CEO Brian Moynihan said in a statement, “We grew consumer and commercial loans; we grew deposits; we grew assets within our Merrill Edge business; we generated more net new households in Merrill Lynch; and we supported more institutional client activity — all of this while we continued to invest in our businesses and began an additional $500 million technology investment, which we intend to spend over the next several quarters, due to the benefits we received from tax reform.”

RELATED: Bank of America Q2 earnings transcript

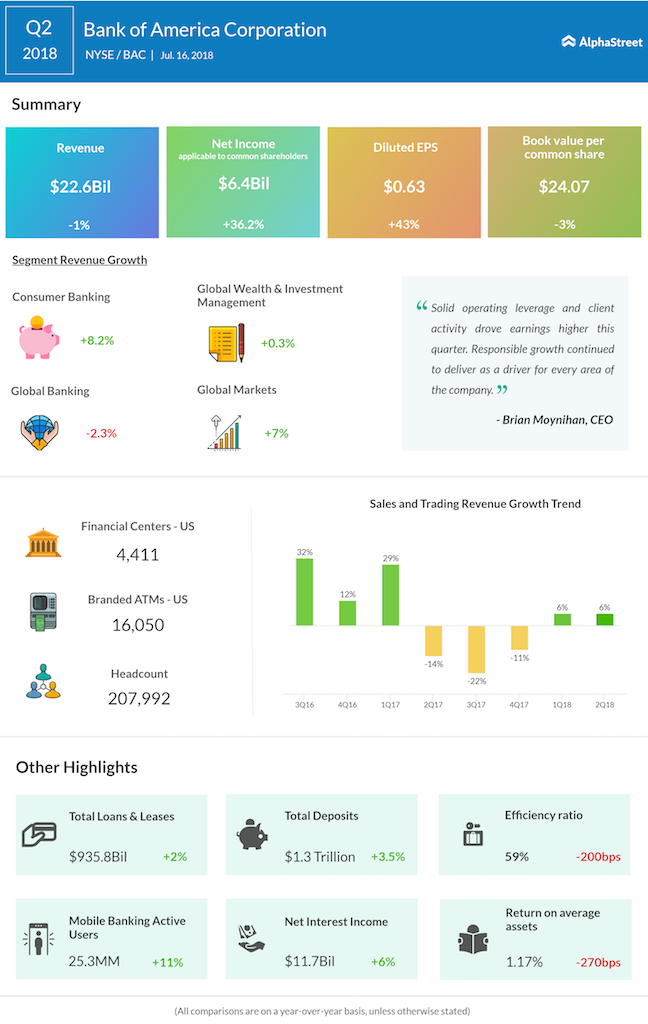

Revenue from its largest segment, Consumer Banking, rose 8% to $9.2 billion, as deposits improved 5% to $688 billion.

Shares of the second-largest US bank were hurt this year by the ongoing trade war between the US and China as investors remained concerned over its risk assets. Since the beginning of March, the bank’s shares have slipped over 11%, versus 3.1% improvement witnessed by S&P 500 index.

Earlier last week, rivals JPMorgan Chase (JPM), Citigroup (C) and Wells Fargo (WFC) had reported earnings. All the three banks saw their stock decline after their results failed to meet the expectations of shareholders.

RELATED: Bank stocks JPMorgan and Citi fail to impress on earnings day

Related IG: First quarter earnings AlphaGraphic (Click to enlarge)