappointing earnings results, the Federal Aviation Administration’s decision to ground all US-registered 737 MAX aircraft acted as the final nail (hopefully). The 737 MAX accounts for 2% of American’s total fleet and the company had stated that it was removing them from flight schedule through August this year.

The grounding forced the airline to slash its full-year earnings forecast to $4 to $6 per share, compared to the prior range of $5.50 to $7.50 per share.

And there seems to be no end to the company’s misery. As it turns out, most of the market risks it had listed in its latest SEC filing are turning into a reality.

READ: WHAT YOU NEED TO KNOW BEFORE BUYING VILLAGE FARMS STOCK

Labor crisis

The last thing a company like American Airlines want at the moment is an internal conflict. Unfortunately, the labor crisis stemming from its merger with US Airways continue to escalate – to a point where operations are being affected. The company had recently alleged that the laborers associated with the Transit Workers Union are slowing down repair works, which has affected 125,000 passengers in the last quarter.

According to the Fort Worth, Texas-based airline, about 900 flights were canceled or delayed during the period.

The workers’ union, on the other hand, is unhappy with the way talks are progressing relating to obtaining their contracts. The Transit Workers Union consists of over 30,000 employees but lacks a contract with American due to disagreements regarding wages and other benefits.

READ:

WHAT IS NASH AND WHICH BIOTECH FIRMS ARE VYING FOR THE FIRST-MOVER STATUS

Competition

Competition has been tightening in the airline industry due to the aggressive expansion of low-cost airlines. Through consolidation and fleet expansion, these companies – including Norwegian Air Shuttle and Icelandair – are now rampantly foraying into the international markets, taking away a large chunk of price-conscious travelers, who often tend to be not loyal to a specific airline.

Rising expenses

Besides the highly

volatile nature of jet fuel prices, the industry as a whole is being impacted

by rising expenses in the form of higher airport charges, cut-throat tax rates

and increased expenditure towards cybersecurity. American Airlines handles data

of a large number of passengers and data security is not something it can

afford to ignore. According to the company, it has been a target of hackers in

the past.

With all these headwinds at play, and only travel demand to offset it, American is likely to face a difficult time regaining its lost vigor.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.