Shares of Macy’s, Inc. (NYSE: M) stayed green on Thursday. The stock has gained 23% over the past 12 months. The retailer is scheduled to report its first quarter 2024 earnings results on Tuesday, May 21, before market open. Here’s a look at what to expect from the earnings report:

Revenue

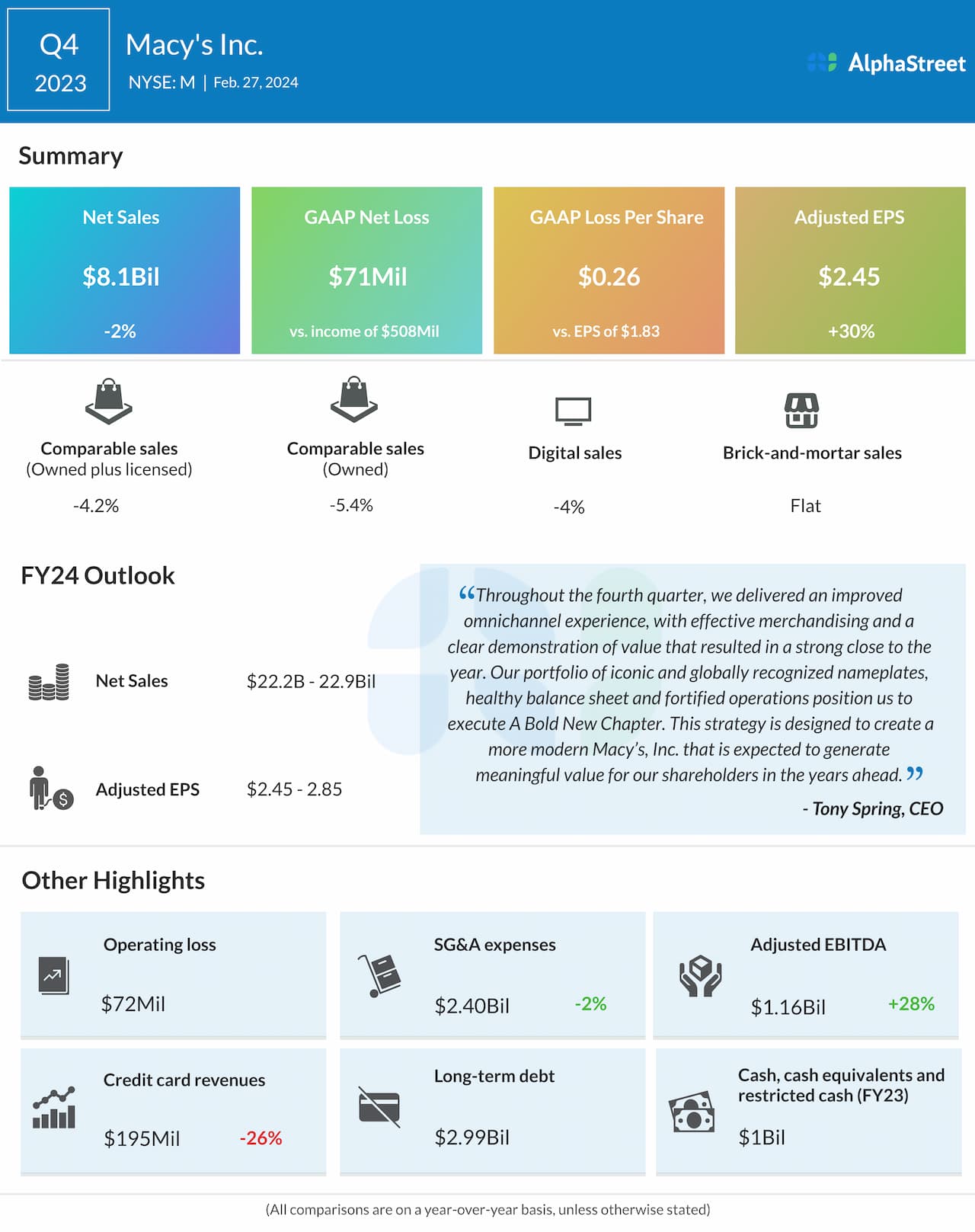

For the first quarter of 2024, Macy’s has guided for net sales of $4.72-4.87 billion. Analysts are projecting revenue of $4.85 billion for Q1. This compares to net sales of $5 billion reported in the same period a year ago. In the fourth quarter of 2023, net sales decreased nearly 2% year-over-year to $8.1 billion.

Earnings

Macy’s has guided for adjusted EPS to range between $0.10-0.16 in Q1 2024. Analysts are predicting EPS of $0.15 for Q1. This compares to adjusted EPS of $0.56 reported in Q1 2023 and $2.45 reported in Q4 2023.

Points to note

Macy’s saw its comparable sales decrease 5.4% on an owned basis and 4.2% on an owned-plus-licensed basis last quarter. Comparable sales for the Macy’s and Bloomingdale’s nameplates also declined in Q4 while Bluemercury saw an increase. Macy’s views fiscal year 2024 as a transition and investment year as it prepares to roll out several changes.

As part of its Bold New Chapter strategy, the company plans to close several underproductive locations and refocus investments to its remaining locations. The stores set to be closed are termed non-go-forward locations and in 2023, they accounted for less than 10% of total sales.

In Q4, go-forward locations’ owned-plus-licensed comparable sales outperformed non-go-forward by about 500 basis points. The non-go-forward locations’ performance is expected to decelerate as the company reduces its investments in these stores. This is likely to reflect in Q1 results.

In Q4, gross and merchandise margins saw improvement, mainly due to lower clearance markdowns. For the first quarter of 2024, Macy’s expects gross margin rate to be down no more than 40 basis points to last year, reflecting a normalized clearance and promotional cycle compared to the first quarter of 2023. The company also expects end-of-quarter inventories to be relatively flat to last year.

Macy’s efforts to revamp its assortment, improve the shopping experience for its customers, and optimize its store portfolio are expected to help drive sales and generate cost savings. The benefits of these initiatives are likely to be seen in the first quarter performance as well.