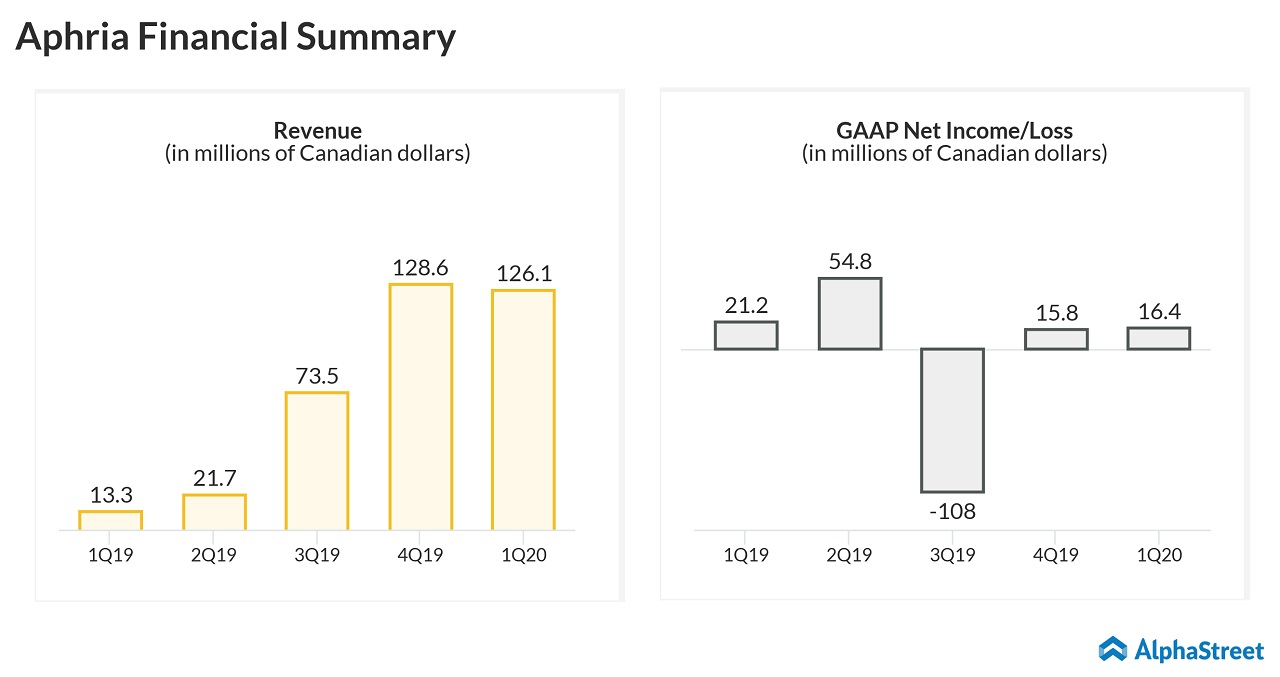

Meanwhile, revenues of CAD $126.1 million was below the street target of CAD 138.4 million. Revenues from adult-use cannabis grew 8% from a year ago to $20 million.

The Canadian marijuana firm also reaffirmed its guidance for full-year 2020 of CAD 650 – 700 million in annual revenues, as well as adjusted EBITDA in the range of CAD 88 – 95 million.

Aphria Chairman Irwin D. Simon said in a statement, “Our success was driven by our international business and the strength and growth of our brands, particularly Broken Coast, despite a small fire at our British Columbia facility at the end of the quarter.”

READ: Aurora, Canopy Growth to be the biggest gainers in Cannabis 2.0

The company added that it is on track to achieve an annual production capacity of 255,000 kilograms when all facilities are fully licensed and operational. The recent incident of peer firm Aleafia Health Inc. terminating a supply agreement it had with Aphria for allegedly not meeting supply obligations had raised some doubts on the same.

The stock has lost

64% in the trailing 12 months, worse than the industry’s decline of 49%. The

industry weakness was primarily due to weak results from other pot firms,

scandals, as well as concerns relating to the vaping business. As vaping

products make up an important part of Aphria’s line-up, the recent fatalities add uncertainty to the stock.

Last

week, shares of HEXO plummeted to a new yearly

low after the company reported

preliminary results for its fourth quarter and withdrew its

previously announced FY20 outlook.

“Fourth-quarter revenue is below our expectation and guidance, primarily due to lower than expected product sell-through,” said its CEO Sebastien St-Louis.