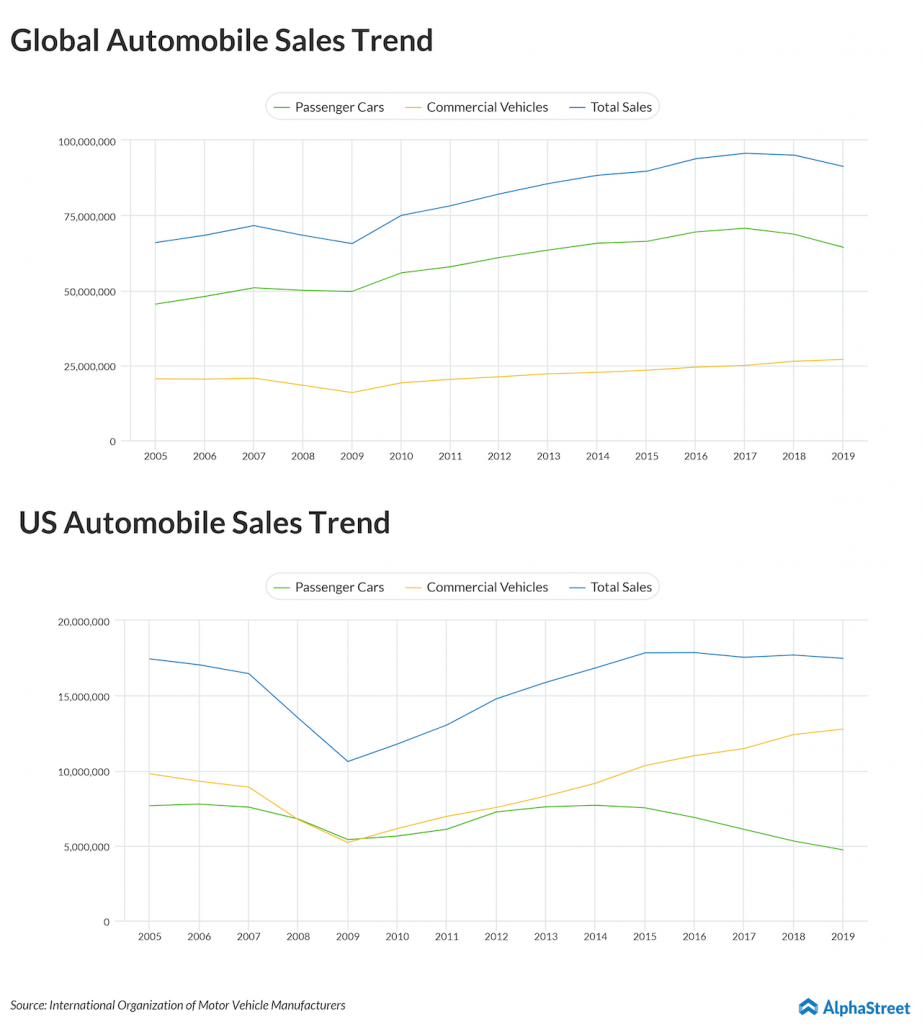

Novel Coronavirus spared few sectors as it wreaked havoc across the globe. And once the dust settles and the economy gradually recuperates, various industries will take their own good time to get back on their feet. The automobile industry will be among the ones that take the longest road to health.

The industry was already struggling with the changing consumer trends and rising competition when the pandemic struck. Even in late January, when the impact of COVID-19 was yet to materialize, the industry was in a two-year downward trajectory. During this period, First Trust NASDAQ Global Auto fund, which tracks automobile mammoths around the globe, was down almost 20%. The virus just acted as a finisher.

A dampener on EV efforts

Automobile firms were rampantly shifting lanes to EV when the pandemic struck. Government subsidies, high oil prices and the backing of environmental activists were all tailwinds in the process that the transformation almost seemed inevitable, despite the staggering costs associated with their manufacture.

However, the dynamics are changing now. The lockdowns and shuttered factories are likely to impact the liquidity of at least the smaller firms, in turn, hindering their EV dreams. Fiat Chrysler Automobiles N.V. (NYSE: FCAU) late last month entered into an incremental credit facility of €3.5 billion in a move to enhance liquidity. This is in addition to its existing credit facilities of €7.7 billion, as well as a €300 million five-year loan with the European Investment Bank, raising the overall liabilities on the firm.

