Proposed asset sales

Xandr cannot exactly be called a leaden asset as the business unit has consistently recorded revenue growth. Looking at the past three years, Xandr’s revenue grew 26.7% to $1.74 billion in 2018 from 2017 and 16.2% to $2 billion in 2019 from 2018. However, this segment accounted for only around 1% of total operating revenues in 2019 and 2018.

In the first quarter of 2020, Xandr’s revenue amounted to $489 million, reflecting a year-over-year increase of nearly 15%, due to strong demand for addressable advertising. At the end of April, AT&T combined Xandr with WarnerMedia to bring together all its advertising businesses as part of its strategy to transform into a modern media company.

However the current reports suggest that the company might be taking a step back on this strategy. Xandr was formed through AT&T’s acquisition of AppNexus for $1.6 billion in 2018. The possible sale of Xandr, which was first reported by The Wall Street Journal, is apparently expected to yield the same amount for AT&T.

Xandr has been criticized for not having any significant new product offerings in the past few years. With the current slowdown in advertising and being a small part of overall revenue, perhaps letting Xandr go might be a good move.

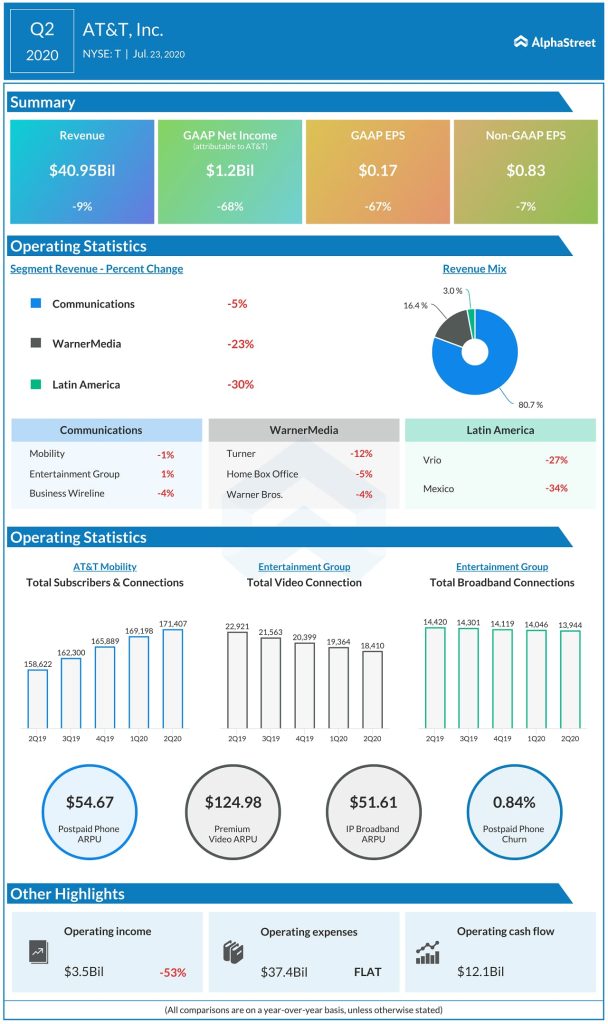

The other asset that might get razed is DirecTV, which has been considered a weak link for quite some time. The Entertainment Group, which includes DirecTV, saw an 11.4% decline in revenues in the second quarter of 2020 along with a loss of 886,000 premium TV subscribers due to competition.

It is speculated that DirecTV might not fetch even half of what AT&T paid for it back in 2015, which was $49 billion. Although it might seem better to offload a problematic asset, it appears unlikely that AT&T will be able to do so at a profitable price.

HBO Max

Despite the WarnerMedia segment and its units Turner, HBO, and Warner Bros. seeing revenue declines during the second quarter of 2020 due to decreases in advertising, subscription and theatrical revenues, the future of HBO Max appears bright.

HBO Max had a strong launch and is on track to hit its targets that were set last fall for subscribers, activations and revenues. The company also expects HBO Max to help increase its broadband adds and wireless ARPU. At the end of Q2 2020, HBO Max had 36.3 million US subscribers.

With a strong trove of content, HBO Max has a significant advantage. AT&T plans to invest significantly in HBO Max which will help drive growth going forward. It would bode well for the company to focus particularly in this area considering its potential to yield massive benefits.

(The opinions expressed in the article are that of the author alone and not of AlphaStreet)