Read management/analysts’ comments on Walmart’s Q3 2022 results

Investing in WMT?

Market watchers, in general, are bullish on the stock, citing its long-term prospects and underlying strength of the Walmart brand. They are expecting a strong rebound over the 12-month period — as much as 21% growth from the last closing price. WMT is undoubtedly one of the best long-term investment options.

Considering the high grocery demand, the company has focused its growth strategy on expanding market share in that segment, lately. The omnichannel push has translated into record digital penetration. Going forward, the company expects to gain an edge over rivals through competitive pricing despite the inflationary environment. It is worth noting that inflation climbed to a 30-year high in September as food and gasoline become more expensive.

Pricing

Nevertheless, the pricing strategy will likely drag down margins though it complements Walmart’s goal of expanding market share ahead of the holiday season. The persistent supply chain disruption can have a negative impact on sales, though the company has tried to tackle the issue by chartering cargo vessels, adding to the cost pressure. Also, in the coming quarters, it might not be easy for the retail giant to match the unusually strong performance of the last one-and-half years.

“What’s really important in retail is knowing your customer, understanding the customer’s intent, and then taking into the catalog, whether it’s 1P or 3P and matching the items that they are looking for, and then it’s up to the team here to execute. And we’ve got a really clear customer value index that we think about each and every day online, and we measure ourselves to that,” said Walmart’s CEO John Furner during his post-earnings interaction with analysts.

