Investig in KO

Stable sales performance across all markets and good growth prospects justify the relatively high valuation. Returning value to shareholders, mainly through dividend payments, has been a key priority for the management. The current dividend yield of about 3% looks attractive.

Read management/analysts’ comments on Coca-Cola’s Q1 2022 earnings

Having successfully overcome multiple challenges – after a promising start to the year – the company has proved itself to be an all-weather business with strong fundamentals. Sales volumes bounced back after the pandemic-era slump aided by increased marketing spending and recovery in consumer mobility amid improvement in the COVID situation.

From Coca-Cola’s Q1 2022 earnings conference call:

“Our enhanced capabilities helped us gain value share overall in both at-home and away from home channels globally and across most of our geographic operating segments, a clear indicator of the power of our new approach. Amidst the dynamic macro conditions and an inflationary cost backdrop, we focused on delivering growth. The key competitive edge with the Coca-Cola system continues to be the ability to deliver value for our consumers and our customers in any environment.”

Strong Margins

Reflecting the high demand for the company’s premium products, margins are improving steadily, supported by the aggressive pricing strategy that offsets the impact of elevated input costs. Currently, the relaxation of COVID restrictions that made people return to concerts, restaurants, and sporting events is driving growth for the company.

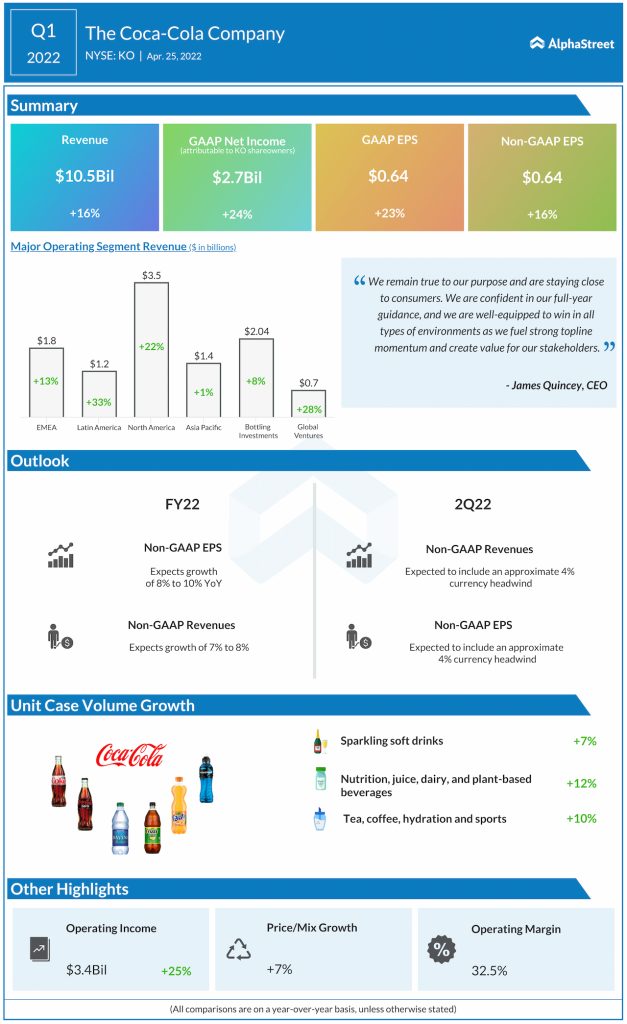

Over the past five years, Coca-Cola’s quarterly earnings either beat or matched analysts’ estimates each time. An almost similar pattern is visible in top-line performance also. In the first three months of fiscal 2022, both revenues and adjusted profit increased by 16% to $10.5 billion and $0.64 per share, respectively. Coca-Cola’s executives are confident of maintaining strong organic sales growth for the remainder of the year.

Stock Watch: Here’s What You Need to Know before investing in Kellogg

The company is preparing to publish second-quarter results on July 26 early morning, with experts warnings of a modest decline in adjusting earnings to $0.67 per share despite an estimated double-digit growth in revenues to $10.55 billion.

The Cons

Meanwhile, a question many stakeholders would be asking is how much cash the company will use for repaying its high debt. Also, there are concerns that the current momentum might not hold up if the economy falls into a recession because demand would be hurt by weak consumer sentiment amid rising inflation and interest rate hikes.

Shares of Coca-Cola closed the last session higher and moved closer to the record highs seen in April. In recent months, the stock outperformed the broad market quite often.