AT&T Inc. (NYSE: T) is scheduled to report fourth quarter 2019 earnings results on Wednesday, January 29, before the market opens. The company is expected to report earnings of $0.87 per share compared to $0.86 per share reported last year. Revenue is expected to dip by 2% to $46.9 billion.

Last quarter, the company saw strength in wireless services and this can be expected to continue in the fourth quarter as well. The development and rollout of 5G services is an important factor in this area. The momentum was offset by weakness in legacy wireline services and WarnerMedia.

The key topic of focus during the announcement is likely to be

HBO Max, which is set to launch in May 2020 with 10,000 hours of premium

content at $14.99 a month. HBO has a wide library of popular content which will

be an advantage for the company.

AT&T is developing a company-wide membership model that

will tap into its 170 million direct-to-consumer relationships, 5,500 retail

stores and 3.2 billion annual customer touchpoints. However, higher costs

related to investments in HBO Max might hurt margins in the quarter.

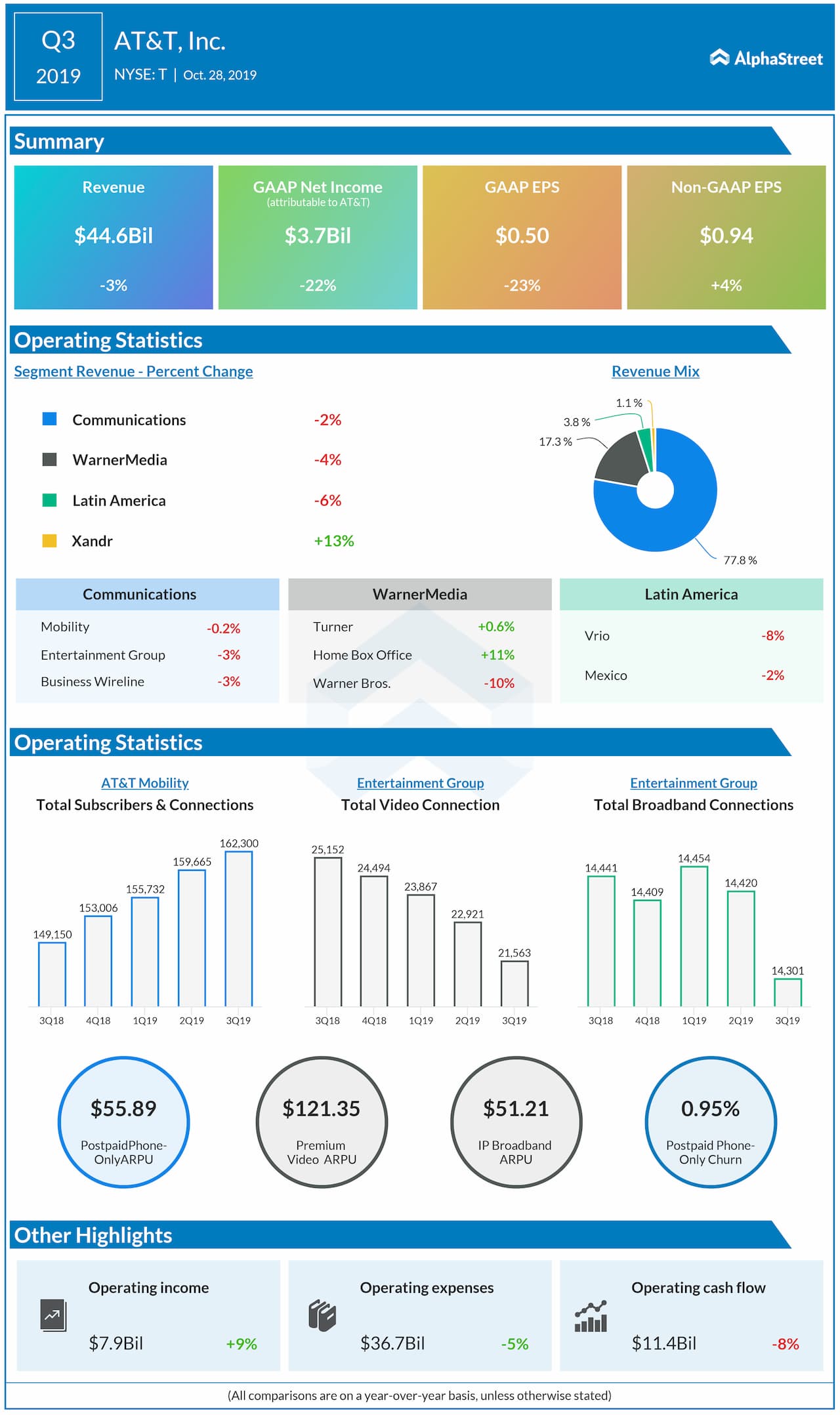

In the third quarter of 2019, AT&T beat earnings estimates while revenues fell short of expectations. Revenues fell 3% to $44.6 billion while adjusted EPS rose 4% to $0.94.

Last quarter, the

company revealed a 3-year financial outlook and capital allocation plan, which is

expected to drive significant growth in EBITDA margins and EPS, and allow it to

invest in growth areas, retire shares and pay down debt. The capital allocation

plan includes dividend growth and payout ratio, share retirement, retiring 100%

of the acquisition debt from the Time Warner deal, and continued disciplined

review of the portfolio.

In 2019, AT&T

had planned to close about $14 billion from monetizing non-core assets. In

2020, the company expects to monetize $5 billion to $10 billion of

non-strategic assets.

Shares of AT&T have gained over 25% in the past one year.