The Stock

It has been a rollercoaster ride for AutoZone’s stock so far in 2023, which has gained about 5% during that period. One of the highest-priced Wall Street stocks, AZO traded slightly above $2,600 on Wednesday. After reaching a record high a few months ago, the stock pulled back sharply but returned to the growth path recently. Considering the company’s strong prospects, currently, the stock is a good investment but it might look expensive to some investors.

AutoZone has remained largely unaffected by inflation and macro uncertainties, mainly due to its effective customer service supported by the large store network, and healthy cash flows. The company is all set to expand the network further by opening new stores in the US and South America. William Rhodes, the current chief executive officer, will be stepping down by 2013-end, to be succeeded by Philip Daniele who will take charge early next year.

Q4 Results

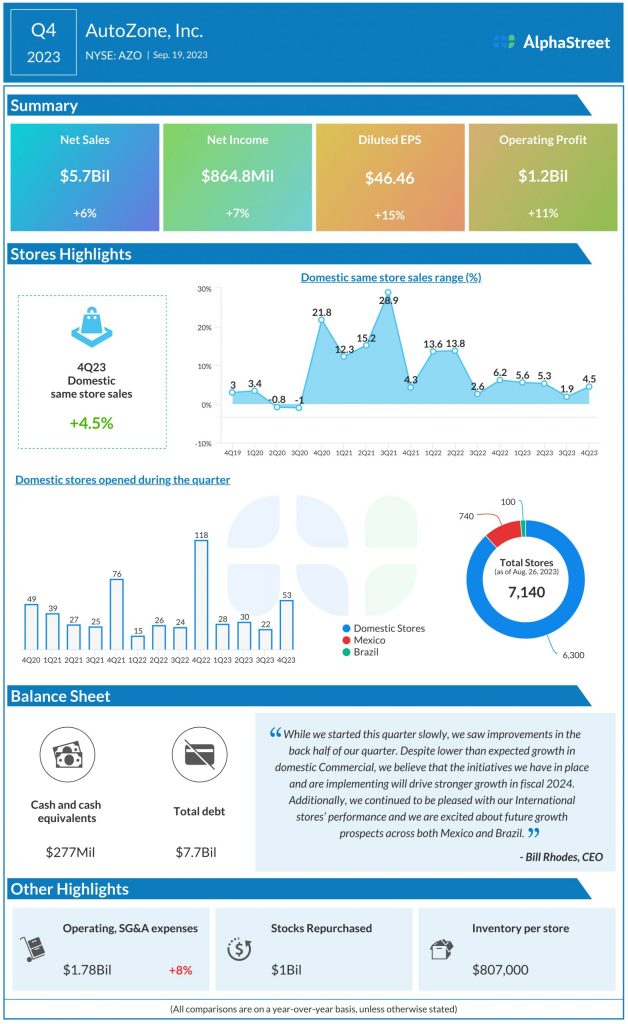

For the fourth quarter of 2023, the company reported better-than-expected earnings that rose 15% year-over-year to $46.46 per share. The double-digit growth reflects a 6% increase in net sales to $5.7 billion. Domestic same-store sales were up 4.5% from the year-ago quarter. During the quarter, the company opened 53 new stores and closed one unit in the US.

Commenting on AutoZone’s financial performance, Rhodes said during a recent interaction with analysts: “As we’ve accelerated our top line since the onset of the pandemic, our competitive positioning has also materially improved. Our efforts for 2024 will be focused on execution. We have a lot of projects in flight, and we need to get them completed. Supply chain improvements will remain a key focus in FY ’24. We will continue with our additions of Mega-Hub and Hub stores, new distribution centers, and international store growth.”

In the past six months, AutoZone’s shares have gained 6%. They closed Wednesday’s session slightly lower after trading mostly higher during the day.