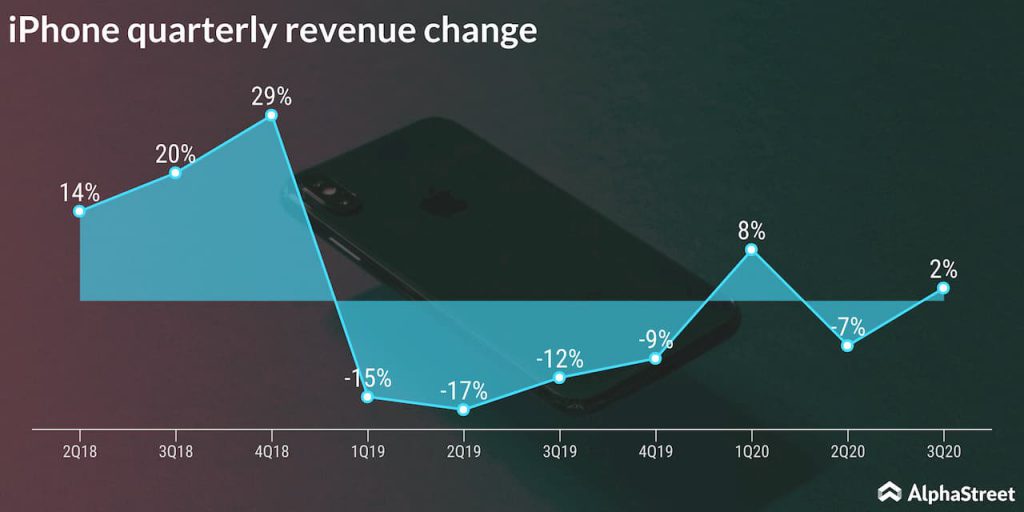

During the post-earnings conference call, CEO Tim Cook said, “The iPhone SE, it’s also clear that from the early data we’re seeing a higher switcher number than we did in the previous year, which we feel very good about. iPhone 11 is still the most popular smartphone, but iPhone SE definitely helped our results. And as Luca (Maestri) said in his outlook, we do see that continuing into this quarter currently.”

Also read: Apple Q3 revenue rises 11% as iPhone sales rebound

To appease the higher-end market, the company is set to launch the next line-up of iPhones this quarter. The upcoming iPhones, along with a high-demand SE, could once again bring the limelight back to the product side. However, the company will delay the launch of the next line-up of iPhones by a few weeks. Apple generally launches its line up in September.

Stock at record high

Shares of the technology giant moved higher by 6.4% in after-hours trading on July 30 after it reported fiscal third-quarter results. Apple stock is currently trading at $409.55, indicating a market cap of $1.77 trillion dollars. Amazon (NASDAQ: AMZN) and Microsoft (NASDAQ: MSFT) trails strongly with market caps of $1.59 trillion and $1.51 trillion respectively.

