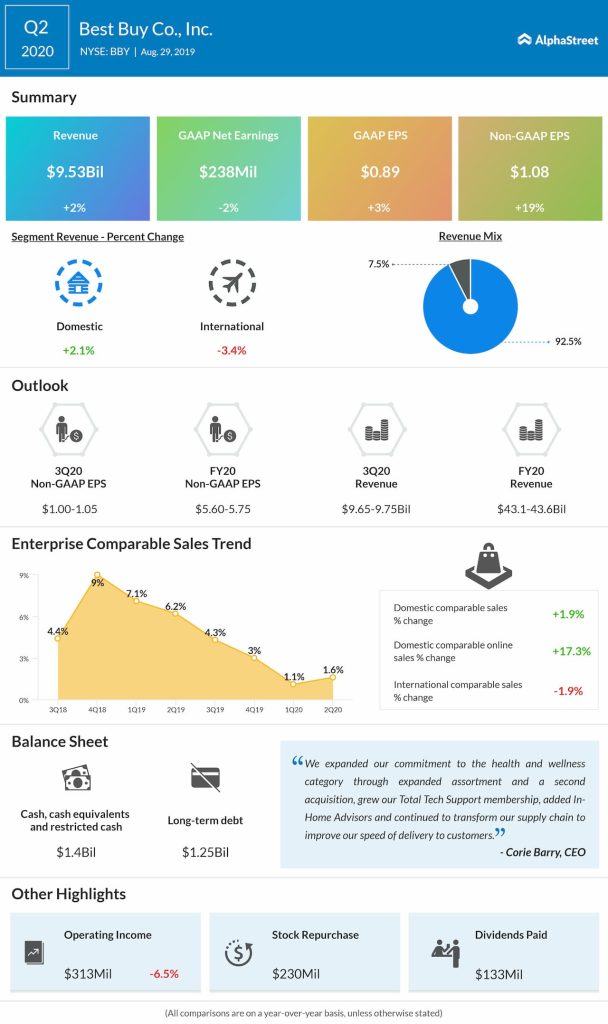

Enterprise revenue rose to $9.53 billion from $9.37 billion in the year-ago quarter but fell short of estimates of $9.56 billion. Enterprise comparable sales increased 1.6% compared to a growth of 6.2% last year.

GAAP net income dropped to $238 million from $244 million last year, hurt by higher restructuring charges, while GAAP EPS increased 3% to $0.89. Adjusted EPS jumped 19% to $1.08, beating forecasts of $0.99. The improvement in profitability was driven by gross profit rate expansion and disciplined expense management.

During the quarter, Domestic revenue grew 2.1% year-over-year to $8.82 billion, driven by comparable sales growth of 1.9% and revenue from the GreatCall acquisition. Domestic comparable online revenue grew 17.3% to $1.42 billion, mainly due to higher average order values and increased traffic.

In the Domestic segment, comp sales growth was driven mainly

by the appliances, tablets, headphones and services categories. This was partly

offset by declines in the gaming and home theater categories.

International revenue fell 3.4% to $715 million, mainly due

to a comp sales decline of 1.9% and negative impacts from foreign currency exchange

rates.

For the third quarter of 2020, enterprise revenue is expected to be $9.65 billion to $9.75 billion and comparable sales is expected to grow 0.5% to 1.5%. Adjusted EPS is expected to be $1.00 to $1.05.

For the full year of 2020, the company updated its outlook for Enterprise revenue to a range of $43.1 billion to $43.6 billion from the prior guidance of $42.9 billion to $43.9 billion. Enterprise comparable sales is estimated to grow 0.7-1.7% versus the prior range of 0.5-2.5%. Adjusted EPS is now estimated to be $5.60 to $5.75, compared to the prior outlook of $5.45 to $5.65.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.