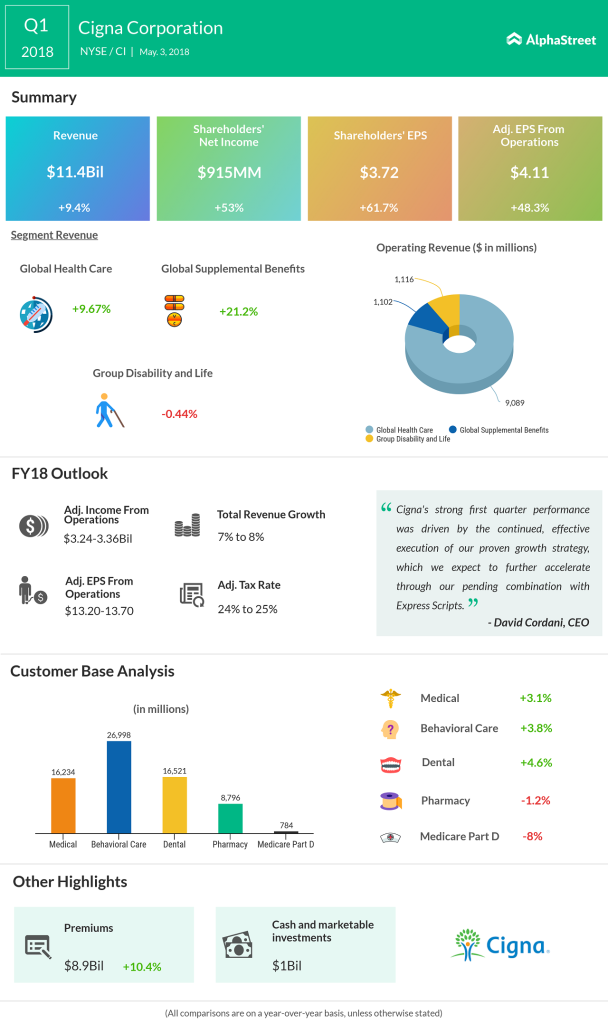

The global health service company reported net income of $915 million, or $3.72 per share, compared with $598 million, or $2.30 per share, for the first quarter of 2017. Excluding items, the company earned $4.11 per share, that easily topped analysts estimate of $3.39.

The company’s medical customers totaled 16.2 million, a growth of 3%. This reflects the strong growth across its commercial market segments. The Total Commercial medical care ratio came in at 73.7% for first quarter 2018, when compared to 77.6% during the prior year period.

The deal with Express Scripts is said to enhance Cigna’s consumer value further creating long-term financial opportunities. This deal also enhances the distribution channels for members that opt for online and retail purchase. The deal is expected to close towards the end of this year.

Cigna shares remained 15% down this year. But after the earnings results, the shares inched a percent higher during the pre-market trading.

A series of deals made recently are all set to remap the healthcare space. Most notably is the $69 billion CVS (CVS)-Aetna (AET) deal, that is expected to change the way people access healthcare. Also, Humana’s (HUM) interest to acquire a minority stake in hospice provider Kindred Healthcare.