“

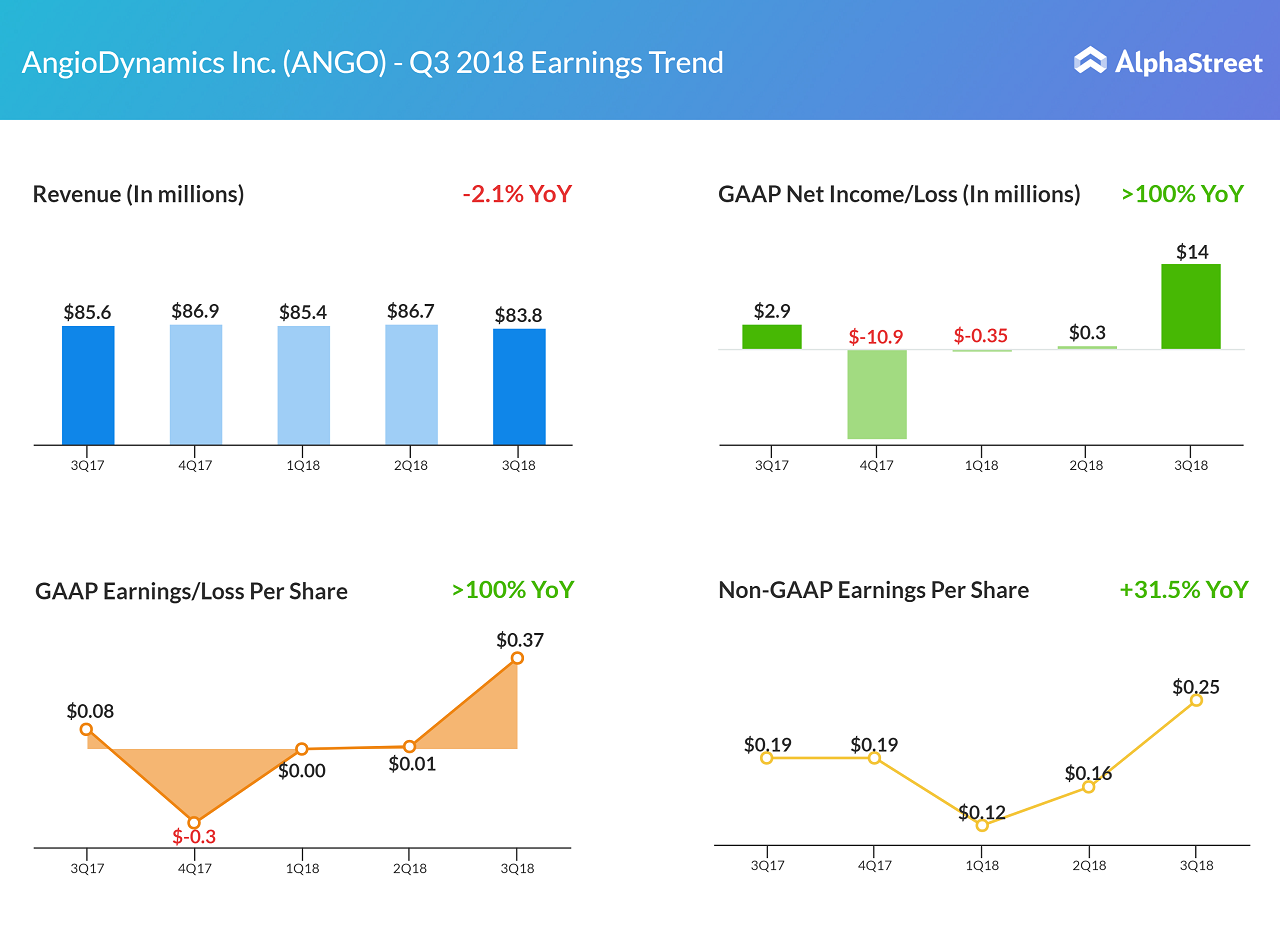

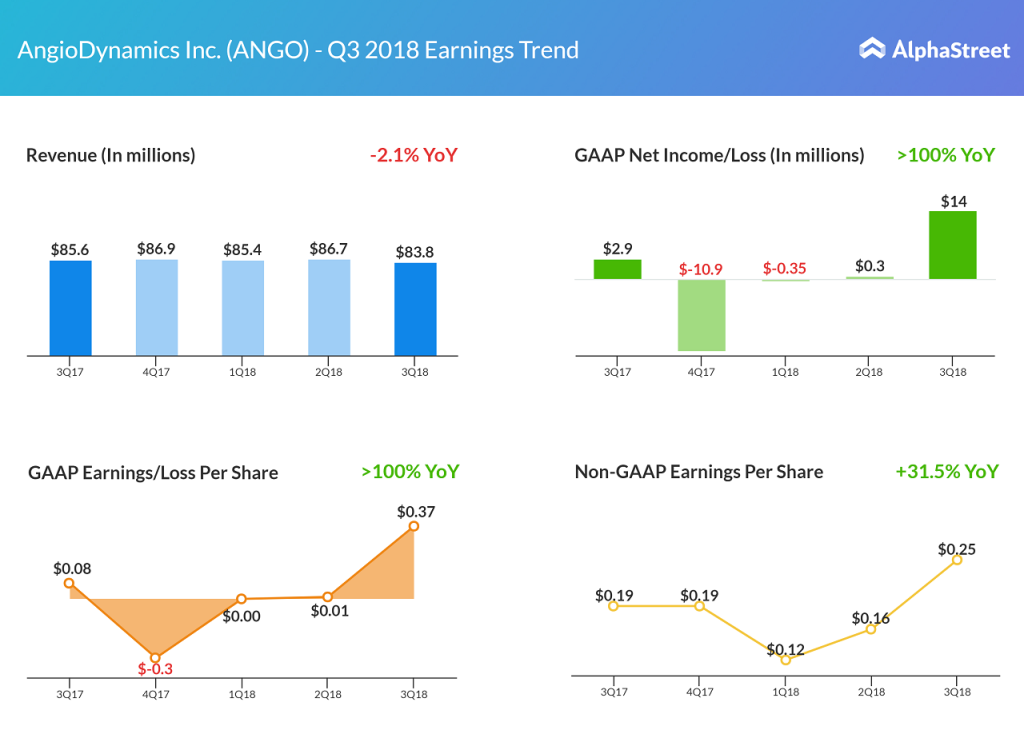

Medical device manufacturer AngioDynamics’ (ANGO) third quarter 2018 revenue fell short of consensus estimate. The company’s revenue dropped 2.1% year-over-year, while the US tax reform lifted the reported earnings and per share figures, which more than tripled for the quarter. The revenue miss was mainly due to the declines in the Venous Insufficiency business and […]

· March 29, 2018

Medical device manufacturer AngioDynamics’ (ANGO) third quarter 2018 revenue fell short of consensus estimate. The company’s revenue dropped 2.1% year-over-year, while the US tax reform lifted the reported earnings and per share figures, which more than tripled for the quarter. The revenue miss was mainly due to the declines in the Venous Insufficiency business and a negative year-over-year comparison related to the Radiofrequency Ablation (RFA) product line that was discontinued in Japan. Profit jumped to $14 million or $0.37 per share from the year ago profit of $2.9 million or $0.08 per share. On an adjusted basis, earnings spiked 31.5% to $0.25 per share.

Geographically, US net sales fell short of expectations, declining 2.8%, hurt by declining sales of Venous, PICCs, and RFA businesses. However, international sales experienced a positive growth due to consistent performance across all the business units.