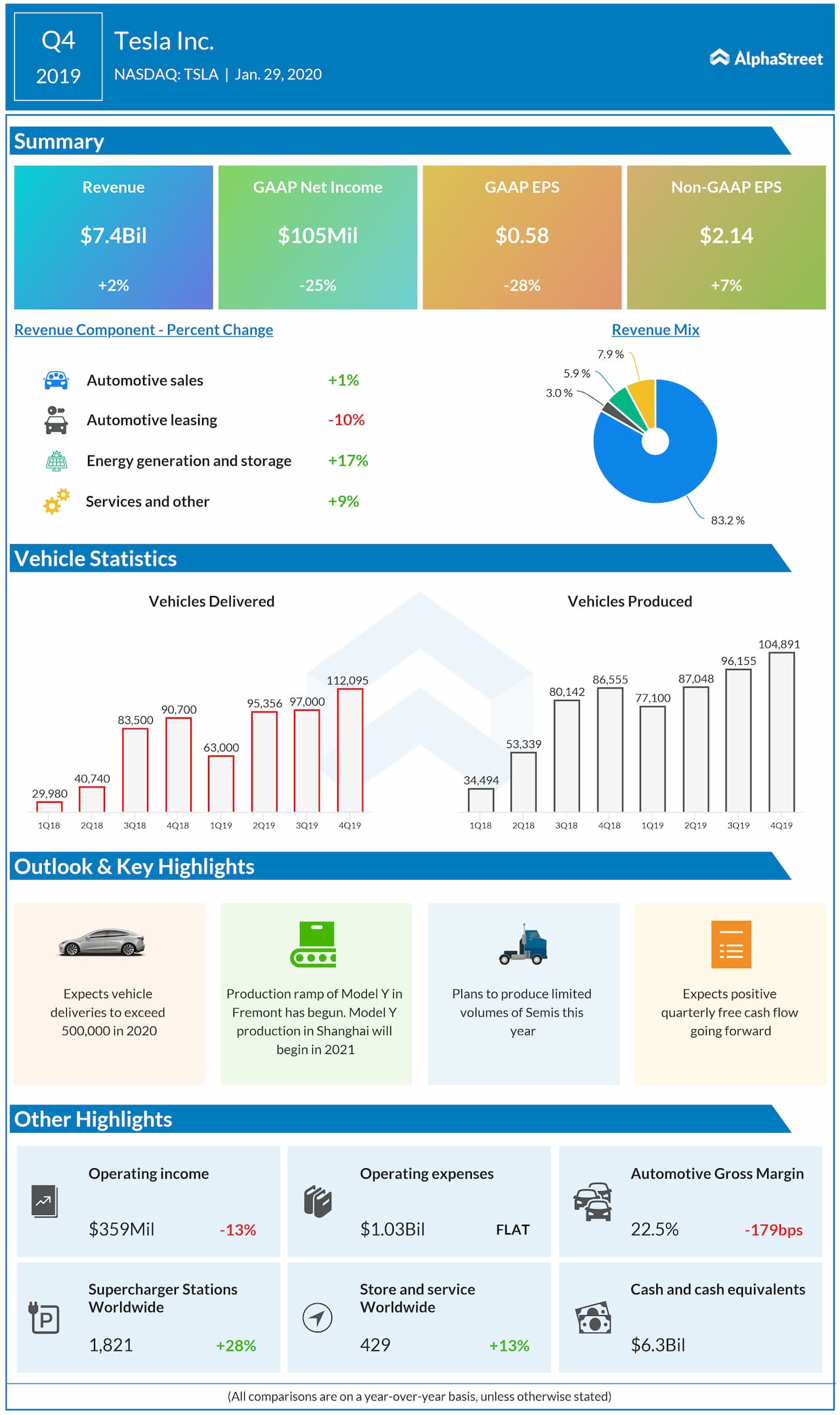

This could also mean trouble for Tesla (NASDAQ: TSLA), which is famously gripped with liquidity concerns. However, if it manages to squeeze past the difficult times, the headstart it has achieved in the EV space could act as an edge over its competitors.

Demand deceleration

On the flip side though, oil price declines driven by the pandemic could deter customers from going for pricey EV models, at least in the short term. According to the International Energy Agency’s recent Oil Market Report, oil demand could normalize only by the end of this year. Separately, an ailing economy is not an ideal host for the auto industry to prosper. With unemployment levels hitting a peak late last month, customers are likely to postpone the purchase of new vehicles, let alone electric vehicles.

Morgan Stanley also recently raised similar concerns, stating that it expects new car sales to fall from 17.1 million last year to 15.5 million this year.

