Bristol-Myers Squibb Company (NYSE: BMY) slipped to a loss in the fourth quarter of 2019 from a profit last year, due to the amortization of acquired intangible assets related to the Celgene purchase. However, the results exceeded analysts’ expectations. Further, the company issued earnings and revenue guidance for the full year 2020 that came in line with the consensus view.

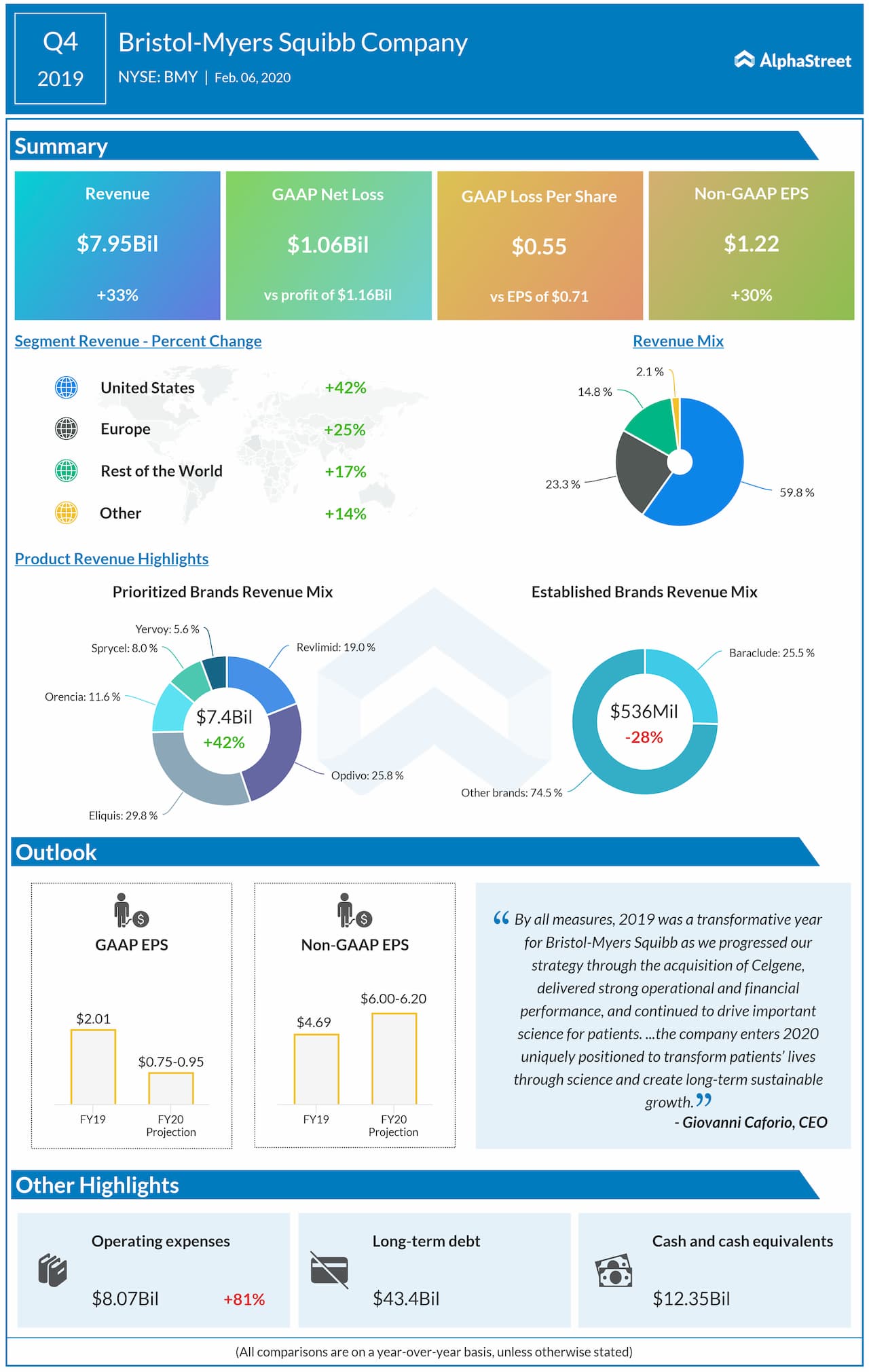

Net loss was $1.06 billion or $0.55 per share compared to a profit of $1.16 billion or $0.71 per share in the previous year quarter. Adjusted earnings increased by 30% to $1.22 per share.

Revenue jumped by 33% to $7.95 billion. Analysts had expected EPS of $0.88 per share on revenue of $6.14 billion for the fourth quarter. The top-line was driven by the Celgene acquisition, which was closed on November 20, 2019. Revenue climbed by 34% when adjusted for foreign exchange impact.

Looking ahead into fiscal 2020, the company expects unadjusted earnings in the range of $0.75-0.95 per share and adjusted earnings in the range of $6.00-6.20 per share. Revenue is predicted to be $40.5-42.5 billion for the full year. The consensus estimates EPS of $6.16 on revenue of $42.2 billion for the full year 2020.

Product-wise, sales of anticoagulant Eliquis and Sprycel moved up 19% and 2% respectively, year-over-year, while sales of melanoma drug Yervoy remained flat. The sales of anti-cancer drug Opdivo declined by 2% while anticoagulant drug Eliquis jumped by 19%.

The US revenues increased 42% to $4.8 billion in the quarter. International revenues increased 21% to $3.2 billion. When adjusted for foreign exchange impact, international revenues increased by 23%.

On Wednesday, Bristol-Myers Squibb issued a statement related to the global health emergency concerning the spread of the 2019 Novel Coronavirus. The company, which has limited and restricted employee travel to and from China, does not expect any disruptions to the supply of medicines for patients.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.