Quarterly performance

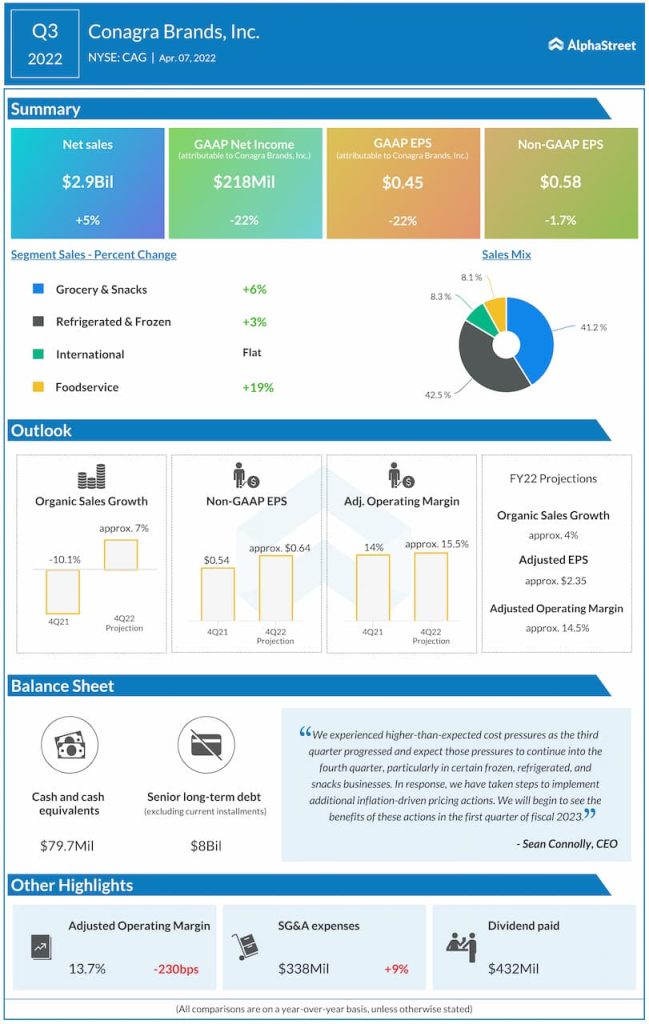

Net income decreased 22.4% to $218 million, or $0.45 per share. Adjusted EPS was down 1.7% to $0.58. The decrease in the bottom line was caused by a drop in gross profit. Gross profit decreased 8.1% to $697 million, mainly due to cost of goods sold inflation and higher supply chain operating costs.

Trends

Conagra continued to see strong demand for its products during Q3 which helped drive top line growth. Sales increased 6% and 2.9% YoY in its Grocery & Snacks and Refrigerated & Frozen segments respectively, helped by share gains in categories like staples, snacks, frozen meals and frozen desserts. Both segments saw decreases in operating profits due to cost of goods sold inflation and higher supply chain operating costs.

Sales in the Foodservice segment rose nearly 19%, helped by a 10.5% increase in volume as restaurant traffic continued to improve with the easing of the pandemic. This segment saw an increase of around 15% in adjusted operating profit as higher organic sales and favorable supply chain realized productivity offset the impacts of inflation. Sales in the International segment remained relatively unchanged at $241 million in the quarter.

Conagra’s investments in ecommerce are paying off as the company delivered robust quarterly growth in its $1 billion ecommerce business. Ecommerce has grown to comprise 10% of its total retail sales during Q3.

Conagra expects the cost pressures seen during the third quarter to continue into the fourth quarter. The company is taking pricing actions to counter this but the benefits of these actions will be visible only from the first quarter of 2023.

Outlook

Conagra revised its full-year 2022 guidance to reflect expectations for strong revenue, higher cost of goods sold inflation and the timing effect of pricing actions. The company had anticipated that demand for its retail products would remain high through the year due to changes in customer habits during the pandemic.

Based on strong consumer demand and planned pricing actions, the company expects organic sales growth to be higher than previously expected. For FY2022, Conagra now expects organic net sales growth to be approx. 4% versus the prior guidance of around 3%. For the fourth quarter of 2022, organic sales is estimated to grow around 7%.

Conagra continues to experience high levels of inflation. Although it is taking measures to tackle the issue, due to the time lag involved in these pricing actions taking effect, they are not expected to fully offset the cost headwinds within FY2022.

For FY2022, adjusted operating margin is expected to be approx. 14.5% versus the previous outlook of 15.5%. Adjusted EPS is estimated to be approx. $2.35, which is lower than the company’s previous guidance of $2.50 as well as analysts’ projections. For the fourth quarter of 2022, adjusted operating margin is expected to be around 15.5% and adjusted EPS is expected to be $0.64.

Click here to read the full transcript of Conagra Brands’ Q3 2022 earnings conference call