All the hype about 5G is reaching a fever pitch. 5G or the fifth generation of wireless networks is faster than 4G, allows more devices to connect to the internet, and offers consistent coverage; and this explains the eagerness surrounding the technology.

A 2017 study by Accenture revealed that the US wireless industry led by AT&T (T) and Verizon (VZ) would spend close to $275 billion into 5G deployment, which in turn is expected to boost the country’s GDP by $500 billion.

Verizon has conducted several 5G fixed wireless trials in 11 US markets and is now geared to deploy it in up to five cities this year including Sacramento and Los Angeles. The carrier expects to offer the mobile 5G service by the first quarter of 2019.

Trailing Verizon is AT&T, which aims to launch 5G services in a dozen cities by the end of 2018. The carrier has picked Dallas, Waco, and Atlanta as the first few cities to receive the new 5G services. AT&T is also planning to open a lab dedicated to 5G in Austin, to meet the timeline for mobile 5G deployment.

Sprint (S), on the other hand, is directly offering mobile 5G, especially after the proposed $26 billion merger with T-Mobile (TMUS).

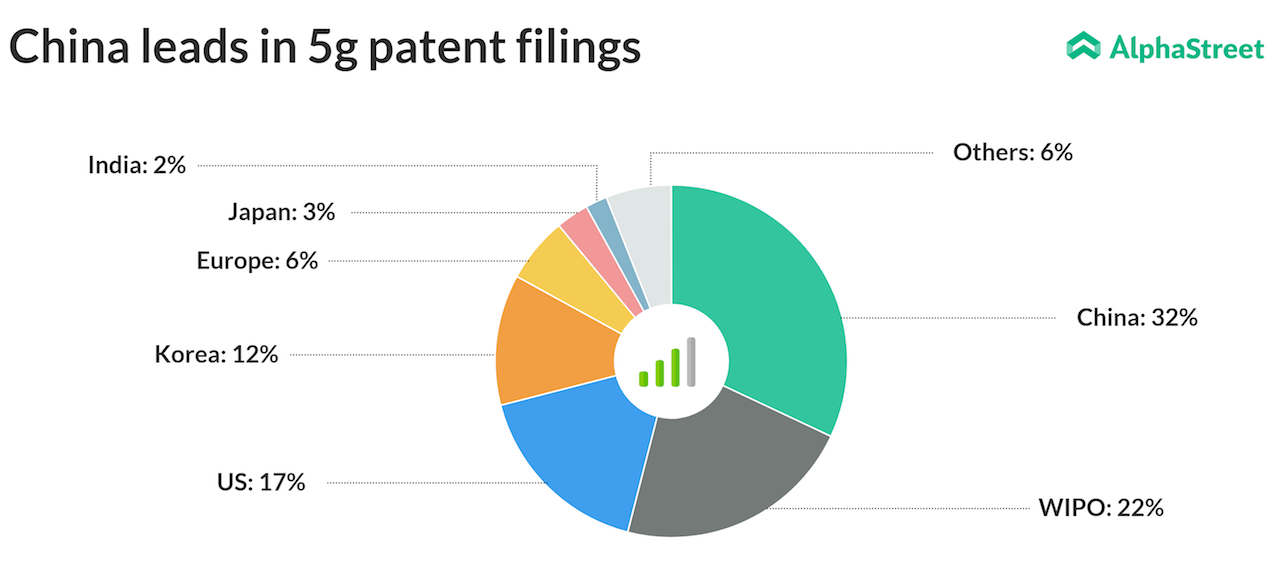

It may be noted that there is mounting pressure on wireless companies, especially from the Trump administration, who doesn’t want to, at any cost, give away the competitive edge in 5G to China.

US versus China

However, the fact remains that the prospects for winning the 5G battle against China is bleak, given the head-start the Asian country has already made so far. The Chinese government had been quick to formulate proactive policies to boost the technology, and it plans to deploy 5G by 2020 on a large commercial scale. The government has also allocated radio frequencies required by the carrier companies.

Source: netscribes

To counter China’s advances in 5G, Trump’s national security team had considered deploying a nationwide 5G network owned by the government. However, the proposal that is said to be in the early stages met with tight resistance from the telecom companies, as well as the FCC. While political observers and analysts agree that winning the 5G race is a national priority, they are definitely not in for the idea to nationalize the network.

US had earlier blocked Chinese firms ZTE and Huawei, which are said to be in the lead to develop and commercialize 5G handsets, from selling smartphones in the country citing security concerns. A merger between Qualcomm (QCOM) and Broadcom (AVGO) was also blocked on the similar grounds. It was feared that if the merger took place, then US would eventually lag behind China in the development of 5G technology since Qualcomm has been investing heavily in it.

But it’s not yet late. There is still enough time for US to outstrip China in the 5G race.

Industries that gain from 5G

The next generation of wireless services is said to benefit numerous industries, particularly health, transport, and energy.

Health: According to IHS Markit, 5G will enable sales of over $1.1 trillion in the healthcare industry. It would help more people access healthcare facilities faster at reduced prices.

Transport: The fifth-generation wireless system will aid in developing new features including smart parking as well as vehicle-to-vehicle communication.

Energy: Besides supporting electric smart meters, the technology would help provide real-time information on energy consumption.