Q2 results

Dismal outlook

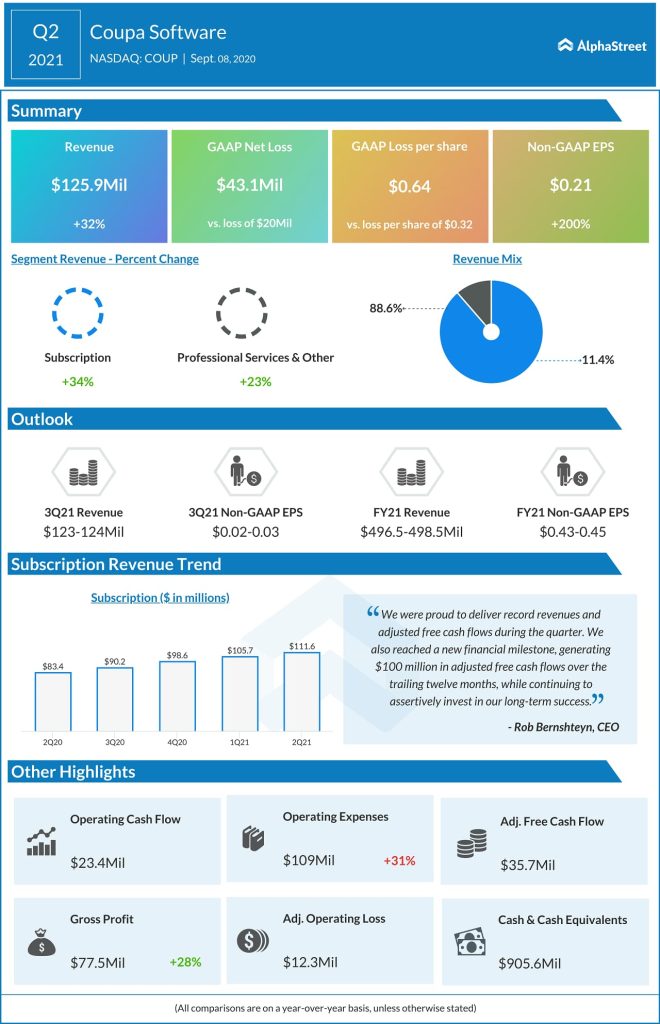

For the third quarter of 2021, Coupa expects revenue to be between $123 million and $124 million. The non-GAAP income per share is estimated in the range of $0.02 to $0.03 compared to the market’s expectation of $0.05 per share. For fiscal 2021, revenue is expected to be in the range of $496.5 million to $498.5 million. The non-GAAP income per share is touted to be between $0.43 to $0.45.

Also Read: DocuSign (DOCU) reports a 45% revenue growth in Q2 2021

The San Mateo, California-based firm expects the macroeconomic environment to remain challenging for at least Q3 and into Q4 with the possibility of things beginning to open up more broadly starting early in the New Year.

During the Q2 earnings call, CFO Todd Ford stated that many customers and prospects continue to operate with caution, especially those in industries highly affected by the pandemic making it difficult to predict the timing of when deals will close.

Recent acquisitions

In May 2020, Coupa acquired all of the equity interest in ConnXus, a cloud-based supply relationship management platform for approximately $10 million in cash. In June 2020, Coupa acquired all of the equity interest in Bellin Treasury International for approximately $121.7 million, comprised of $79.9 million in cash and $41.8 million in stock.

Stock performance

COUP stock had gained 89% so far this year and 89% in the last one year. Peer F5 Networks (NASDAQ: FFIV) has lost 12% since the beginning of this year and 9% in the last 12 months.

Read the entire transcript of Coupa Software Q2 2021 earnings call