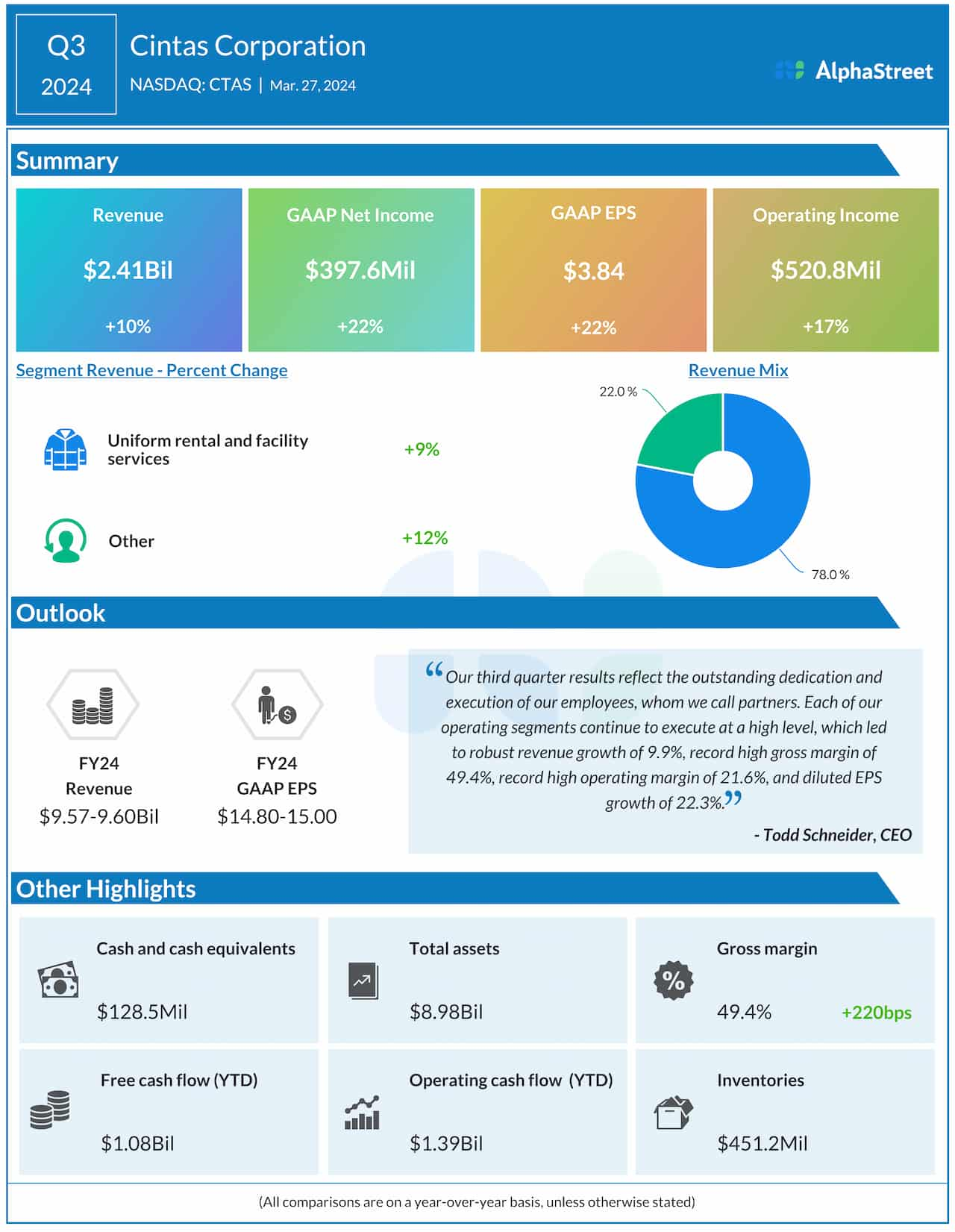

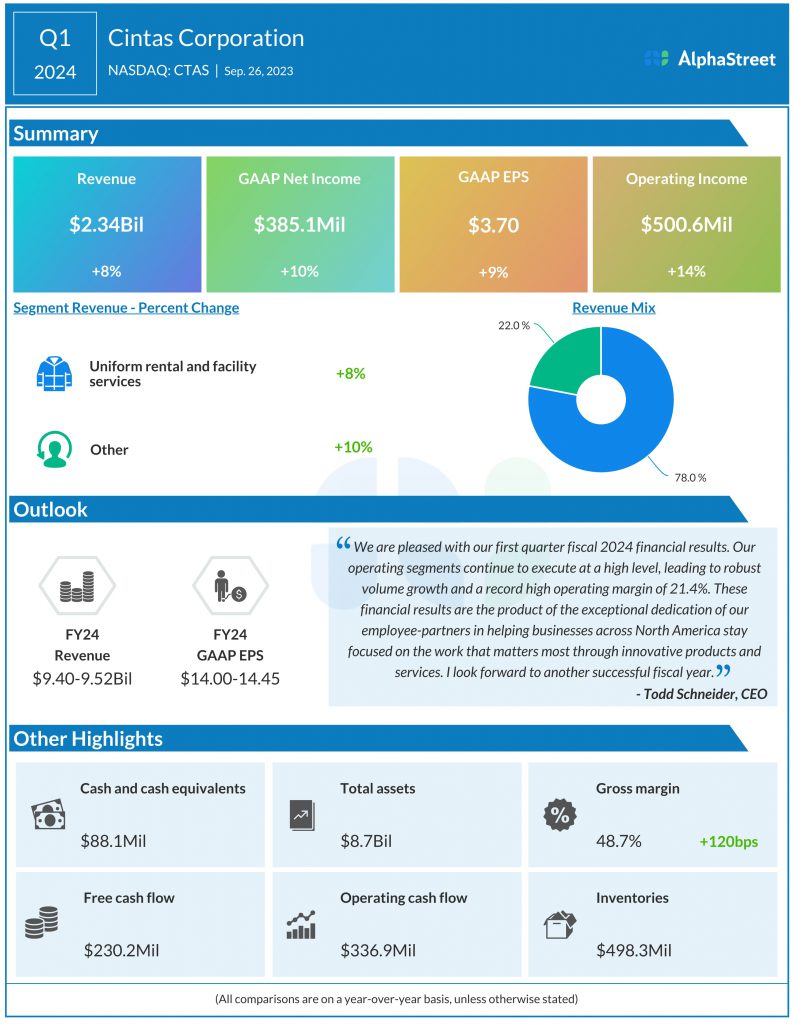

Uniform rental company Cintas Corporation (NASDAQ: CTAS) reported an increase in revenues and earnings for the third quarter of 2024.

Third-quarter revenue increased 10% year-over-year to $2.41 billion from $2.19 billion in the corresponding period of 2023. Organic revenue growth, adjusted for the impacts of acquisitions and foreign currency exchange rate fluctuations, was 7.7%. As a result, net income rose to $397.6 million or $3.84 per share in the February quarter from $325.8 million or $3.14 per share in the prior year period.

The company also raised its revenue and earnings guidance for fiscal 2024. Revenue is now expected to range between $9.57 billion and 9.60 billion and EPS is expected to range from $14.80 to 15.00.