Baozun is often called China’s Shopify and provides e-commerce solutions to enterprises. It integrates e-commerce capabilities that include IT solutions, store operations, digital marketing, customer services, warehousing and fulfillment. The company helps brand partners to successfully execute e-commerce strategies in China and provides a platform to sell products directly to customers online.

China’s e-commerce segment continues to grow at a rapid pace; however, this has also increased complexity and Baozun aims to simplify the end-to-end shopping process for enterprises and customers.

E-commerce partners can leverage Baozun’s capabilities that also allows them to integrate back-end systems to enable data tracking and analytics across the entire value chain. Baozun also helps brand partners to establish a market presence and launch products at China’s online marketplaces such as Tmall, and JD.com.

Baozun’s focus on customer acquisition

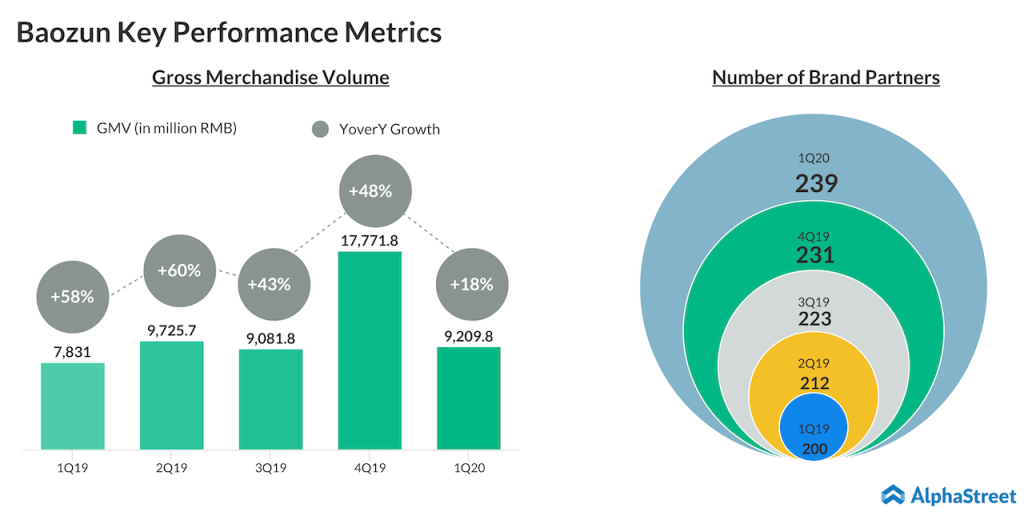

Baozun ended Q1 with 239 major brand partners on its platform that include Nike (NYSE: NKE), Starbucks (NASDAQ: SBUX) and Microsoft (NASDAQ: MSFT). In the last 12-months, it acquired 39 new brands that increased Q1 sales by 18.4% to $215.2 million.

In 2019, the company managed to grow sales by 35% year-over-year due to record growth in gross merchandise volume and net addition of new brands. This also ensured Baozun could generate positive cash flow for the first time ever.

Baozun revenue growth continues to outpace China’s e-commerce market that grew by 16.5% in 2019 and accounted for 20.7% of total retail sales. As stated above, the pandemic might increase the percentage of online sales at a stellar pace in the next few quarters.

[irp posts=”67125″]

During Baozun’s Q1 call, CEO Vincent Qiu said, “As China’s economic recovery strengthens in the second quarter, we believe the adoption of online retail will continue to accelerate going forward as brand partners increasingly prioritize their digital go-to-market strategies. This will create even more opportunities for us to drive mid-to-long-term sustainable growth.”

The management forecasts revenue growth between 20% and 23% in the second quarter. The company continues to post an adjusted profit, making it one of the top bets in the e-commerce space.

A look at valuation and upside potential

Despite Baozun’s market beating returns, it continues to trade an attractive valuation. It has a price to sales multiple of 2.3x and a price to earnings multiple of 30.8x. Comparatively, Shopify and Amazon are valued at a price to sales multiple of 61.6x and 5x respectively.

The long-term growth potential for Baozun remains solid as it continues to onboard brand partners. The increase in purchasing power for China’s middle class coupled with a rapidly expanding addressable market will continue to be key drivers of Baozun’s revenue growth.

[irp posts=”68370″]