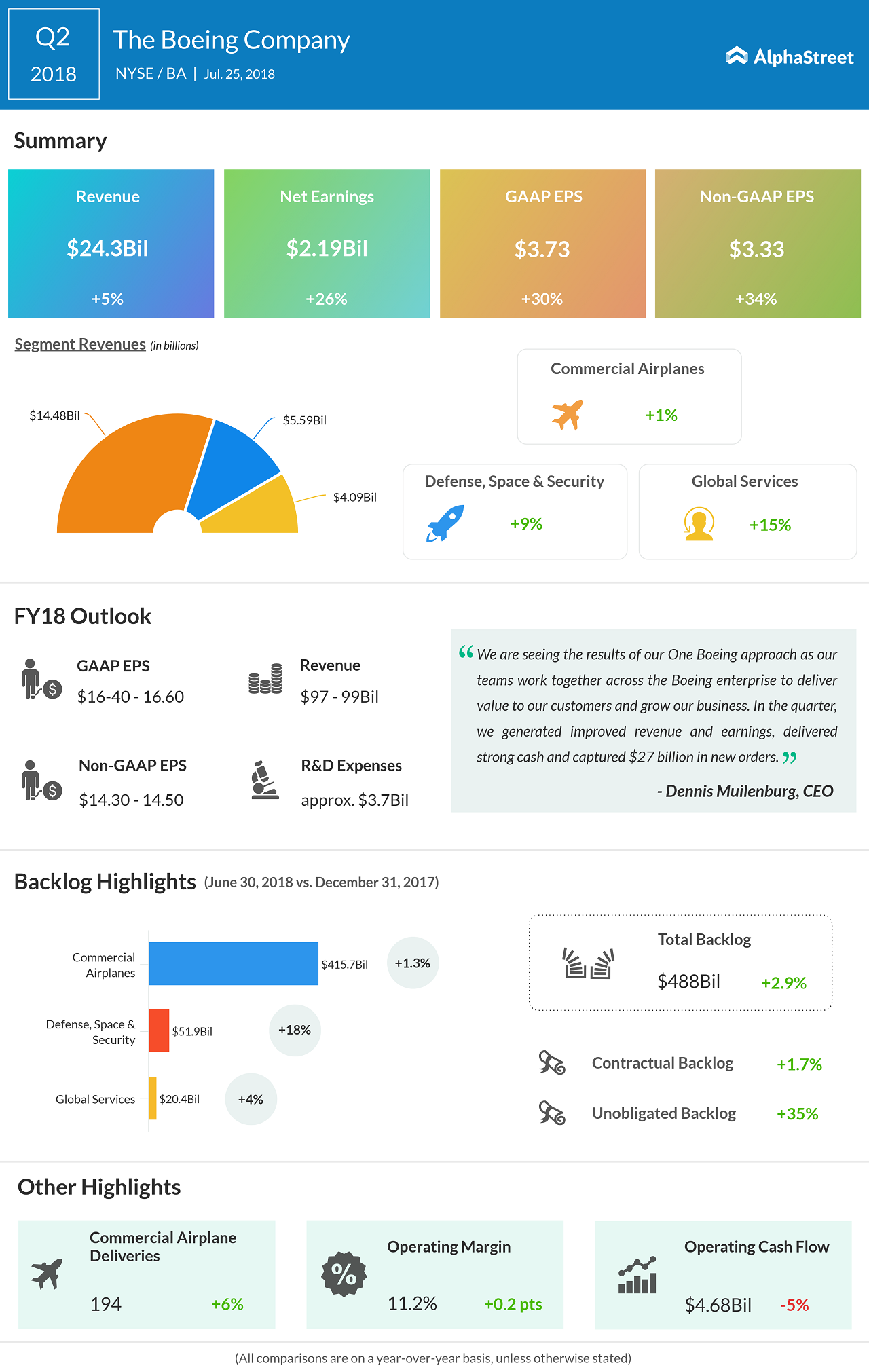

Revenue increased 5% to $24.3 billion from the prior-year period. The aircraft maker saw solid growth across all its segments during the quarter. Backlogs improved by $2 billion to $488 billion at the end of the quarter and included net orders of $27 billion.

Related: Strong airplane deliveries lift Boeing’s first quarter results

Looking ahead into fiscal 2018, Boeing raised its revenue outlook to $97 billion – $99 billion from $96 billion -$98 billion, driven by defense volume and services growth. The aerospace giant maintained its EPS estimate of $16.40-$16.60 and its adjusted EPS guidance of $14.30-$14.50. Operating cash flow is still expected to be between $15 billion and $15.5 billion.

Research and development expenses are still anticipated to be about $3.7 billion and capital expenditures are predicted to be around $2.2 billion for the full-year 2018. For the Defense, Space & Security segment, the company lifted revenue from outlook to $22 billion – $23 billion from $21.5 billion – $22.5 billion, while lowering its operating margin estimate to 10-10.5% from about 11%.

For the second quarter, Boeing’s deliveries rose 6% primarily aided by strong demand for its single-aisle 737 airplanes. Over the next two decades, single-aisle planes, which are in high demand globally, are expected to garner two-thirds of the global demand.

In early July, media reports revealed that Boeing received a total of 460 new orders in the first six months of 2018, more than double the number of orders booked by Airbus during the same period. Also, Boeing is intending to lift the monthly output of 737s by 10% to 52 units in the second half of 2018 and further to 57 units in 2019.

Related: Farnborough 2018: Boeing and Airbus land orders worth billions

During the quarter, Commercial Airplanes delivered 194 airplanes, including delivery of the first 737 MAX airplanes to Jet Airways, Ethiopian Airlines, and Xiamen Airlines. Commercial Airplanes booked 239 net orders during the quarter, including 91 widebodies.

Investors remained concerned on the increase in costs associated with the Defense, Space & Security segment during the full year 2018, which dragged the operating margin outlook down despite an increase in revenue estimate.

Shares of the aerospace giant fell 3.03% in the pre-market trading.

Related Infographics: Q1 Earnings