[irp posts=”52976″]

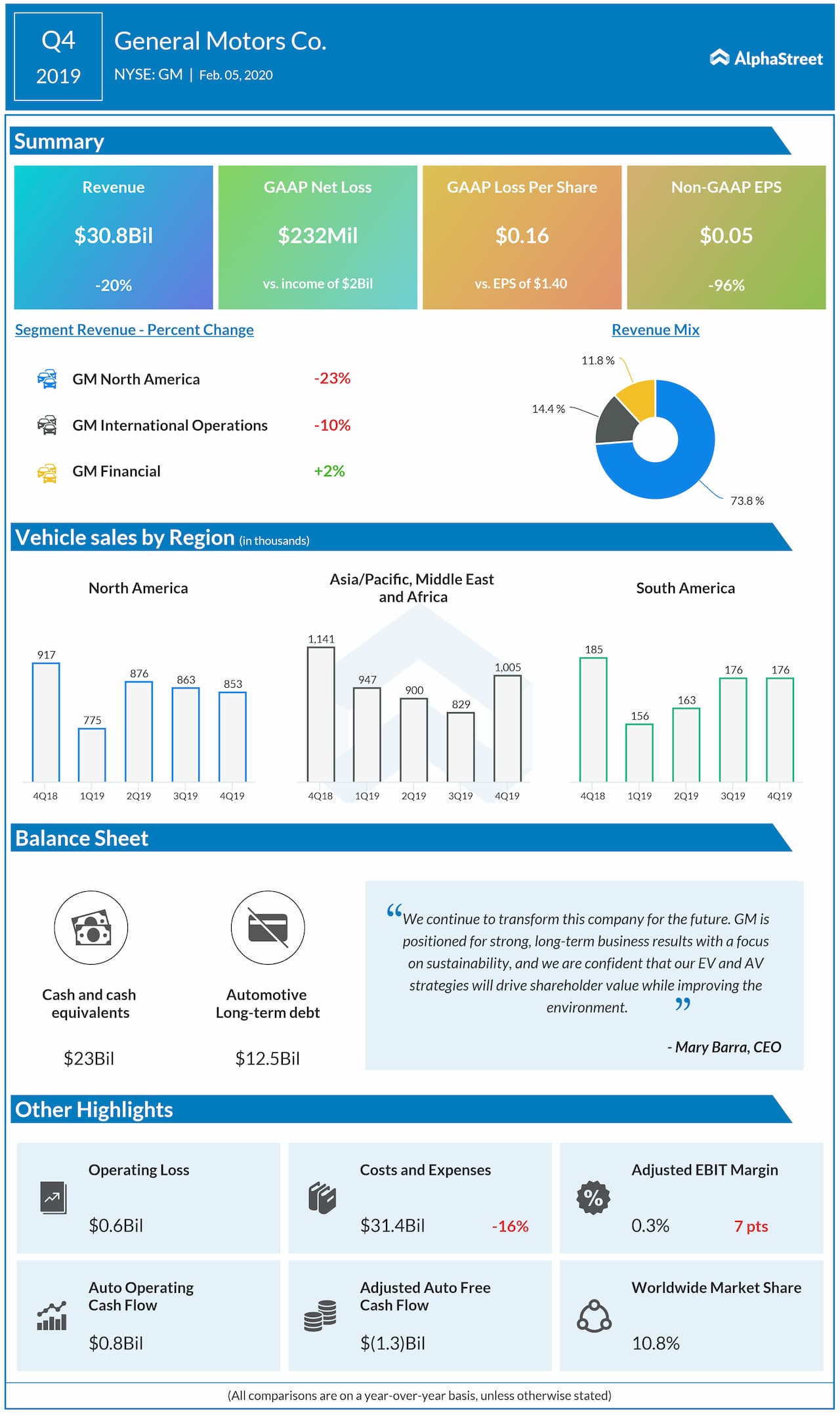

Meanwhile, companies that provide automotive aftermarket sales and services, such as AutoZone (NYSE: AZO), Advance Auto Parts (NYSE: AAP) and O’Reilly Auto Parts (NASDAQ: ORLY) may become the earliest beneficiaries in the aftermath of the crisis. And it points to why these stocks have fared much better than automobile manufacturers such as Ford (NYSE: F) or General Motors (NYSE: GM) following the panic sell-off period.

It is difficult to assess the impact on ride-hailing services including Uber (NYSE: UBER) and Lyft (NASDAQ: LYFT) at this juncture, but the slew of allegations against these companies over not providing their drivers with adequate safety equipment is likely to see repercussions at a later stage.

