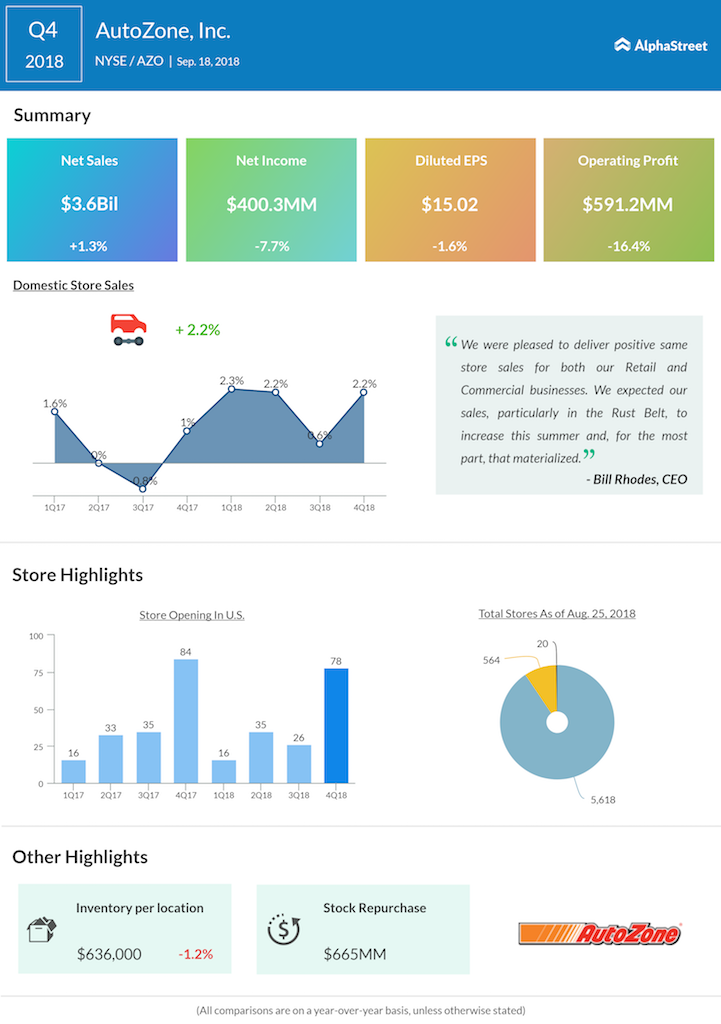

AutoZone Inc. (AZO) beat analysts’ expectations on earnings for the fourth quarter of 2018 but sales missed market consensus causing the stock to fall over 5% during premarket hours. The auto parts retailer reported a 1.3% increase in net sales to $3.56 billion for the fourth quarter of 2018 compared to the same period last year, as domestic same-store sales increased 2.2%.

Both the Retail and Commercial businesses saw positive same-store sales. Total domestic commercial sales increased 8.8% from last year.

Net income dropped 7.7% to $400.3 million while diluted EPS fell 1.6% to $15.02 versus the prior-year period. Adjusted net income increased 13.8% to $494 million, while adjusted diluted EPS grew 21.4% to $18.54, helped by lower income tax rates due to the tax reform.

Gross margins improved to 53.6% during the quarter from 52.8% last year, driven by the impact of the sale of two business units completed during the year and higher merchandise margins, partially offset by higher supply chain costs.

Inventory increased 1.6% over the prior-year period, driven by new stores and increased product placement, partially offset by the impact of the sale of two business units.

During the quarter, AutoZone opened 78 new stores and relocated four stores in the US, opened 28 new stores in Mexico and four in Brazil. As of August 25, 2018, the company had 5,618 stores in 50 states in the US, the District of Columbia and Puerto Rico, 564 stores in Mexico and 20 stores in Brazil for a total count of 6,202.

Related: AutoZone Q4 2018 Earnings Call Transcript

Earnings Preview: AutoZone is likely to surpass expectations