Constellation Brands Inc. (STZ) reported a 38% dip in earnings for the third quarter due to a loss from unconsolidated investments. The results exceeded analysts’ expectations. However, the wine and beer maker lowered its earnings guidance for the fiscal year 2019. Following this, the stock fell over 11% in the premarket session.

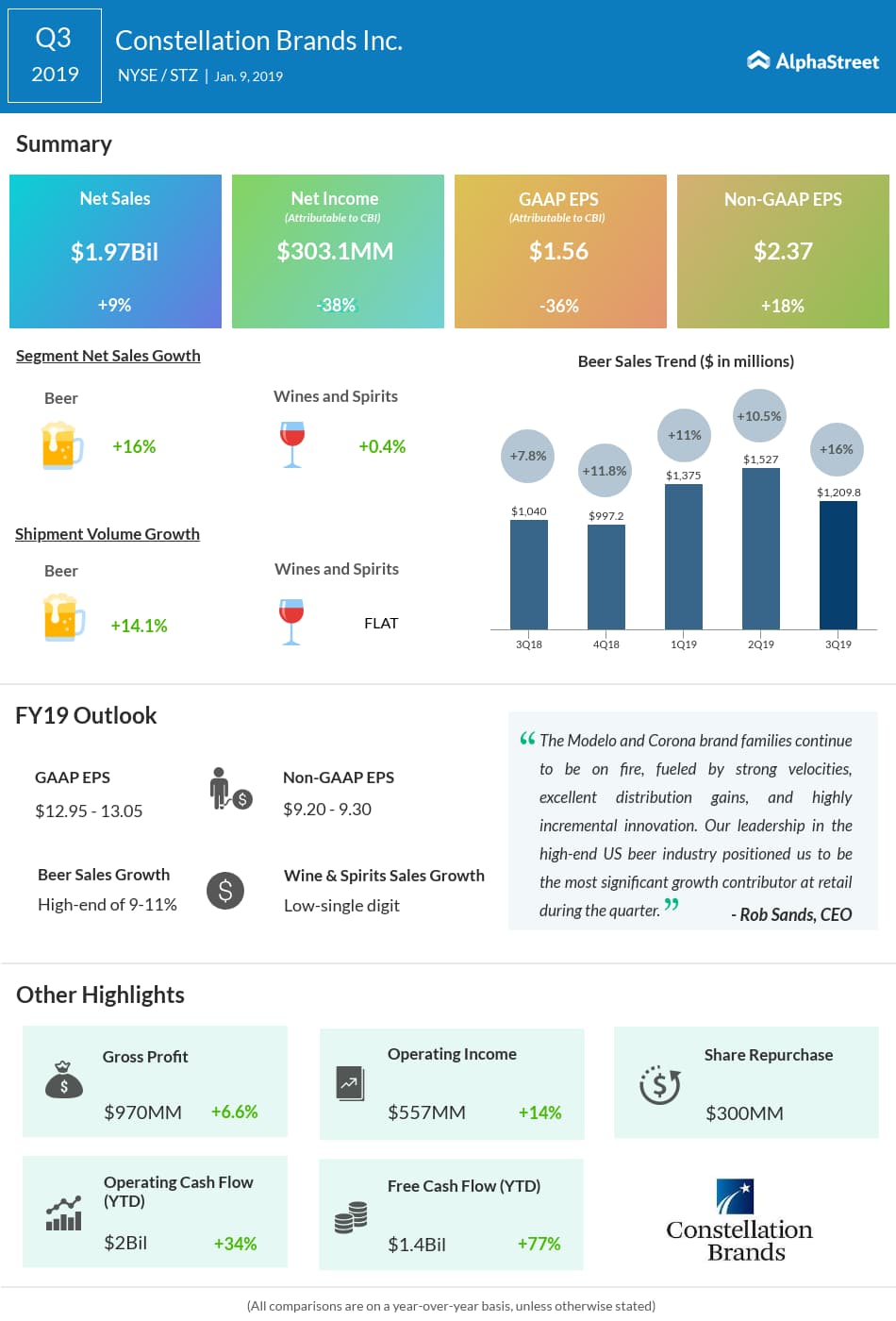

Net income plunged 38% to $303.1 million and earnings dropped 36% to $1.56 per Class A common share. The results were impacted by a loss from unconsolidated investments and a $164 million decrease in the fair value of Canopy investments recognized for the third quarter. Comparable earnings grew 18% to $2.37 per share.

Net sales increased 9% to $1.97 billion. The top line benefited from the strong portfolio performance and market share gains from the beer division as well as strong shipment volume growth in the wine and spirits division.

Looking ahead into the fiscal year 2019, the company lowered its earnings guidance to the range of $12.95 to $13.05 per share from the prior range of $14.10 to $14.25 per share. Comparable earnings outlook was cut to the range of $9.20 to $9.30 per share from the previous estimate range of $9.60 to $9.75 per share.

For fiscal 2019, the beer business now expects net sales growth to be at the high end of the 9% to 11% range and operating margin to approximate 39%. For the wine and spirits business, the company now expects net sales and operating income to decline low-single digits.

The company currently predicts interest expense in the range of $380 million to $390 million for fiscal 2019. Operating cash flow is anticipated to be $2.35 billion to $2.55 billion and free cash flow is expected to be $1.2 billion to $1.3 billion. Capital expenditures are predicted to be $1.15 billion to $1.25 billion, including about $900 million targeted for Mexico beer operations expansion activities.

For the third quarter, the Modelo and Corona brand families drove depletion growth of 8%, with the Constellation beer business achieving the most significant share gains in the US beer industry. Strong shipment volume was primarily timing related as fiscal year-to-date shipment and depletion volume is closely aligned.

In the wine business, focus on higher retail price points is paying off. Depletion performance for the below $11 price point continues to be challenged, resulting in an overall fiscal year-to-date depletion decline of 2%. Fiscal year-to-date US shipment volume has outpaced fiscal year-to-date depletion volume. This shipment timing benefit is expected to reverse in the fourth quarter.

On January 8, the company’s board of directors declared a quarterly cash dividend of $0.74 per share of Class A common stock and $0.67 per share of Class B common stock. The dividends are payable on February 26, 2019, to stockholders of record as of February 12, 2019.

Shares of Constellation Brands ended Tuesday’s regular session up 1.30% at $172.34 on the NYSE. The stock has fallen over 20% in the past year and over 24% in the past three months.