AI Push

The demand for the company’s products and services remains high — despite the dip in enterprise spending due to economic uncertainties and inflation pressures –, thanks to strong orders from hyperscalers for advanced technologies. Meanwhile, efforts are on to ramp up the company’s artificial intelligence capabilities in response to the strong deployment of generative AI by customers and to support the shift to AI networks. This segment of the business is expected to grow steadily in the coming years, outshining the other areas. Also, once completed, synergies from the planned acquisition of cloud computing firm VMware are expected to catalyze revenue growth going forward.

Commenting on the pending VMware deal, Broadcom’s CEO Hock Tan said at the last earnings call, “We’re making good progress with our various regulatory filings around the world, having received legal merger clearance in Australia, Brazil, Canada, South Africa, and Taiwan, and foreign investment control clearance in all necessary jurisdictions. We still expect the transaction will close in Broadcom’s fiscal 2023. The combination of Broadcom and VMware is about enabling enterprises to accelerate innovation and expand choice by addressing their most complex technology challenges in this multi-cloud era, and we are confident that regulators will see this when they conclude their review.”

What to Expect

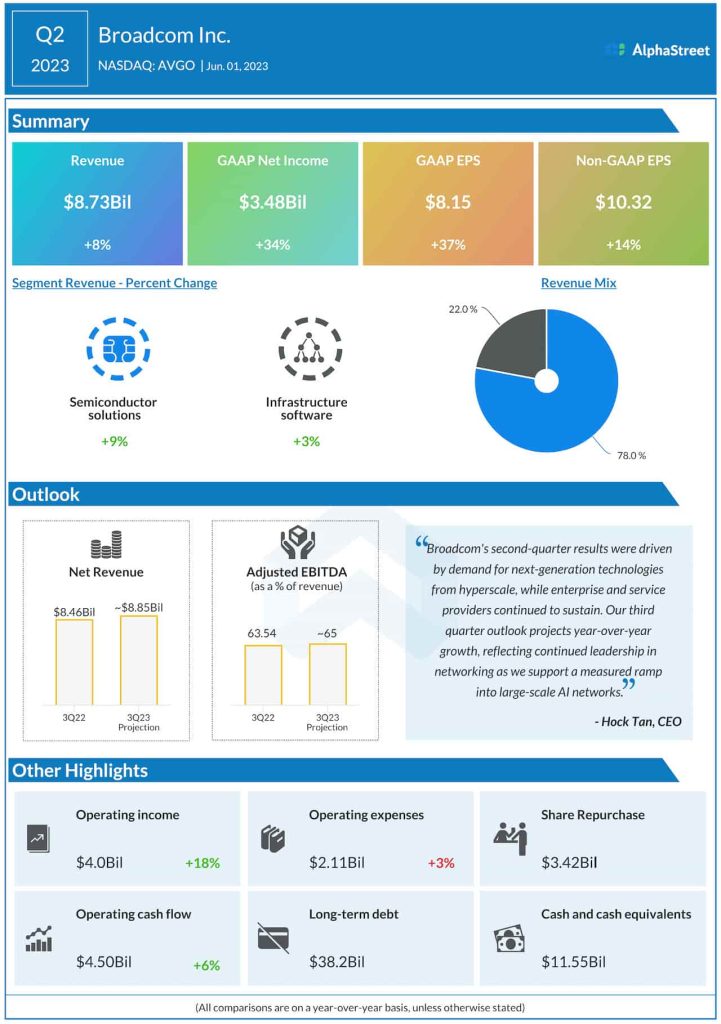

When Broadcom reports July-quarter results on Thursday, Wall Street will be looking for an adjusted net income of $10.42 per share, which is up 7% year-over-year. The positive earnings outlook reflects an estimated 4.7% annual growth in revenues to $8.86 billion. That broadly matches the revenue guidance issued by the management a few months ago.

Interestingly, earnings beat estimates in every quarter since the second half of 2020. It was not different in the second quarter when adjusted earnings per share climbed 14% from last year to $10.32 even as revenues moved up 8% to $8.73 billion. All operating segments, including the core Semiconductor Solutions division, expanded during the quarter.

Broadcom’s stock traded higher on Tuesday afternoon, as it did in the trailing quarters. AVGO is up an impressive 60% since the beginning of the year.