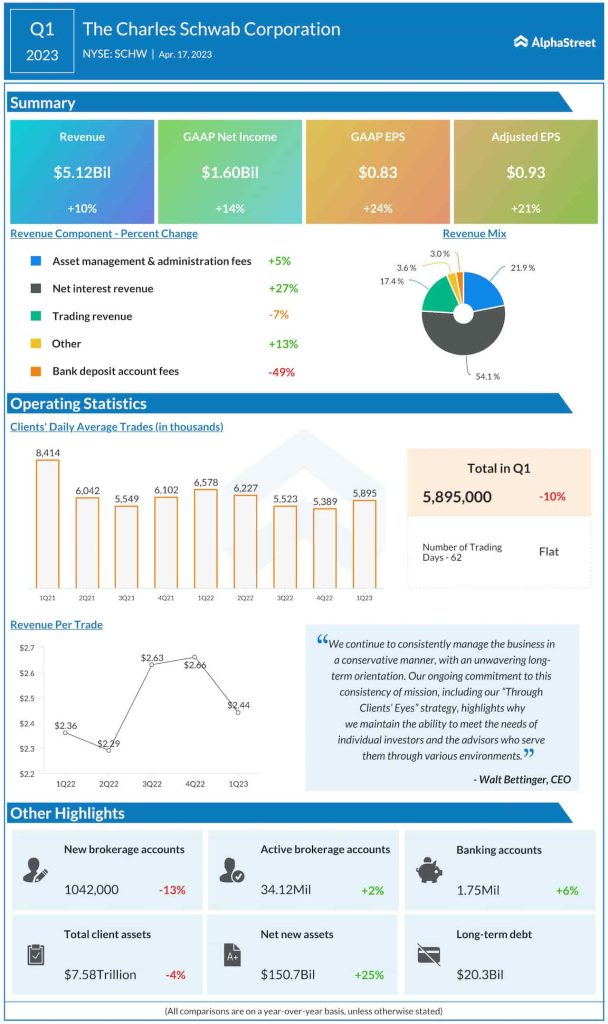

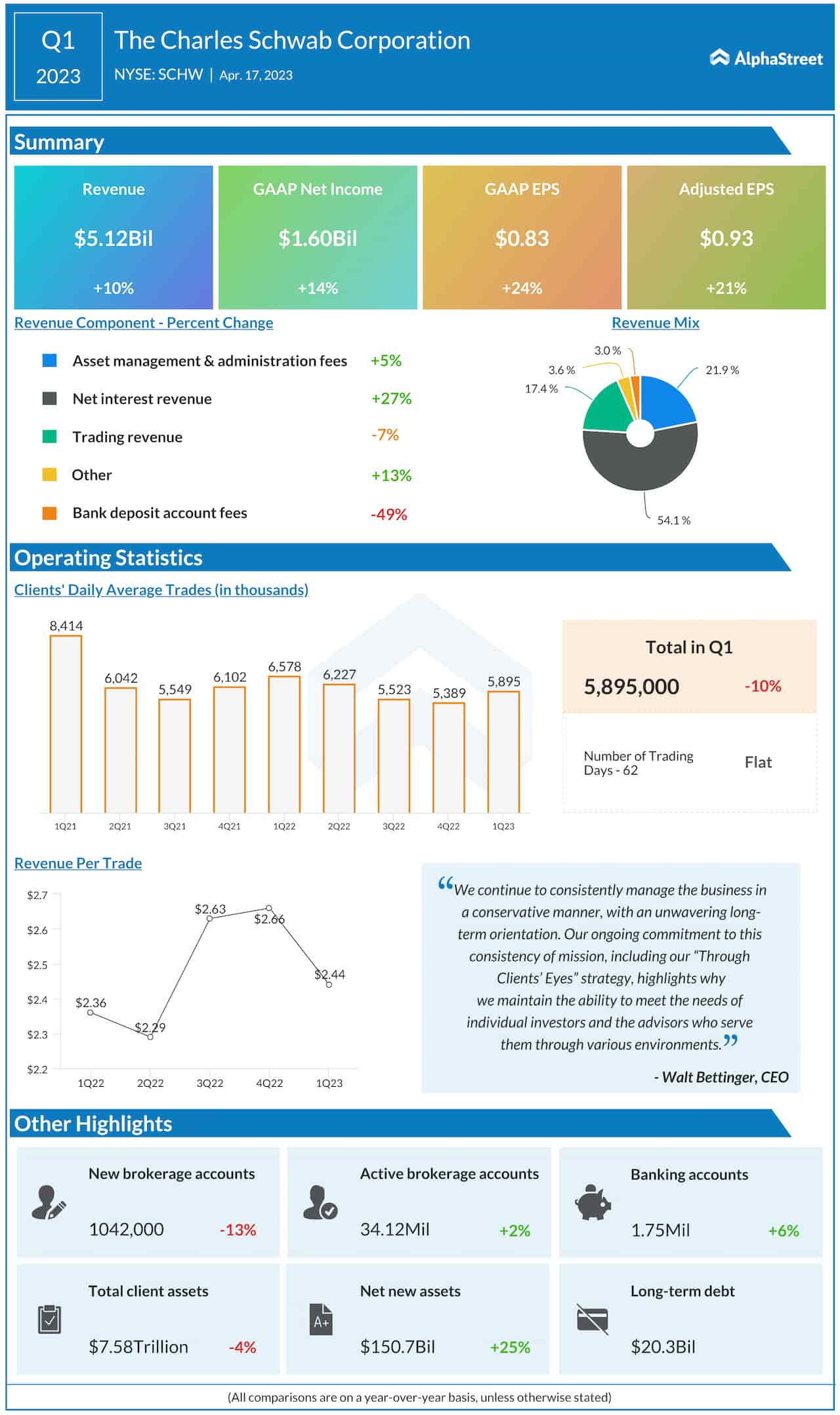

Total revenues increased 10% year-over-year to $5.12 billion in the first quarter. During the quarter, clients opened over one million new brokerage accounts and entrusted the company with $132 billion of core net new assets.

Net profit, on an adjusted basis, moved up to $0.93 per share in the three-month period from $0.77 per share in the comparable quarter of last year. Unadjusted net income was $1.60 billion or $0.83 per share, compared to $1.40 billion or $0.67 per share in the year-ago quarter.

“When I drafted my first letter to stockholders 15 years ago in the middle of the financial crisis, I outlined four factors that helped distinguish Schwab from other financial institutions during a very challenging time for global markets: a strong financial foundation, a client-centric strategy, a disciplined operating approach, and a diversified business model. These characteristics remain every bit as relevant to our story today,” said Walt Bettinger, CEO of Charles Schwab.