Overall, there has been a slowdown in volumes lately as the food company faces multiple challenges including changing customer preferences, macro uncertainties, and competition. The company lags behind some of its peers, though its snack business and certain select brands remained stable in recent years, including during the pandemic era.

Q1 Report

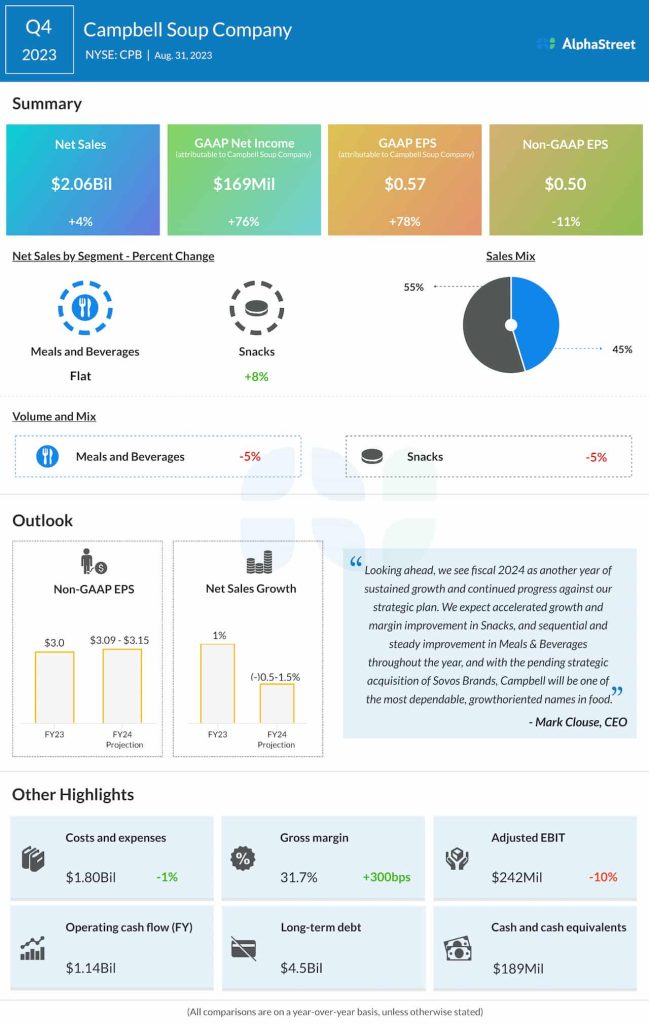

Campbell Soup will be reporting first-quarter results on December 6, at 7:15 a.m. ET. On average, analysts forecast adjusted earnings of $0.88 per share, compared to $1.02 per share in the prior-year quarter. Revenues are expected to be $2.52 billion. For the full fiscal year, the management predicts a modest increase in adjusted earnings per share to $3.09-3.15, and expects the top line to be almost flat.

“We have strategically balanced the interplay between pricing and promotional frequency while enhancing the tremendous equity and differentiation of our brands. We also continued to invest in expanding capacity for the future and enhancing our capabilities in supply chain, marketing, sales, and innovation. Looking ahead to fiscal 2024, we’re excited about the next stage of Campbell’s growth. The snacks business will continue to deliver on the value proposition of the Snyder’s-Lance acquisition with top line and margin building momentum,” said Campbell’s CEO Mark Clouse in a recent statement.

Key Numbers

In the fourth quarter, net sales increased 4% year-over-year to $2.1 billion, primarily due to an increase in the Snacks business. There was a 5% growth in organic net sales. Net income was $169 million or $0.57 per share in Q4, compared to $96 million or $0.32 per share a year earlier. On an adjusted basis, earnings decreased 11% year-over-year to $0.50 per share. Both numbers were broadly in line with estimates. In the trailing three quarters, earnings topped expectations.

The stock ended the last trading session slightly lower, extending the recent weakness. The shares have traded below their 12-month average since mid-year.