BlackRock (NYSE: BLK) reported an 8% decline in earnings for the third quarter of 2019 due to lower non-operating income and a higher effective tax rate. The bottom line exceeded analysts’ expectations while the top line missed consensus estimates.

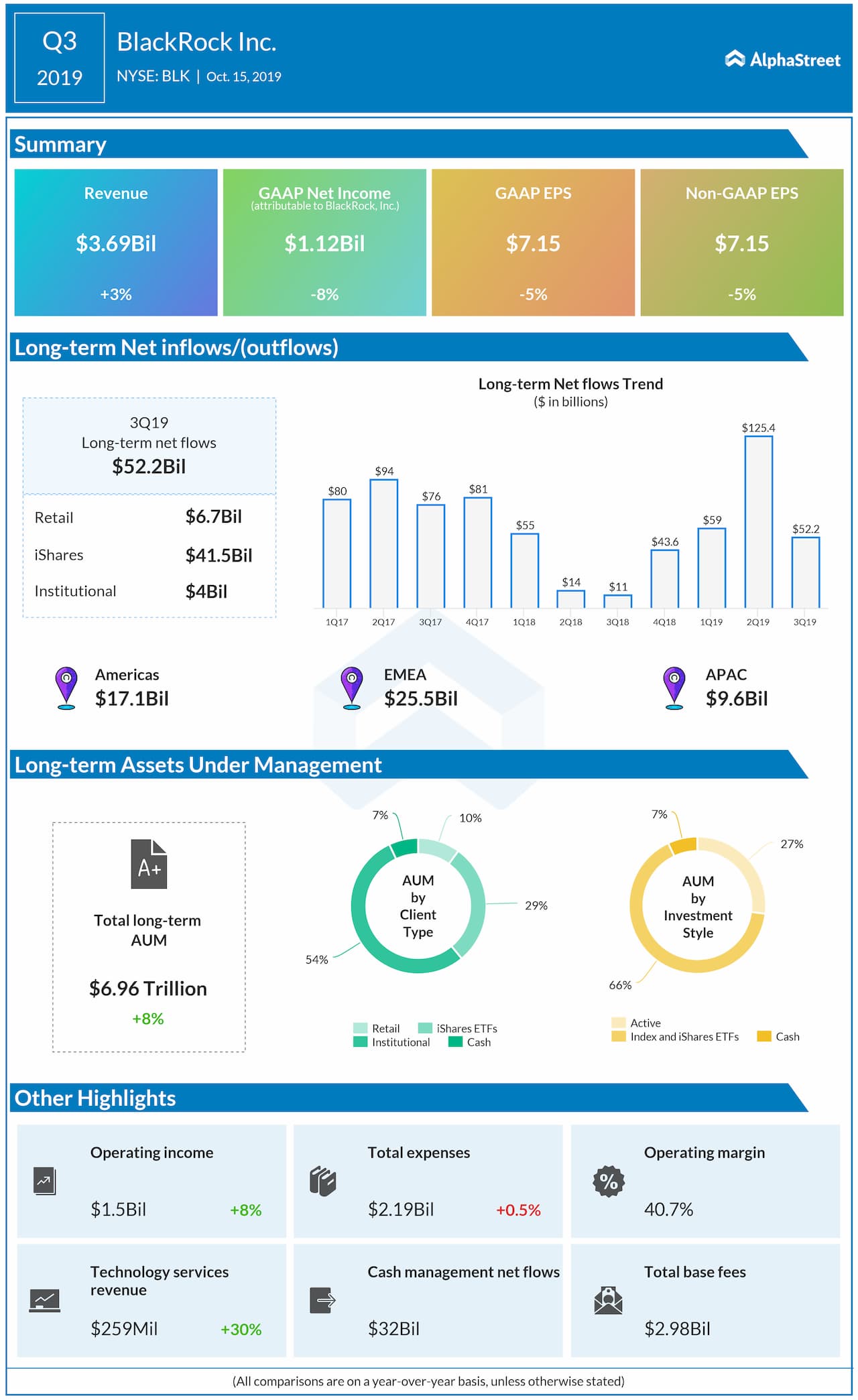

Net income fell by 8% to $1.12 billion or $7.15 per share. However, revenue rose by 3% to $3.69 billion, driven by higher base fees and technology services revenue, partially offset by lower performance fees. Assets under management increased by 8% to $6.96 trillion.

Technology services revenue grew by 30% year-over-year, reflecting Aladdin’s growth and the impact of the eFront acquisition. Aladdin’s comprehensive investment operating system powers BlackRock’s digital offerings and enables asset and wealth managers to scale and grow their businesses.

Total net inflows for the third quarter were $84 billion compared to outflows of $3.1 billion in the previous year quarter. This was driven by continued momentum in fixed income, cash, and alternative strategies, as clients re-balanced, de-risked and sought uncorrelated sources of return in the face of significant global market volatility.

BlackRock believes that clients could be rising due to their goals in portfolio and investment in the context of a complex and changing landscape. In the last twelve months, the company has been authorized to manage almost $350 billion in new assets by the clients, who depended on BlackRock’s broadly diversified asset management and technology platform.

The operating margin rose to 40.7% from 39% a year ago, reflecting its long-term ability to manage ongoing costs with its revenues. Operating margin is used to evaluate the company’s relative performance against industry peers as it eliminates margin variability arising from the accounting of revenues and expenses related to distributing different product structures in multiple distribution channels utilized by asset managers.

The company remained positive about its ambition to significantly expand its operations outside the US, particularly in China. BlackRock intends to become a dominant player by building its presence in China. The company is expected to share additional information about the expansion in China at the earnings conference call today.