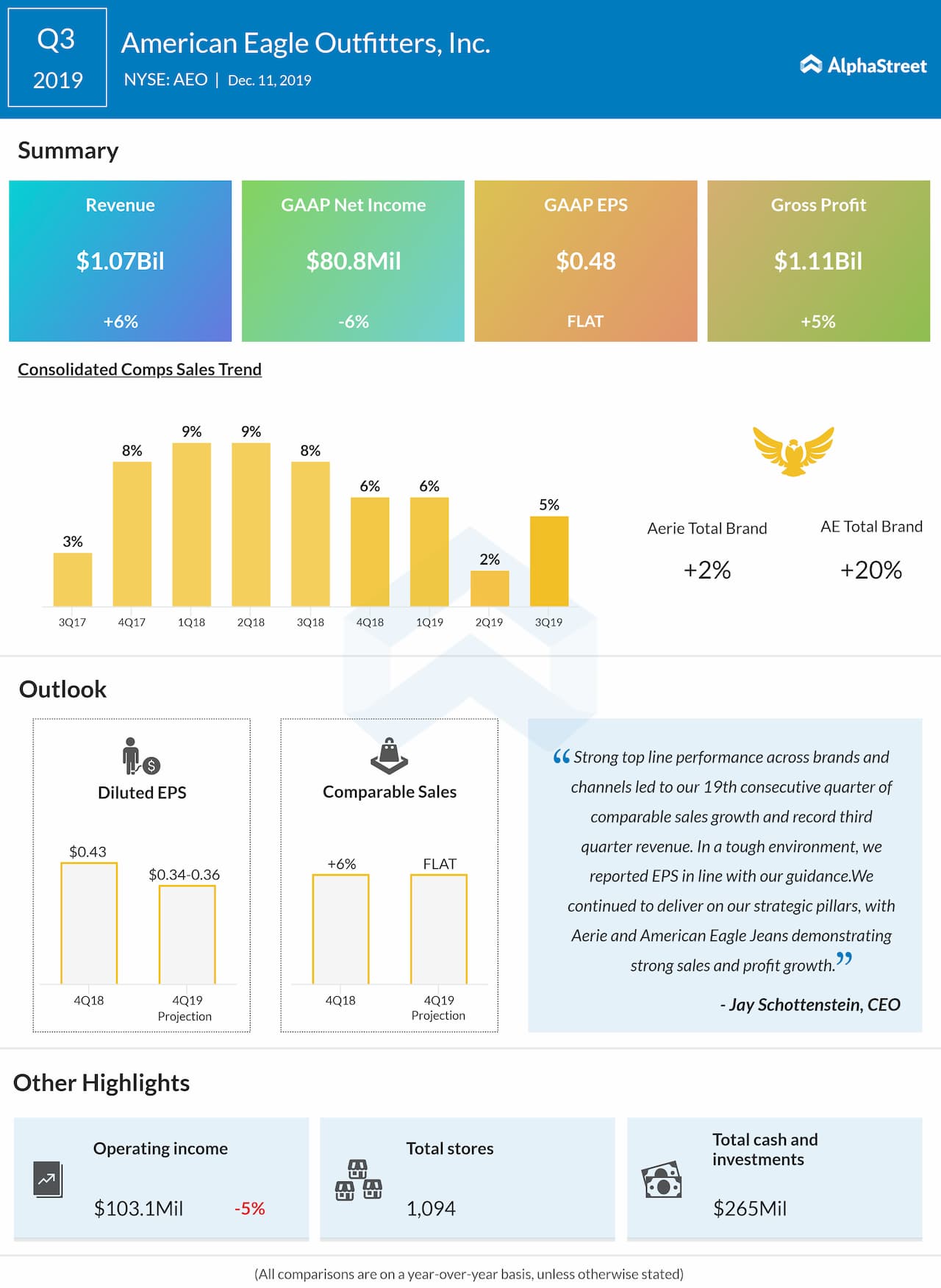

— American Eagle Outfitters Inc. (NYSE: AEO) reported its third-quarter 2019 earnings of $0.48 per share versus $0.48 per share expected.

— Total net revenue grew by 6% to $1.07 billion versus $1.06 billion expected.

— Consolidated comparable sales increased 5%, following an 8% comparable sales increase last year, and was positive across both store and digital channels.

— By brand, American Eagle’s comparable sales rose 2% and Aerie’s comparable sales increased 20%.

— Gross margin fell to 38.2% from 39.8% last year. The decline primarily reflected increased markdowns.

— During the quarter, the company opened 6 American Eagle stores, ending with 945 American Eagle stores, including 170 Aerie side-by-side locations.

— The company opened 12 Aerie stand-alone stores and closed 1, ending with 142 Aerie stand-alone stores. Internationally, the company ended the quarter with 241 licensed stores compared to 223 last year.

— For the fourth quarter, the management expects EPS of $0.34 to $0.36, with comparable sales about flat. This is lower than the analysts’ expectations of $0.48 per share. Last year, the company posted an EPS of $0.43.