Buy CAT?

Caterpillar Inc. Q2 2022 Earnings Call Transcript

The global construction equipment market is estimated to grow around 68% by 2030. Caterpillar’s ability to tap into that opportunity would depend largely on continued investment in environment-friendly products, considering the growing awareness about environmental protection globally. Of late, the company has been investing in machines and components that help reduce waste and environmental impact. Meanwhile, the management is betting on Caterpillar’s brand legacy to enter new markets.

Challenges

Though the heavy-equipment manufacturer successfully dealt with adverse market conditions, the supply chain disruption remains a drag on sales. Of late, the top line has also come under pressure from the continued slowdown in China — which plays an important role in the company’s expansion in the Asia Pacific — due to the real estate market crisis in that country. Adding to the slump, the resurgence of COVID cases has derailed the region’s economic recovery.

“Pricing was better than expected, while sales of equipment to end users lagged our expectations due to supply chain challenges and additional weakness in China. Looking to the third quarter, we currently anticipate the top line will increase compared to the prior year on higher sales to users and favorable price realization. Strong demand should support higher sales across the three primary segments, subject to our ability to navigate through the ongoing supply chain changes,” said Caterpillar’s CEO Andrew Bonfield during the Q2 earnings call.

Key Numbers

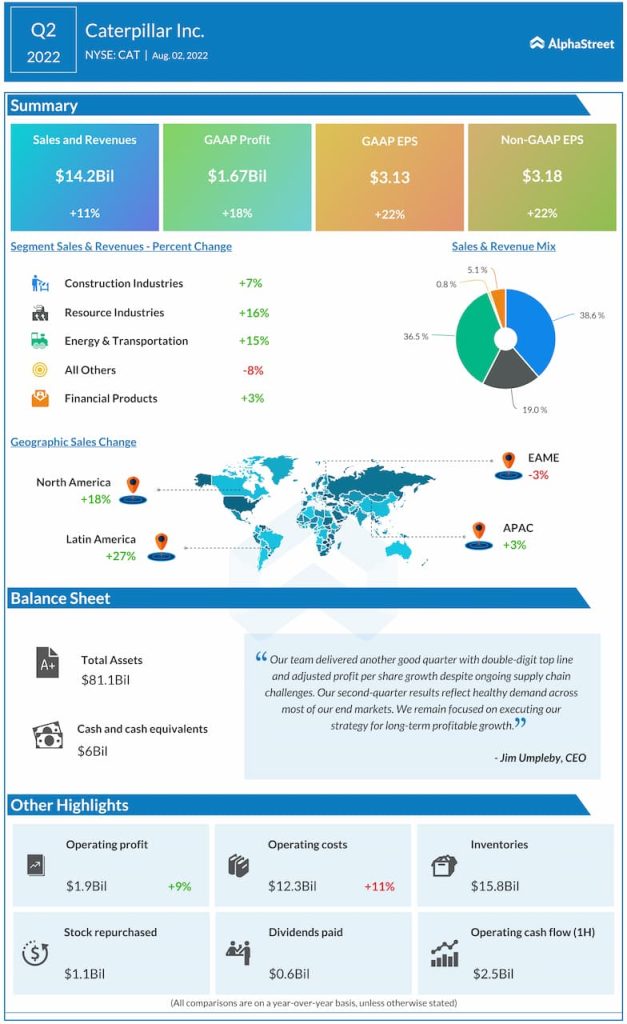

In the second quarter, the main operating segments –Construction Industries, Resource Industries, and Energy & Transportation — registered solid revenue growth. A similar trend was seen in the case of geographical segments. That translated into an 11% increase in total sales to around $14 billion. But it was not enough to impress the market that was looking for stronger growth. A dip in margins due to elevated operating costs, mainly related to high shipping expenses and factory inefficiency, added to the concerns.

Stock Watch: Why General Motors is a good buy after earnings

But the resultant squeeze on the bottom line was largely offset by favorable price realization, a trend the management expects to continue in the near term. Net income, adjusted for special items, increased in double digits to $3.18 per share and beat the estimates.

After hitting a one-and-half-year low last month, CAT has pared a part of the losses and is moving closer to the $200 mark. The stock performed particularly well this week and maintained the uptick on Friday, after opening the session higher.