Today, Celgene announced that it has joined hands with Hamburg, Germany-based Evotec to work together and develop new therapies in the field of oncology. Evotec will receive an upfront payment of $65 million, and it could also earn significant milestone payments.

Even though the pharma giant is confident that partnerships and acquisitions will pay off in the future, it suffers continuously from several headaches including its decision to abandon the Crohn’s disease trial, trimming down its 2020 outlook, FDA refusing to review Ozanimod drug, generic competition, and the exit of top executives, to name a few.

The main reason for yesterday’s slump in the stock price was cited as the quiet exit of Celgene’s business development head George Golumbeski. It’s a shock for the investors that the deal-making Golumbeski’s last day in the New Jersey-based biotech company was April 16. Golumbeski has joined as a member of the supervisory board of MorphoSys. Already, CEO Mark Alles is taking additional responsibilities because of COO Scott Smith’s sudden exit in early April.

In early 2017, President Trump criticized the pharma industry by saying “getting away with murder.” Even though Trump has announced some steps to reduce the drug prices, it could take many months or years to implement them and control the pricing of the drugs. When stringent measures are imposed, selling the drugs at higher prices would be tough for all the pharma companies, including Celgene.

Meanwhile, Celgene is set to present its clinical data on blood cancer and solid tumor therapies at upcoming American Society of Clinical Oncology Annual Meeting between June 1 and 5 in Chicago. Also, Celgene announced that it would present new and updated data across a range of blood diseases at the 23rdEuropean Hematology Association (EHA) annual meeting in Stockholm, Sweden, from June 14-17, 2018. Celgene believes that the drugs that are in the pipeline, as well as partnerships and acquisitions, will support them in the future.

The main reason for yesterday’s slump in the stock price was cited as the quiet exit of Celgene’s business development head George Golumbeski

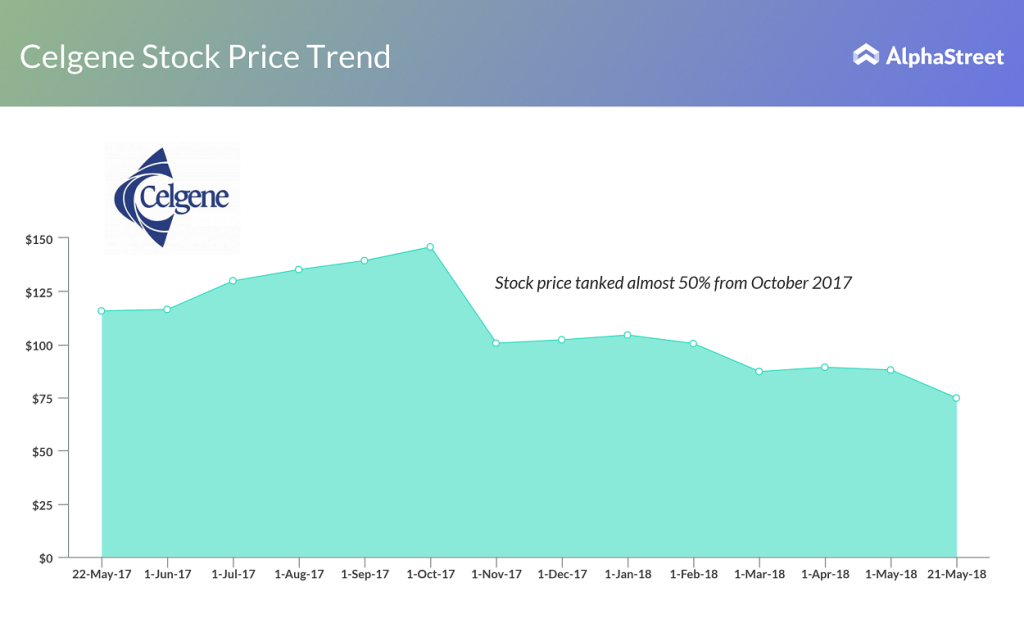

In the last one month, 15 analysts have recommended a buy rating on Celgene, and 13 analysts have advised a hold rating, while one recommended selling the stock. It’s worth noting that the pharma company reported upbeat first-quarter results in early May. Celgene’s stock price has tanked almost 50% from where it was at the beginning of October 2017. In May 2014, exactly four years back, Celgene was trading around the 74-ish range, and now it has again reached that level.