Broad-based Gain

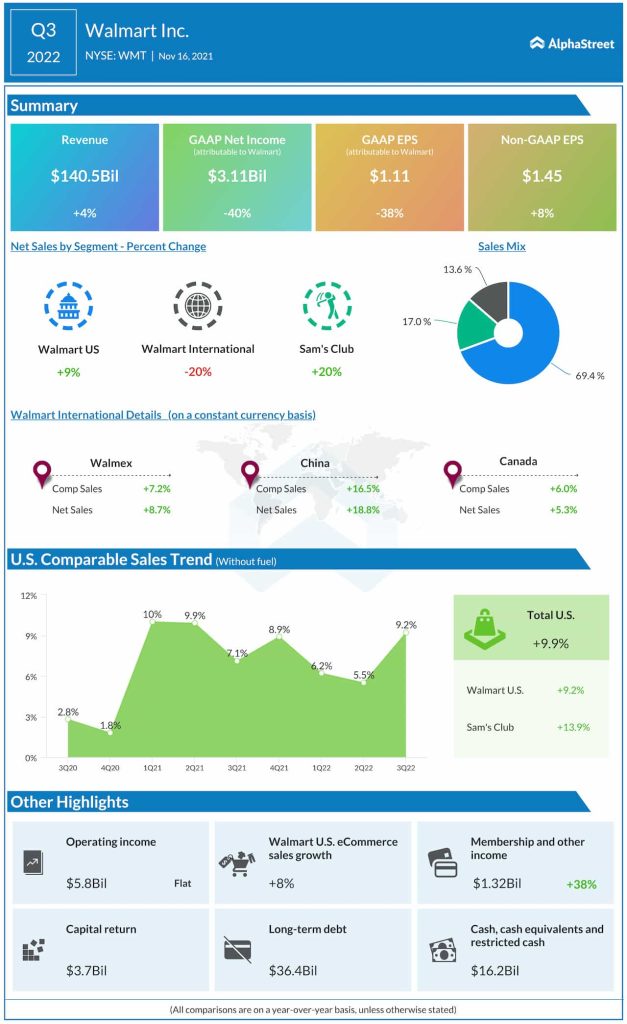

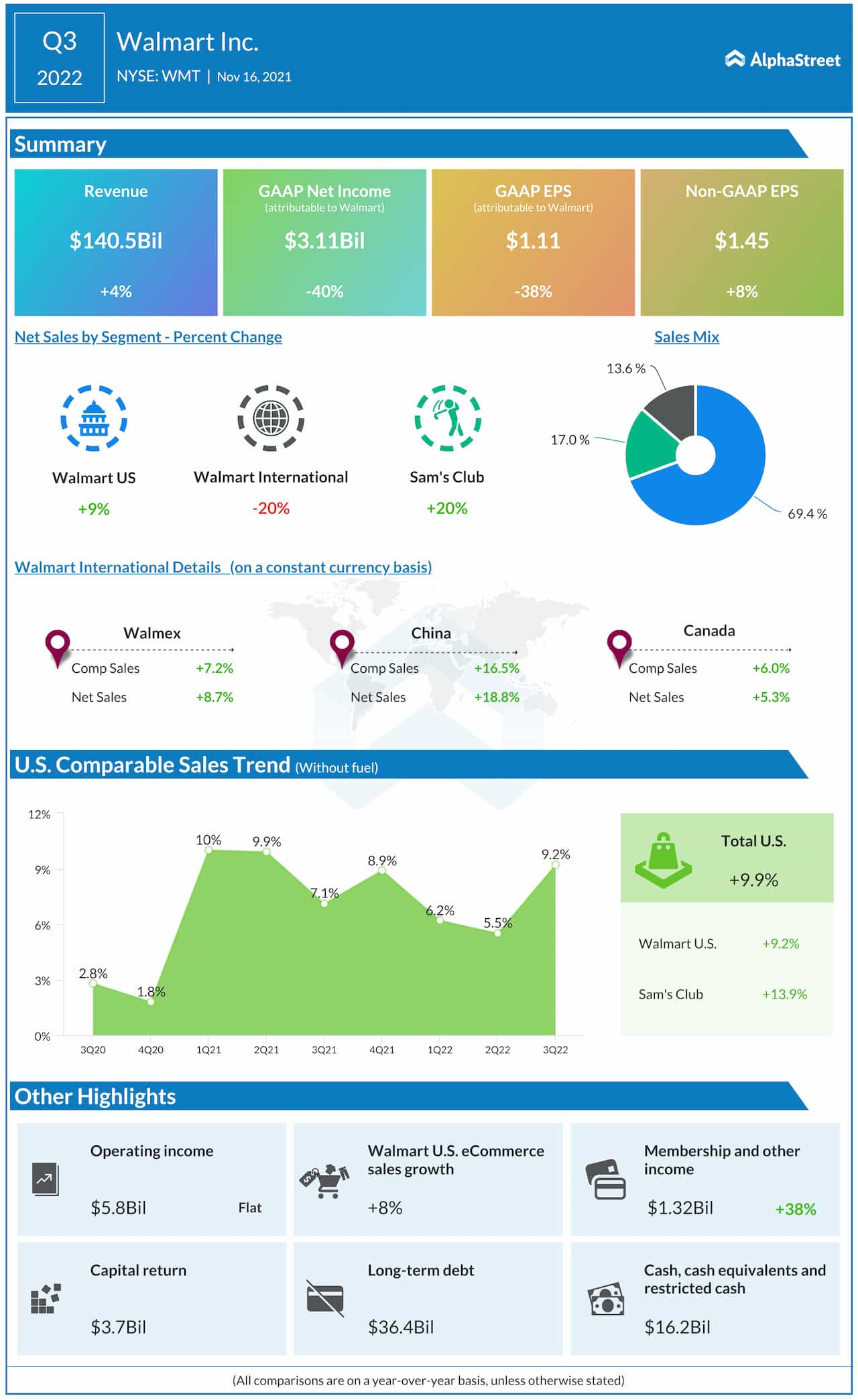

In the September quarter, earnings topped expectations as they did in the trailing two quarters. A 20% fall in international sales was more than offset by high domestic and Sam’s Club sales. There was a 9.2% growth in U.S comparable store sales. As a result, adjusted earnings moved up by 8% to $1.45 per share in the third quarter and came in above the estimates.

Fellow retailer Target Corporation (NYSE: TGT) on Wednesday said its sales grew 13% annually to around $26 billion in the most recent quarter, driving up earnings by 9% to $3.03 per share.

Beating odds, Best Buy emerges as a COVID winner. Is the stock a buy?

After peaking almost a year ago, Walmart’s stock experienced high volatility in 2021, often underperforming the S&P 500 index. In the past twelve months, it lost about 5% and closed the last trading session at $143.17.