Charles Schwab Corporation (NYSE: SCHW) reported a 9% decline in earnings for the fourth quarter of 2019 due to lower revenue. The bottom line missed analysts’ expectations while the top line exceeded consensus estimates.

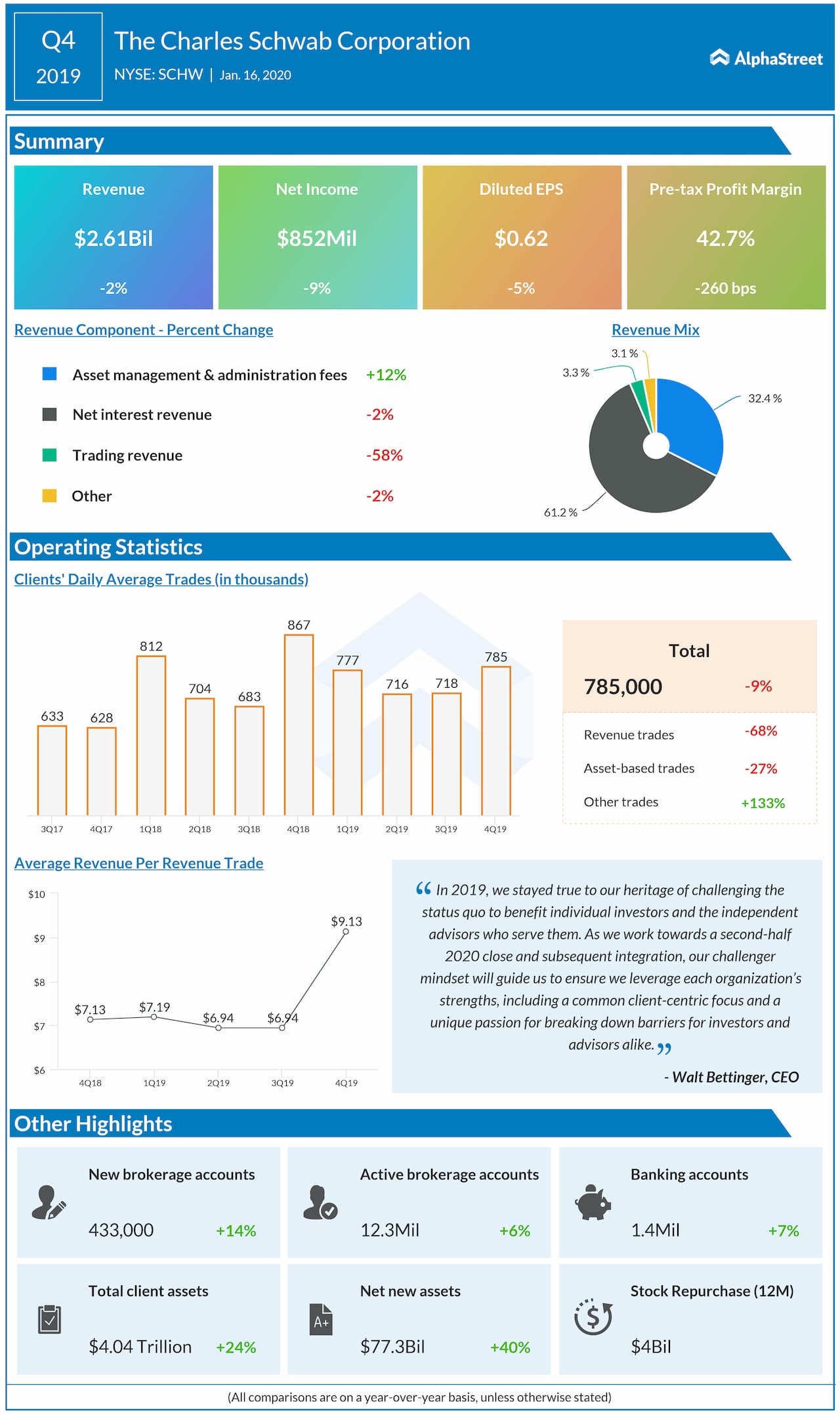

Net income decreased by 9% to $852 million or $0.62 per share. Revenue declined by 2% to $2.61 billion. Analysts had projected Charles Schwab to post earnings of $0.64 per share on revenue of $2.6 billion for the fourth quarter.

The San Francisco, California-based firm’s net interest revenue declined by 2% in 4Q to $1.6 billion, due to lower interest revenue.

Core net new assets were $66.2 billion in the fourth quarter of 2019. The online brokerage firm attracted 433,000 new brokerage accounts in the quarter, raising the active brokerage accounts to 12.3 million, up 6% year-over-year. Client assets totaled a record $4.04 trillion at quarter-end, up 24% from last year.

Throughout the year, investor sentiment reflected a complex market environment that included ongoing global trade negotiations, the Brexit debate, and an uncertain economic outlook at home. At the same time, stocks continued their steady march upward, with the S&P 500 rising 29% in the year to record levels.

The Federal Reserve reversed course on monetary policy, cutting the Fed Funds target three times in 2019, and the yield on 10-year Treasury notes hit a low of 1.47% before rebounding to average 2.14% for the year, leaving the rate environment significantly lower than initial expectations.

Overall, the company’s 2019 results emphasize the enduring nature of Schwab’s financial model, which allows it to consistently invest in capabilities and clients while building value for stockholders through the business cycle.