Hits

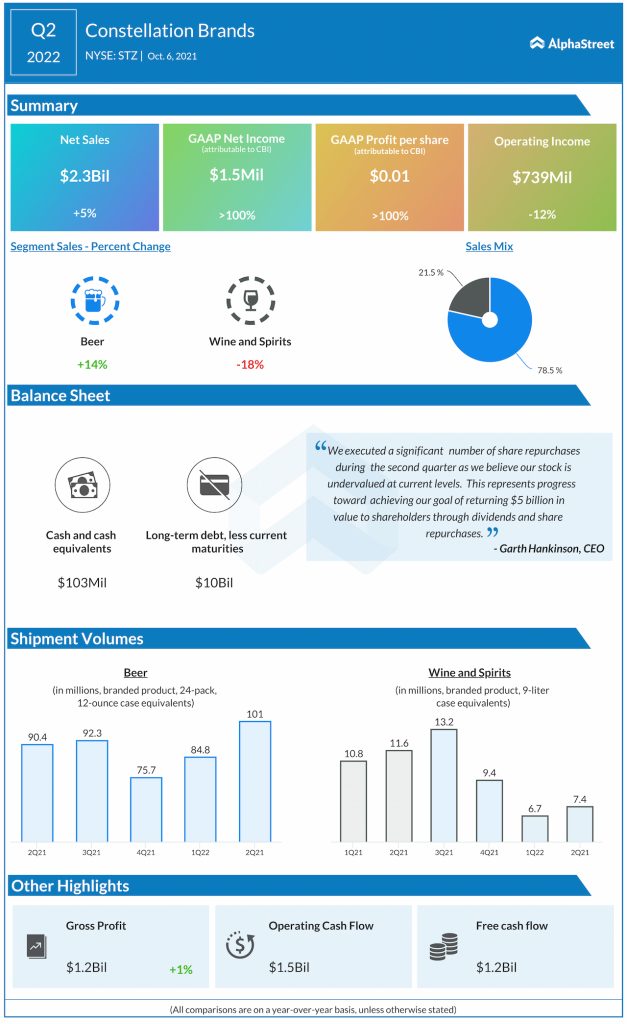

Net sales rose 5% year-over-year to $2.37 billion in Q2, helped by double-digit sales growth in the Beer business and strong organic sales growth in the Wines and Spirits segment. The top line beat market estimates.

Guidance increase

Constellation raised its FY2022 comparable EPS outlook to a range of $10.15-10.45 compared to the previous range of $10.00-10.30. The company now expects net sales within the Beer segment to increase 9-11% for the year versus the previous range of 7-9%. Organic net sales in the Wine and Spirits segment is expected to grow 2-4%.

Strong Beer results

Net sales in the Beer segment increased 14% YoY to $1.86 billion in Q2. Depletion volume growth was over 7%, driven by strong performances from Modelo Especial and Corona Extra. Depletion volume growth was 16% for Modelo Especial and around 5% for Corona Extra. Shipment volume increased 11.7% in the quarter. For FY2022, operating income in the Beer segment is estimated to increase 4-6%.

Constellation expects the strong demand for the Modelo Especial, Corona Extra and Pacifico brands to continue for the foreseeable future. The company is seeing a steady rise in household penetration for Modelo Especial and expects to see continued growth for this brand.

Misses

Earnings miss

For the second quarter of 2022, Constellation reported comparable EPS of $2.38, which was down 14% year-over-year and below analysts’ projections.

Wine and Spirits

Reported net sales fell 18% YoY to $509.8 million in the second quarter. Shipment volume was down 36.2% and depletion volume dropped 2.3%. Shipments and depletions were negatively impacted by port delays for international brands as well as route to market changes. Depletions were also affected by the challenging overlap in consumer pantry loading behavior, especially for mainstream brands which saw good growth during the pandemic.

On an organic basis, however, the wine segment delivered net sales growth of 15% and shipment volume growth of 5.7%. This growth was driven by strong performances within The Prisoner Brand Family, Kim Crawford and Meiomi.

For FY2022, Constellation expects net sales in this segment to decline 22-24% and operating income to decrease 23-25%.

Click here to access the full transcript of Constellation Brands’ Q2 2022 earnings conference call