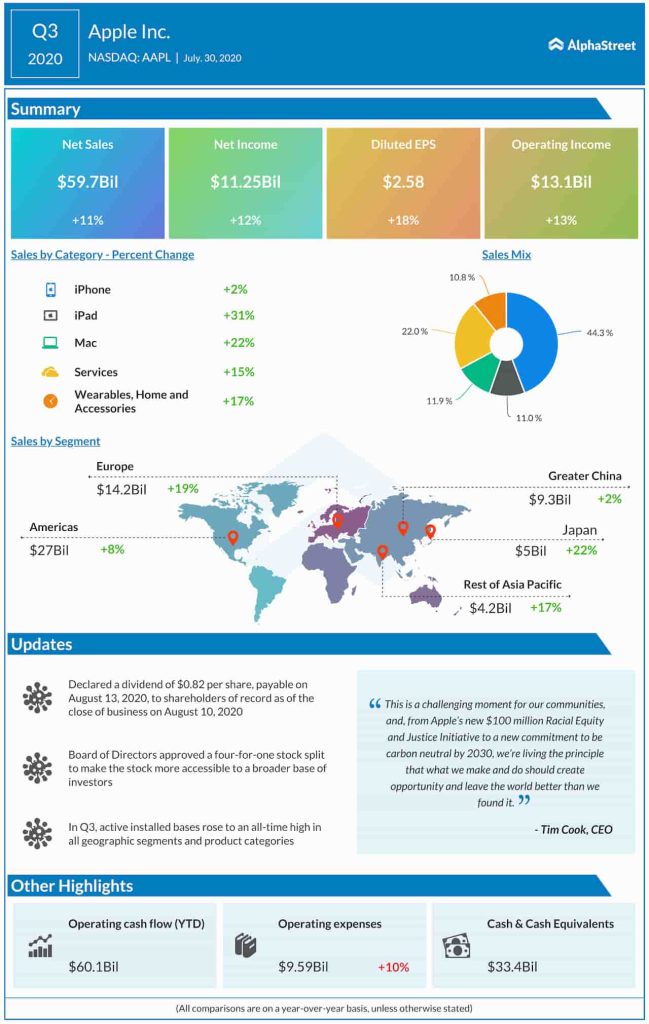

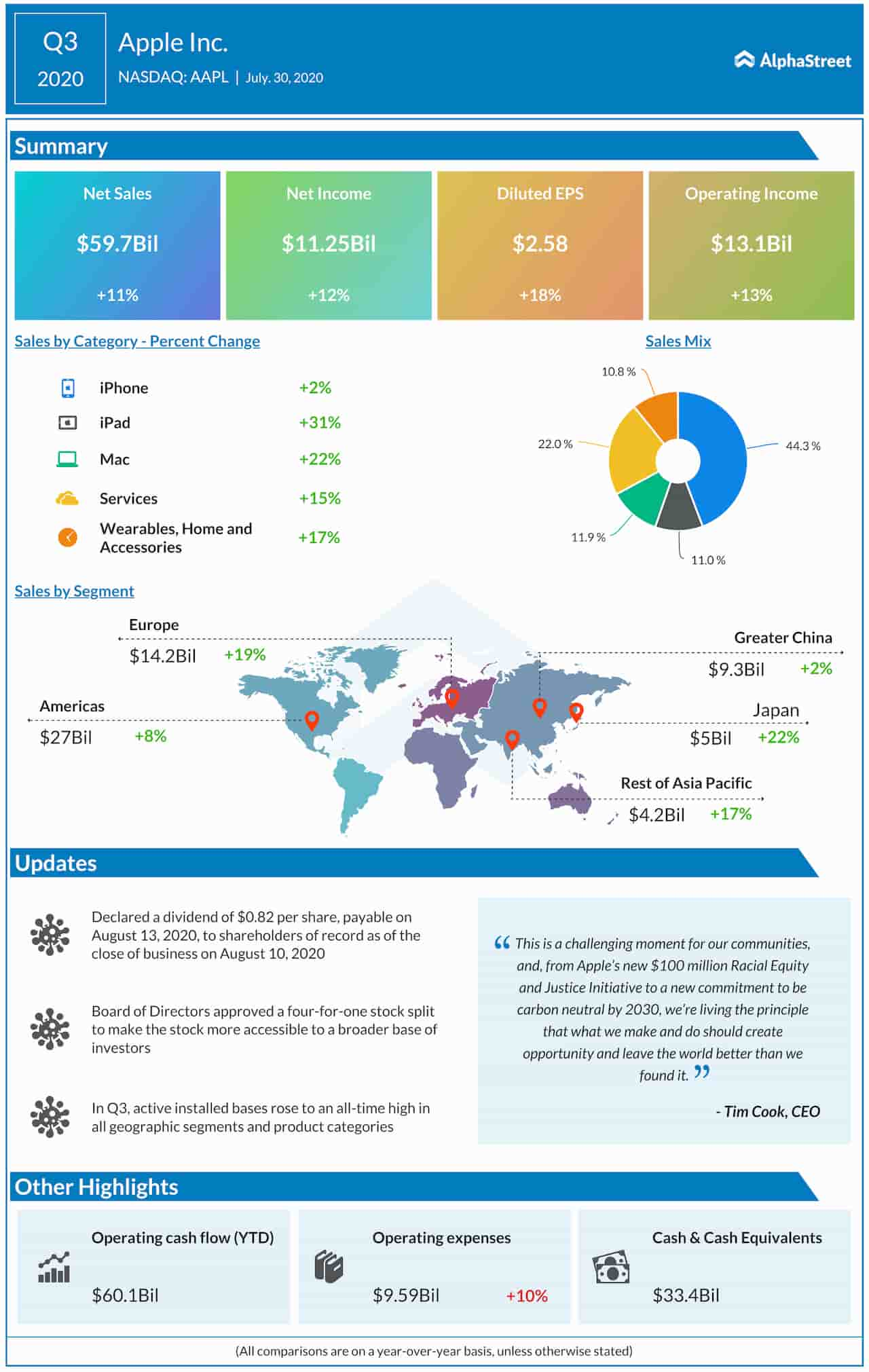

Apple reported Q3 revenue of $59.7 billion with earnings per share of $2.58. This was significantly higher than Wall Street revenue and earnings estimates of $52.25 billion and $2.04 respectively. Its EPS grew 18% while sales were up 11% year-over-year and the company generated operating cash flow of $16.3 billion.

Cook said that record Q3 sales were driven by double-digit growth in Products and Services in each of its geographic segments. Despite an uncertain macro environment, Apple has managed to hold its own and Cook commented, “….this performance is a testament to the important role our products play in our customers’ lives and to Apple’s relentless innovation.”

Apple’s Services business is its second-largest segment and sales rose 14.8% to $13.1 billion. The company had targeted to double 2016 Services revenue by the end of fiscal 2020. However, it managed to achieve this target six months ahead of schedule.

Dividend and stock split

We can see why Apple shares soared higher in after-hours trading to touch a record price. The company not only managed to easily crush Wall Street estimates amid a highly uncertain economic environment, it also remains bullish about the upcoming quarters.

Also read: Highlights from the tech-antitrust congressional hearing

While sales were impacted in April, demand for most products improved in May and June. The installed base of active bases touched an all-time high in all segments across all categories. The tech giant expects Q4 to see the same trends as the June quarter with the exception of Apple Care.

_____

For more updates about Apple, read the full earnings call transcript here.