In a sign that the mixed outlook did not go well with investors, the stock dropped on Wednesday evening after making modest gains soon after the company released fourth-quarter results. Yet, it hovered near the all-time highs seen a week ago. The recent performance indicates that prospective buyers shouldn’t wait any longer to grab NVDA, which has been on an upward spiral for a long time. The stock, which already looks expensive, is poised for double-digit gains this year.

Broad-based Growth

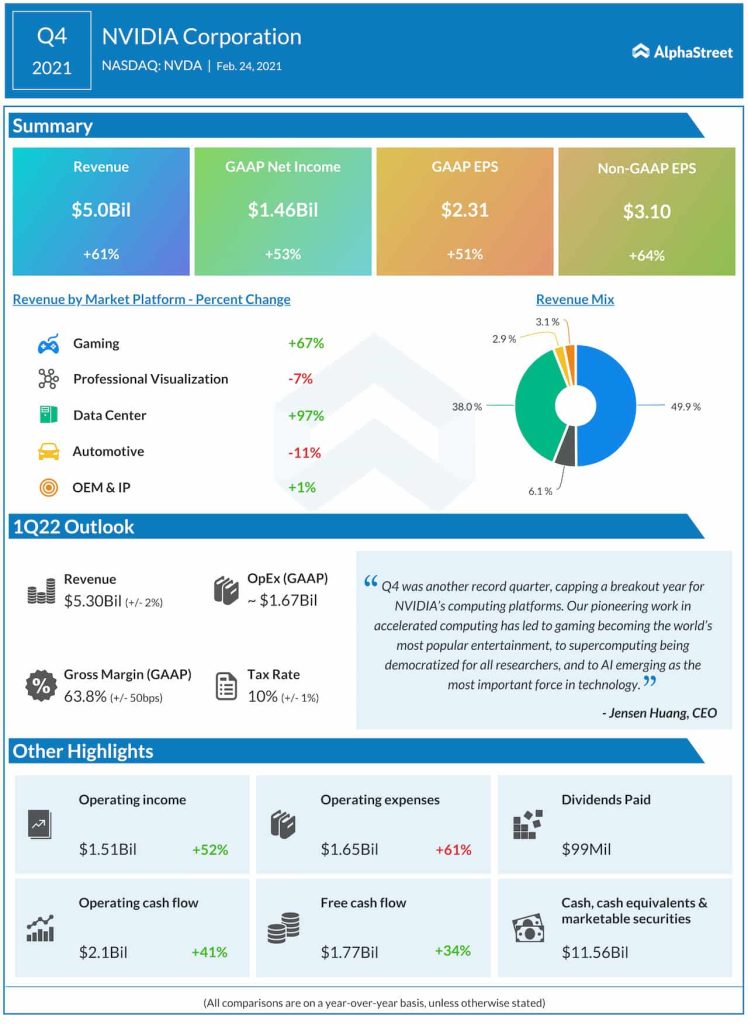

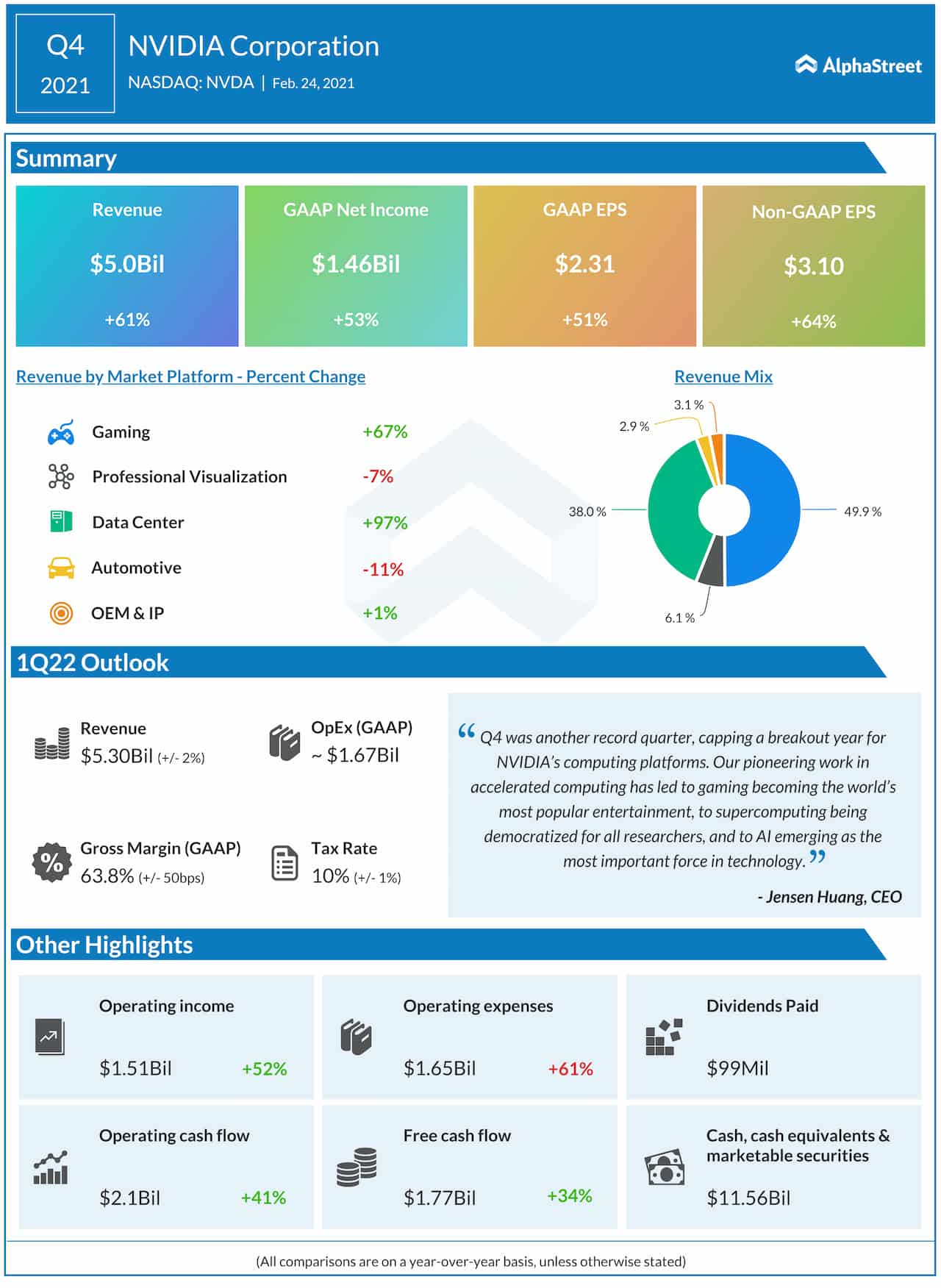

Gaming and datacenter, the main operating segments, expanded at record rates in the fourth quarter, with the latter’s revenues nearly doubling. As a result, total revenues surged to an all-time high of $5 billion, far exceeding the projection. At $3.10 per share, earnings were up 64% from last year and above the estimates. The bottom-line topped expectations consistently in the past several years. The management’s bullish guidance signals that the gaining-streak would continue.

From Nvidia’s fourth-quarter 2021 earnings conference call:

“Looking ahead, the reopening of businesses will benefit desktop workstations, but longer-term workforce trends will likely shift our mix to notebook GPUs and cloud offerings. Healthcare was a standout vertical in the quarter with significant orders from GE, Siemens. and Oxford Nanopore Technologies. Public sector and automotive also showed strength.”

New Design