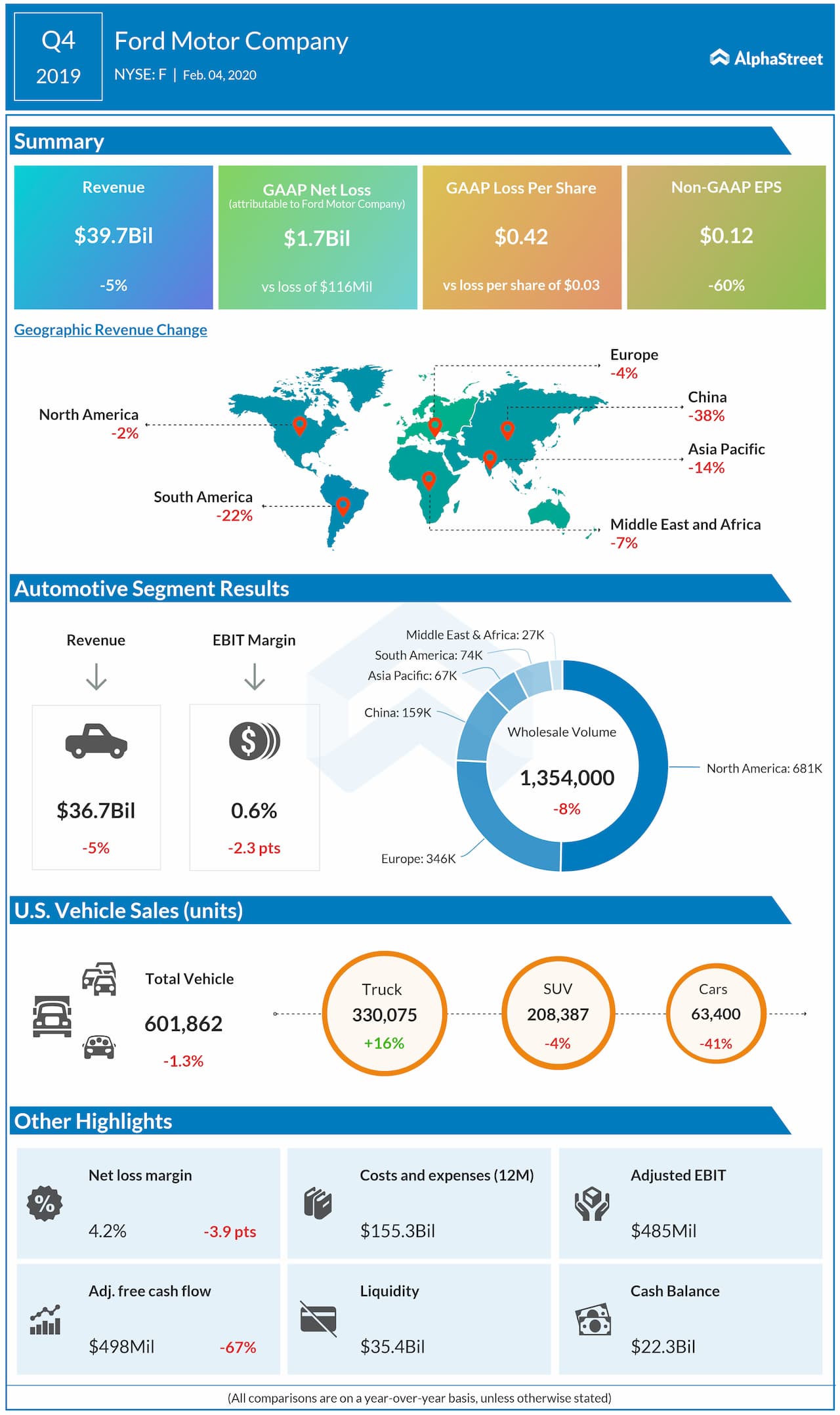

Ford v Coronavirus

With a relatively stable balance sheet and

less exposure to the commuter segment, Ford will be among the earliest to

recover. Separately, the Detroit-based firm has also announced a slew of

measures including suspension of dividends, reduction of operating expenses and

partial deferral of executive salaries to keep liquidity intact.

The company had over $30 billion cash on the balance sheet as on April 9. Ford CFO Tim Stone noted:

“We continue to opportunistically assess all funding options to further strengthen our balance sheet and increase liquidity to optimize our financial flexibility. However, we believe we have sufficient cash today to get us through at least the end of the third quarter with no incremental vehicle production and wholesales or financing actions.”

Ford had also announced a 21% decline in wholesale vehicle sales and lower-than-expected revenue figures due to lower production. And as we have stated earlier, analyst estimates are hard to go by this quarter, as even the markets are still in the process of assessing the overall impact of COVID-19 on each industry. And with production starting once again in China, which is slowly opening up, recovery could now gradually take shape.

[irp posts=”55999″]

Ford is scheduled to announce quarterly results on April 28, a day before Tesla. General Motors will, meanwhile, deliver financial results on May 6.