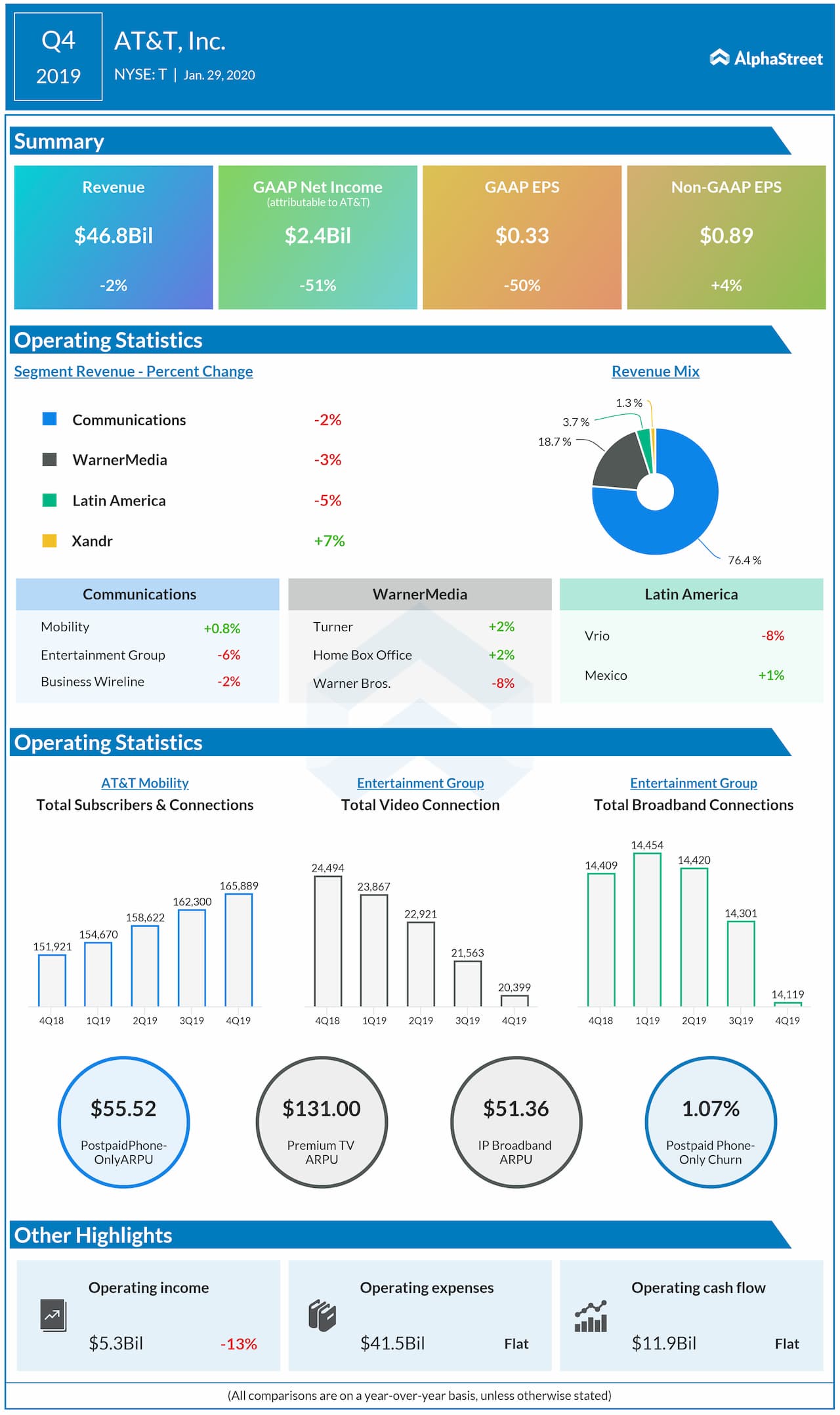

The company saw growth in revenues from domestic wireless

services and strategic and managed business services, which was partly offset by

revenue declines in domestic video, legacy wireline services and WarnerMedia.

Net income attributable to common stock was $2.4 billion, or $0.33 per share, compared to $4.9 billion, or $0.66 per share, last year. Adjusted EPS was $0.89, above forecasts of $0.87.

Also see: AT&T Q4 2019 Earnings Preview

In the Communications segment, mobility service revenues

were up 1.8% in the quarter while total wireless revenues rose 0.8%. In the

Entertainment Group, IP broadband revenue grew 2.7%. In WarnerMedia, Turner

revenues grew 1.6% with gains in subscription revenue. HBO revenues increased

1.9% with gains in digital subscribers.

AT&T expects revenue to grow 1-2% in 2020. Adjusted EPS is expected to be $3.60 to $3.70, including HBO Max investment.

As part of its three-year financial guidance, AT&T expects to achieve adjusted EPS of $4.50-$4.80 by 2022. Revenue is expected to grow 1-2%.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.