Mixed results

Trends

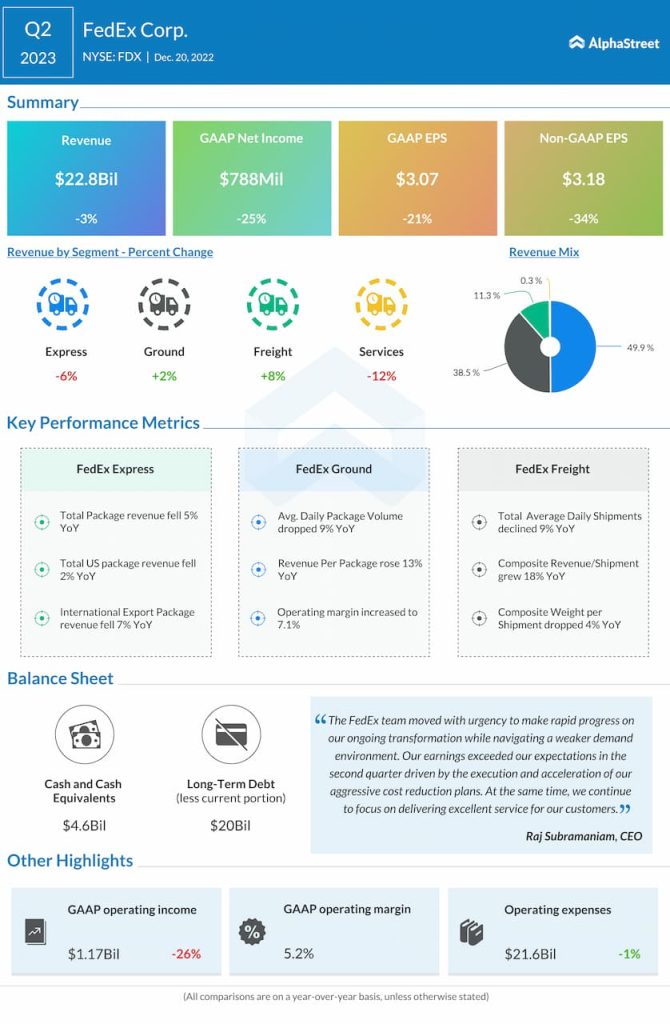

FedEx faced a challenging operating environment during the second quarter with slow demand for its products and services. FedEx Express was impacted the most with revenue down 6% YoY mainly due to volume and yield softness in Europe and Asia. Operating income in the segment fell 64% due to lower global volumes.

At FedEx Ground, revenue growth of 2%, driven by higher yield, was partly offset by lower volumes. Operating income rose 24%, driven by a 13% yield increase and cost reduction actions. At FedEx Freight, revenue increased 8% and operating income grew 32%.

FedEx is working on reducing its costs to align them to the weak volume. The company is looking to achieve cost savings of approx. $3.7 billion in FY2023, which is $1 billion higher than its previous projection.

On its quarterly conference call, the company mentioned that the majority of these cost reductions are focused in its Express segment, where most of the savings will come from reduced flight frequencies. FedEx has reduced eight international routes and 32 US domestic routes and also parked five aircraft thus far this year. This pulled down US domestic flight hours by 6% and international flight hours by 7% in the second quarter YoY.

FedEx expects business conditions to remain challenging in the second half of 2023. However, the company expects to see a moderation in volume declines at Express and Ground by the end of the third quarter with comparisons easing further in the fourth quarter as it laps the onset of softer volumes. Yield growth will also see pressure from shifts in customer demand. In the midst of these trends, FedEx plans to continue with its cost reduction efforts to improve its performance.

Outlook

For fiscal year 2023, FedEx expects adjusted EPS to be $13.00-14.00. This compares to the consensus estimate of $14.08. The company expects EPS to be $12.50-13.50 before the MTM retirement plans accounting adjustments.