The Sunnyvale, California-based tech firm’s impressive value proposition and growth prospects – supported by the virus-related tailwinds – make the stock an attractive investment. With demand conditions remaining upbeat, the current uptrend is expected to continue and the stock is seen rising in double-digits in the twelve-month period. That makes it a strong buy, though there are concerns that CRWD is highly speculative and a bit too expensive despite the recent pullback. In the long term, strong market-share growth would be imperative to justify the high valuation.

Top Priority

Cybersecurity will be a top priority for businesses going forward, amid the hectic cloud migration and digitalization spree. It is widely expected that enterprises would continue to upgrade their tech infrastructure and online capabilities, which bodes well for CrowdStrike and its peers. The fast-paced transition often puts firms more at risk of cyberattacks than usual. On the flip side, the company’s not-so-impressive fundamentals and the uncertainty surrounding enterprise spending call for caution, from an investment perspective.

Turnaround

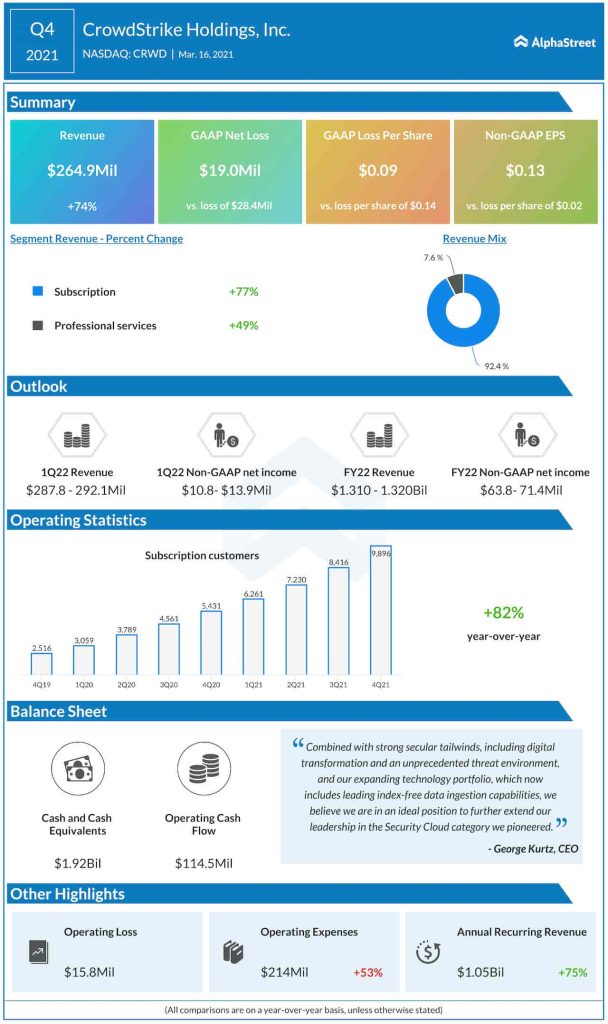

Interestingly, CrowdStrike turned profitable during the pandemic, after staying in the negative territory since going public in 2019. It recorded positive bottom-line numbers in each of the last four quarters. In the final months of 2021, the number of subscription customers increased a whopping 82% year-over-year to 9,896. As a result, the top-line jumped to $265 million and the company swung to a profit of $0.13 per share from last year’s $0.02-per share loss. The results also topped the market’s expectations.

Palo Alto Networks Inc Q2 2021 Earnings Call Transcript

Organizations around the world are shedding legacy and inferior next-gen security technologies and accelerating their move to modern cloud-native technologies to meet the demands of today’s threat landscape, future-proof their security architecture and adopt a zero-trust security model. Our go-to-market strategy is executing on all fronts to seize on the strong secular tailwinds and opportunities we see in the market. Demonstrating the power of our sales engine and our land-and-expand strategy, we added a record 1,480 net new subscription customers in the quarter and now proudly serve 9,896 subscription customers worldwide.

George Kurtz, chief executive officer of CrowdStrike

Gaining an Edge

When it comes to fighting future cyberattacks, it is more about ensuring identity protection and cloud workload security than just protecting the endpoints. As part of preparing the business to meet growth goals and expanding market share, CrowdStrike this month completed the acquisition of Humio for $400 million. Such initiatives should give the company an advantage over rivals and help it rise to the top in the long run.

Read management/analysts’ comments on CrowdStrike’s Q4 report

CrwodStrike’s stock made a positive start to 2021 and reached a record high a month ago. But the momentum waned since then and the shares closed the last session lower. The value nearly tripled since last year, gaining 50% in the past six months alone.