The blockbuster results came on the heels of the company redesigning the GeForce RTX 3060 gaming cards to limit its use for cryptocurrency mining. It also launched the CMP processor that is exclusively meant for crypto mining. The move, to ensure that the gaming cards reach the right hands, assumes significant given the widespread chip shortage the market is currently witnessing, with the auto industry bearing the maximum brunt.

As part of its strategy to tap emerging opportunities in the automotive sector, the company is working on a high-value design win pipeline for its self-driving AI cockpit solutions, which is expected to contribute significantly to the top-line in the coming years.

Infographic: Intel Q4 earnings beat despite lower revenue

“The gaming laptop market has grown seven-fold in the past seven years and momentum is building. With top OEMs bringing to market a record 70 plus laptop models based on the GeForce RTX 30 Series. GeForce laptops as a whole are the fastest growing and one of the largest gaming platforms. Also at CES, we announced the GeForce RTX 3060 GPU priced at $329, extending the 30 Series desktop lineup further into the mainstream. We expect strong demand when it launches this Friday as 60-class GPUs have traditionally been our most popular products,” said Colette Kress, chief financial officer of Nvidia, this week.

Stock Peaks

Shares of Nvidia closed the last trading session at $565.68, which is up 7% since the beginning of the year. Interestingly, the stock has gained more than three-fold in less than two years, outperforming the S&P 500 index to which it belongs. It traded down 4% in the early hours of Thursday’s regular session.