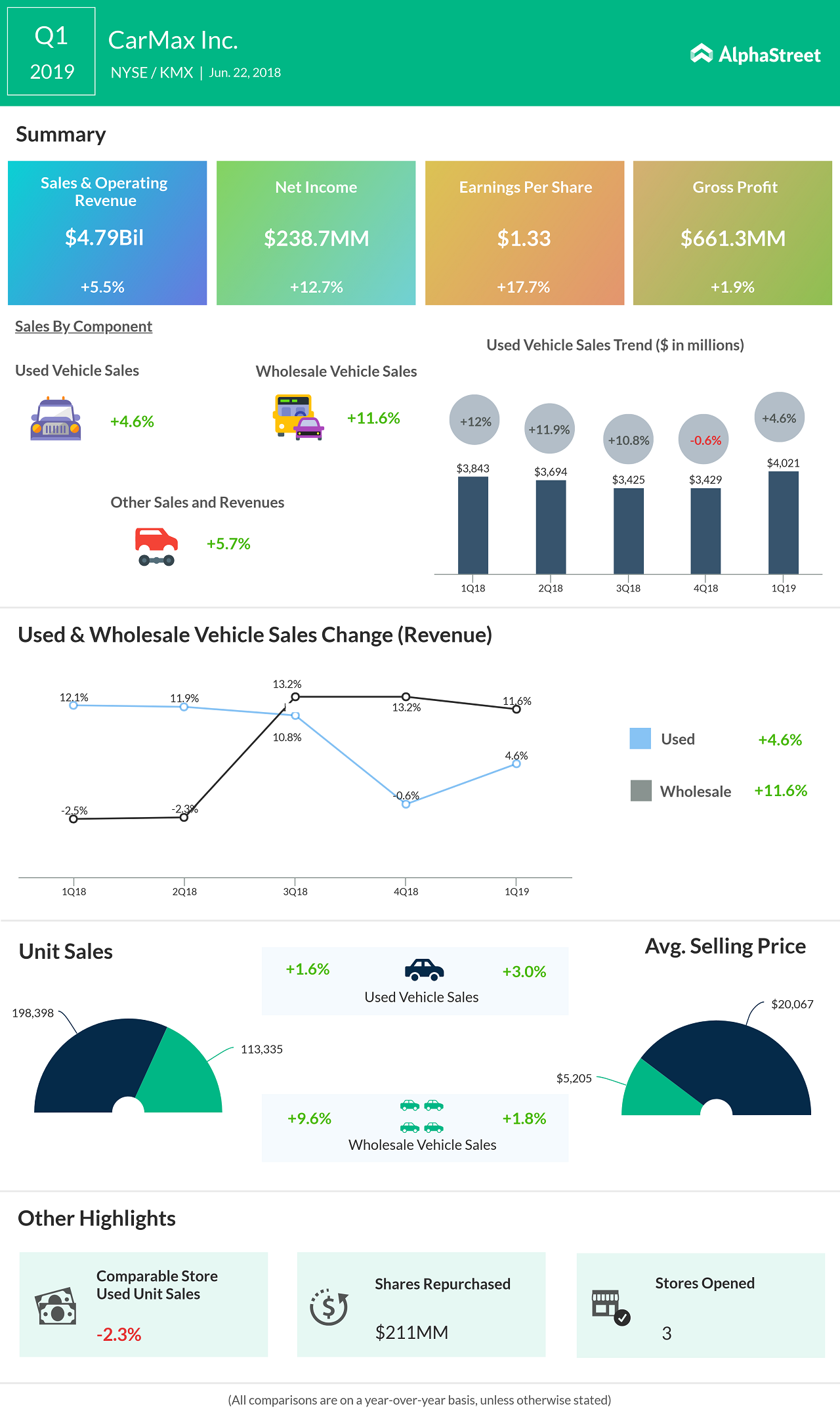

Total wholesale vehicle unit sales increased 9.6%, largely driven by an increase in its appraisal buy rate and the growth in store base. Other sales and revenues increased by 5.7% compared with a year ago.

During the recently ended quarter, the Richmond, Virginia-based company opened two stores in existing television markets (Dallas and Miami) and entered the Greenville, North Carolina television market. Following the end of the quarter, CarMax opened a store in Santa Fe, New Mexico. The company plans to open 15 new stores before May 31, 2019.

For fiscal 2019, the company plans to enter ten new television markets and expand its presence in five existing television markets. Of the 15 stores CarMax plans to open during the 12 months ending May 31, 2019, nine will be in Metropolitan Statistical Areas having populations of 600,000 or less.

During the first quarter, CarMax bought back 3.3 million common shares for $207.4 million. As of May 31, 2018, the company had $809.5 million balance available for repurchase under the current authorization.

Shares of CarMax ended Thursday’s regular trading session down 2.36% at $71.05 on the NYSE. The stock had been trading between $57.05 and $77.64 for the past 52 weeks.