Q1 Report Due

After achieving double-digit earnings growth in the final three months of FY24, Campbell Soup is preparing to report first-quarter results on Wednesday, December 4, at 7:15 am ET. The average earnings estimate of Wall Street analysts is $0.88 per share for the quarter, excluding special items, on revenues of $2.8 billion. That compares with earnings of $0.91 per share and sales of $2.52 billion in Q1 2024.

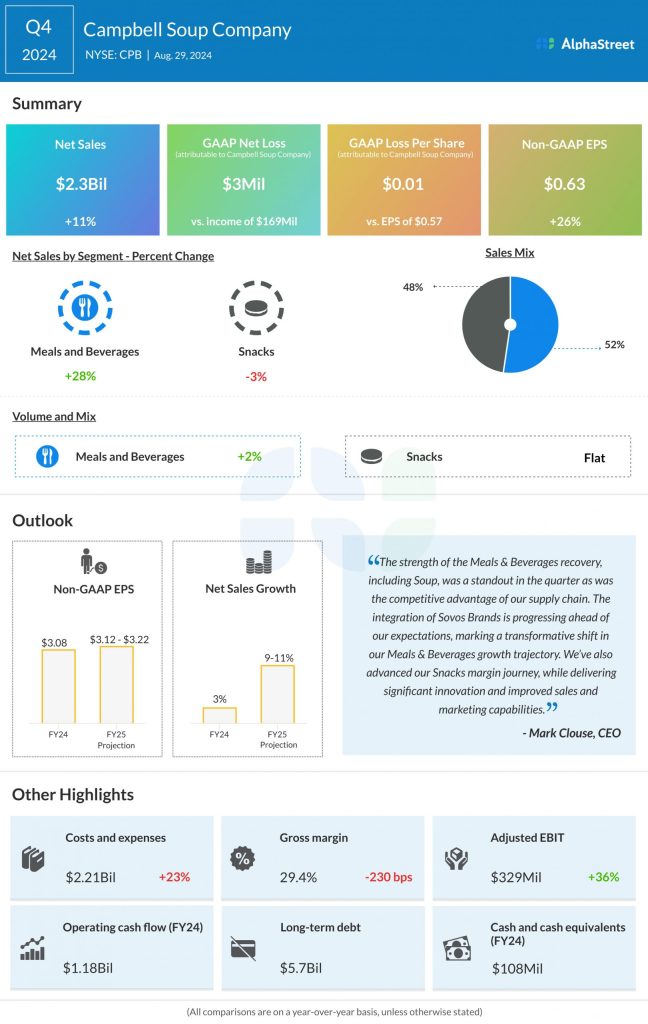

In the fourth quarter, net sales increased 11% annually to $2.3 billion, while organic net sales decreased 1%. Excluding special items, Q4 earnings climbed 26% year-over-year to $0.63 per share. On an unadjusted basis, it was a net loss of $3 million or $0.01 per share in the July quarter, compared to net income of $169 million or $0.57 per share in the prior year. Earnings beat estimates while sales fell short of expectations.

From Campbell Soup’s Q4 2024 earnings call:

“In Q4 we continued to successfully navigate the evolving consumer landscape and delivered solid results; including, sequential volume improvement across both divisions, a second consecutive quarter of double-digit year-over-year adjusted EBIT growth and adjusted EPS growth, underpinned by sequentially improving margins on both businesses. It also marks the end of a dynamic year during which we drove significant progress against our strategic plan.”

Q4 Outcome

For fiscal year 2025, the management expects net sales growth of 9-11% and organic sales growth of 0-2%. Adjusted profit, on a per-share basis, is expected to grow 1-4% in FY25. The company this week said it received shareholders’ approval to change its official name from Campbell Soup Company to The Campbell’s Company. The new name will be effective after filing an amendment to the company’s certificate of incorporation.

CPB had a positive start to the week and maintained the momentum in the early sessions. The stock closed the last trading session slightly higher.