The top-line growth was driven by a well-balanced mix of growth in fee, spend and lend revenues, consistent with the high levels of revenue growth the company has delivered for over two years.

The New York-based payment processing company added 11.5 million new proprietary cards during 2019 and continued to deliver solid billings growth.

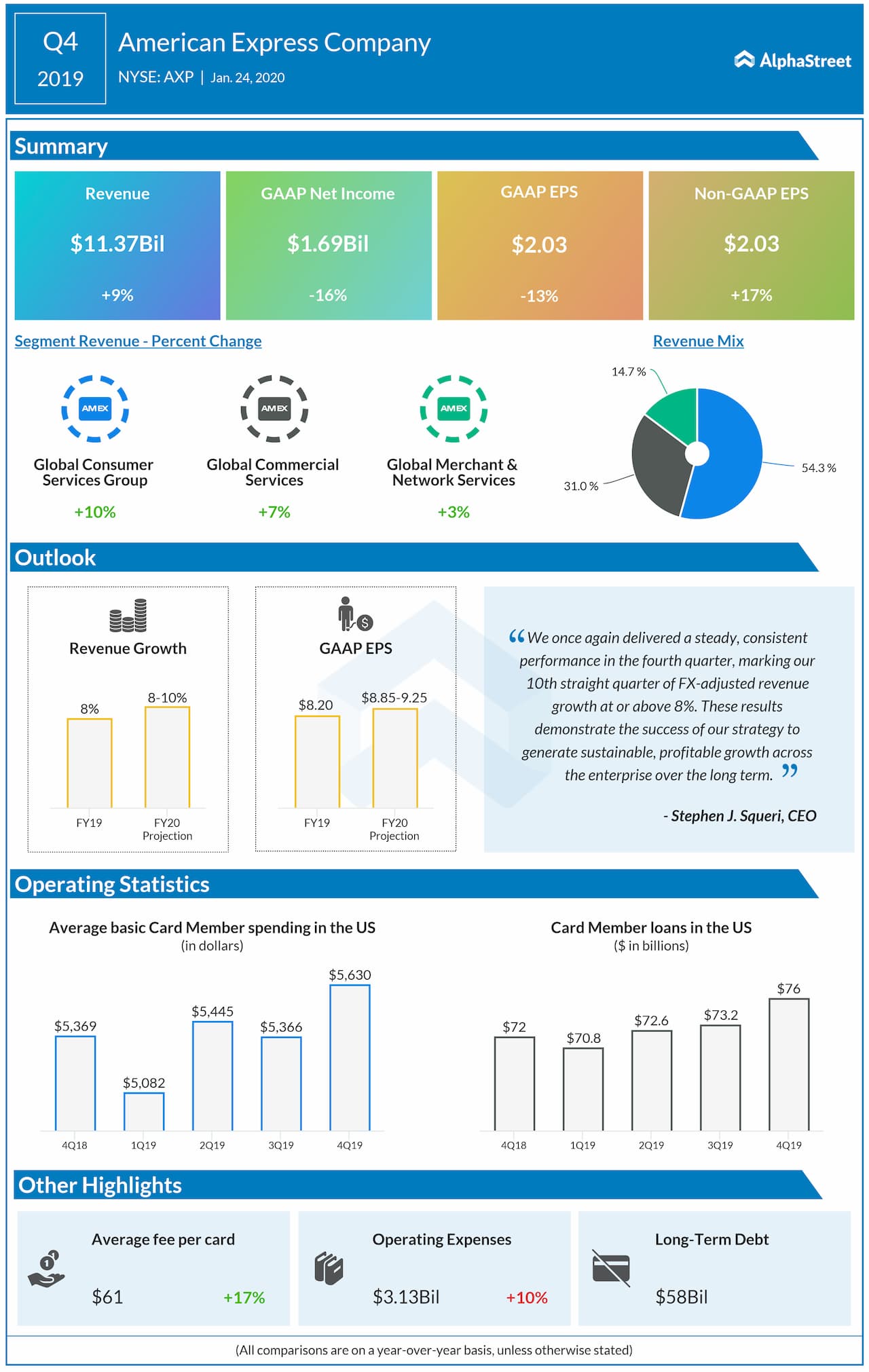

For fiscal 2020, the company expects revenue growth in the range of 8-10% on a foreign exchange-adjusted basis and earnings of $8.85-9.25 per share. The consensus estimates EPS of $8.98 on revenue growth of 7.40%.

For the fourth quarter, Global Consumer Services Group reported a 10% rise in total revenue net of interest expense primarily driven by higher net interest income, cardmember spending, and card fees. Revenue net of interest expense in Global Commercial Services increased by 7% and that in Global Merchant and Network Services rose by 3%.

Consolidated expenses increased 9% due to the growth in rewards and other customer engagement costs driven by increased Card Member spending and higher usage of card benefits as well as higher operating expenses.

Billed business rose by 5% to $325.2 billion while the number of cards issued remained virtually unchanged at 114.4 million. The average fee per card increased by 17% to $61 from last year. Average proprietary basic card member spending increased by 5% to $5,237.