Over the last two weeks, several major retailers reported their quarterly earnings results and most of them saw improvements in general conditions thanks to vaccination drives, store reopenings and stimulus payments. People want to go out and they are also looking forward to travelling again. This drove improvements in sales results with underperforming categories like fancy apparel and luggage seeing a rebound.

At the same time, certain areas that gained strength during the COVID-19 pandemic stayed strong. Digital channels continued to see momentum even as stores stayed open and curbs were reduced. Categories like casual apparel continued to see demand even as restrictions eased and people stepped out.

Digital growth

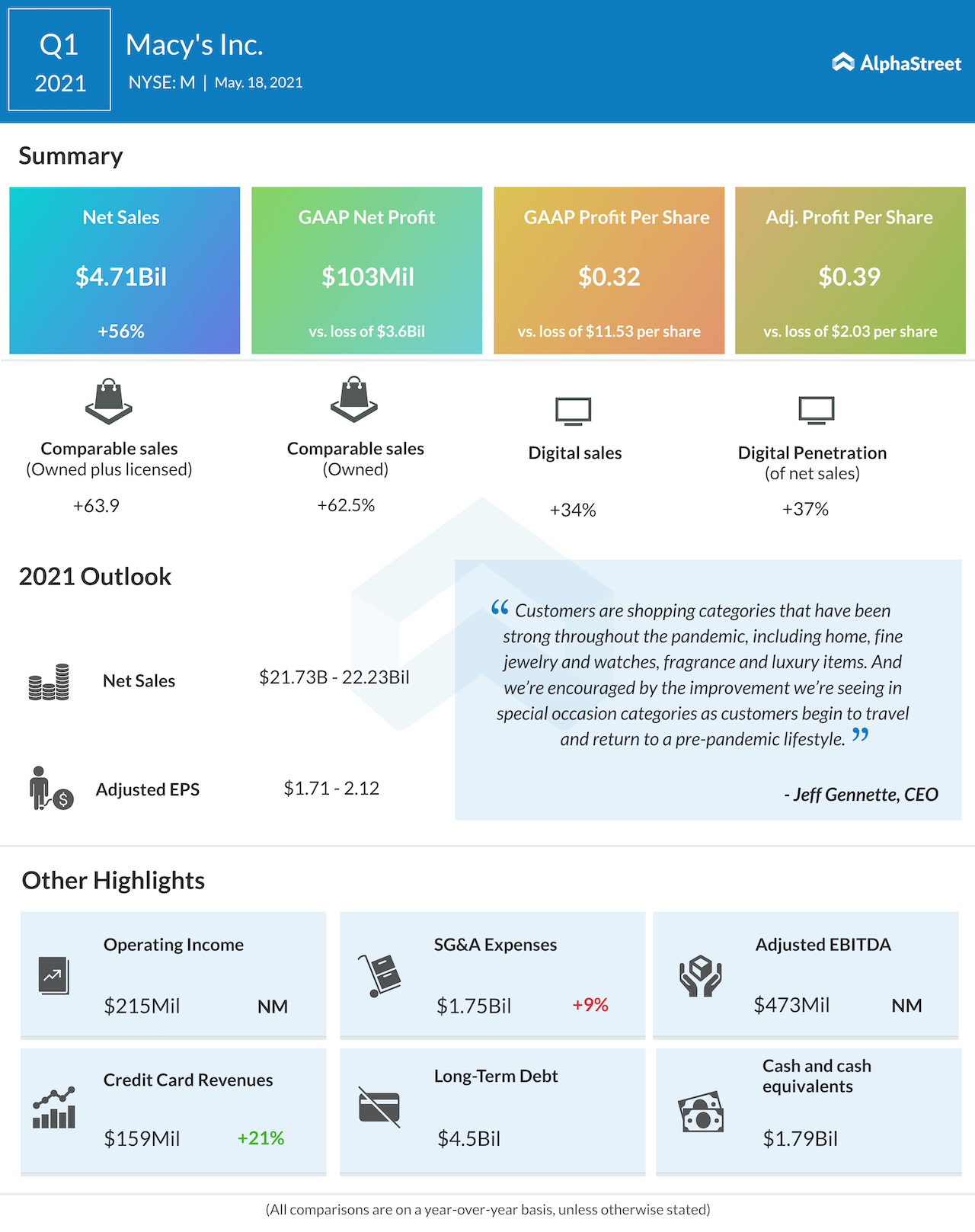

Digital channels maintained good growth even as stores reopened and shopping trends began to normalize. Macy’s (NYSE: M) said 47% of its new customers made their initial transaction through digital during the first quarter of 2021, which was up 74% compared to the same period in 2019.

Kohl’s Corp. (NYSE: KSS) saw digital sales increase 14% year-over-year in Q1 2021 and over 40% compared to 2019. Digital accounted for 30% of sales during the period. In Q1, American Eagle Outfitters (NYSE: AEO) saw digital revenue increase 57% compared to the same period in 2019. Digital made up 40% of total revenue compared to 30% in 2019.

Nordstrom (NYSE: JWN) maintained strong growth in its digital channels despite a rebound in store traffic and sales. Digital sales increased 23% year-over-year and 28% over Q1 2019. Nordstrom’s digital penetration over the past two years has increased to 46%. 75% of digital traffic came from mobile customers.

Urban Outfitters (NASDAQ: URBN) saw momentum within its digital channel in North America and Europe. Even though store sales suffered in Europe, digital sales gained nicely with triple-digit comp gains across all three brands and a 120% increase in new digital customers.

Assortment trends

Casual apparel, which got a boost during the pandemic, is still seeing healthy demand. In addition, categories like fancy dresses, which had been experiencing weakness, witnessed a recovery as restrictions eased.

Macy’s saw strength in casual apparel, jewelry, sandals and swimwear. It also saw a pickup in demand for luggage, signalling customers’ interest in resuming their travel plans. Kohl’s is seeing strength in athleisure as well as a recovery in apparel and the company believes the demand for casual comfort will continue even after the pandemic.

American Eagle Outfitters saw strong performance in leggings, fleece and tanks while Nordstrom saw strength in the active and home categories. Nordstrom saw demand for dresses, denim, makeup and handbags.

The strength in the digital channels as well as the preference for casual and comfortable apparel is likely to continue for the foreseeable future which will be an advantage for retailers in the coming months.