Mixed results

[irp posts=”61882″]

Ad sales take a toll

iQIYI’s revenue from advertising slumped 27% in the first quarter, primarily due to the challenging macroeconomic environment in China related to the virus situation. It’s worth noting that iQIYI’s parent Baidu (NYSE: BIDU) also recorded a decline in advertising revenue in its recently ended quarter. iQIYI expects the weakness to continue in the second quarter as a result of the delay in content production. CEO Yu Gong said,

“Looking ahead, given the challenging macroeconomy and the ongoing coronavirus impact, we expect that Q2 and the full year will still be under pressure. Q2 ad revenues could see slightly sequential recovery but will be down year-over-year, especially now that some of our variety shows will likely be pushed out to Q3 or even Q4 as their production process was delayed due to the pandemic, major content pipeline have been pushed out to Q3 to Q4 from Q2. That’s understandable because of the pandemic impact. So because of the content delay, that will also have some negative impact on our advertising business.”

ADVERTISEMENT

Answering a question regarding advertising, Yu Gong stated that ad sales for domestic clients have been recovering and especially sponsorship advertising had returned back to the near pre-pandemic period. However, the company expects ad sales for international clients to be back to normal two to three months later than domestic clients.

[irp posts=”55402″]

Subscriber growth outlook

In the coming days, it’s obvious that people will be spending less time for traveling and more time for online entertainment due to pandemic impact. iQIYI, which is often called “The Netflix of China”, expects performance in the summer for the online entertainment industry to be stronger than previous years, but the impact is expected to be short-term. CEO Yo Gung said that the company will not be able to provide the outlook regarding the addition of subscribers because of the unprecedented situation.

“With the pandemic largely under control in China and more people coming back to work, the focus now turns to enhanced membership retention. However, due to delayed box-office window and online airing window for many theatrical films, which usually play an important role in membership business, our retention efforts may be adversely impacted. Meanwhile, many Japanese animated series have suspended releasing new episodes since late April, pending for notice of resuming air.”

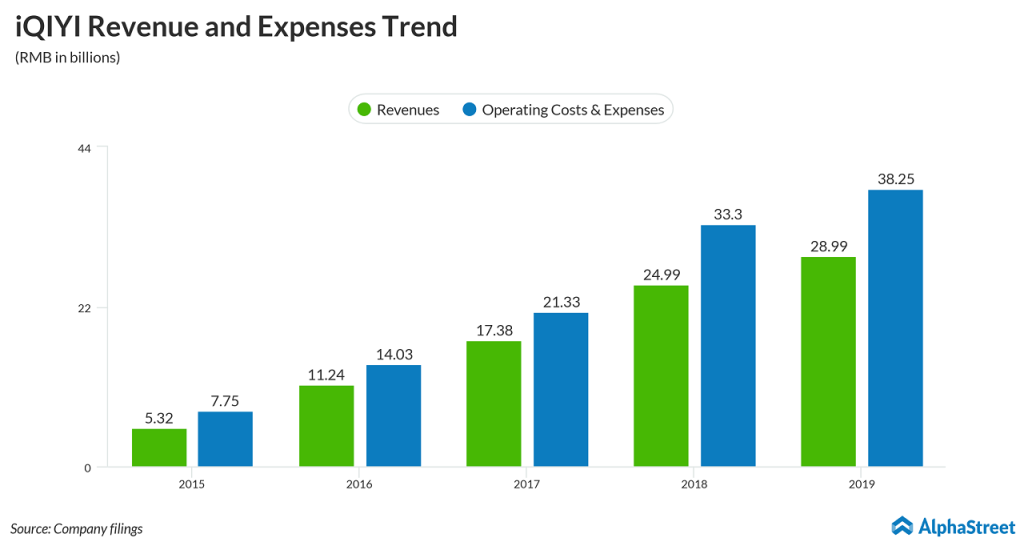

Short-seller report

After the due diligence firm Wolfpack Research accused iQIYI that the company had magnified 2019 revenue and overstated its subscribers, IQ stock plunged to a new 52-week low ($14.51) on NASDAQ last month. Wolfpack also alleged that iQIYI has bloated its costs, the amount it pays for the content, other assets, and buyouts to wipe off the cash. Responding to the allegations made by Wolfpack Research, iQIYI stated that the short seller’s report contains numerous errors, unsubstantiated statements and misleading conclusions and interpretations. IQ stock, which had lost 21% of its value since the beginning of this year, ended down 5.1% at $16.76 yesterday.